LA LTC LAT05 2013 free printable template

Show details

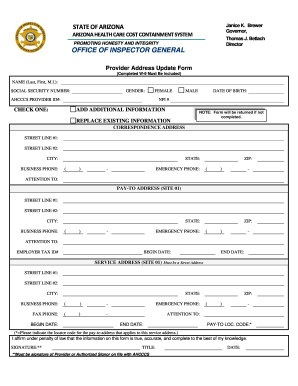

LAT 5 INVENTORY MERCHANDISE ETC. 20 PERSONAL PROPERTY TAX FORM NAME/ADDRESS INDICATE ANY CHANGES RETURN TO CONFIDENTIAL RS 47 2327. FIRMS HAVING 10 YEAR EXEMPTIONS SHALL COMPLETE FORM LAT 5A AND ATTACH TO THIS FORM. BANKS ONLY ATTACH TO THIS REPORT A LIST OF SHAREHOLDERS AND A COPY OF YOUR CONSOLIDATED REPORT OF CONDITION AND CONSOLIDATED REPORT OF INCOME AS FURNISHED TO THE OFFICE OF FINANACE INSTITUTIONS ST OR TO THE COMPTROLLER OF CURRENCY AS OF DECEMBER 31. Only the Assessor the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA LTC LAT05

Edit your LA LTC LAT05 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA LTC LAT05 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA LTC LAT05 online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit LA LTC LAT05. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LTC LAT05 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA LTC LAT05

How to fill out LA LTC LAT05

01

Begin by downloading the LA LTC LAT05 form from the official website.

02

Fill out your personal information, including name, address, and contact details at the top of the form.

03

Provide details about your healthcare services needed, including the type and frequency.

04

Complete the sections regarding your medical history and any medications you are currently taking.

05

If applicable, include any additional documents or identification as required.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the completed form according to the provided instructions, either through mail or in person.

Who needs LA LTC LAT05?

01

Individuals seeking long-term care services in Los Angeles County must complete the LA LTC LAT05 form.

02

Caregivers or family members managing the care of individuals requiring such services may also need to fill out this form on their behalf.

03

Healthcare providers and facilities may use this form as part of the intake process for new clients.

Instructions and Help about LA LTC LAT05

Fill

form

: Try Risk Free

People Also Ask about

How are long term capital gains taxed?

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year (also known as a long term investment). The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status. They are generally lower than short-term capital gains tax rates.

What is Louisiana's income tax?

Louisiana requires you to pay taxes if you're a resident or nonresident who receives income from a Louisiana source. The state income tax rates for the 2021 tax year range from 2.0% to 6.0%, and the sales tax rate is 4.45%.

How much Louisiana state tax do I owe?

Louisiana requires you to pay taxes if you're a resident or nonresident who receives income from a Louisiana source. The state income tax rates for the 2021 tax year range from 2.0% to 6.0%, and the sales tax rate is 4.45%.

How do I know if I owe state taxes in Louisiana?

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

What is Louisiana State tax 2022?

Determination of Tax Effective January 1, 2009Effective January 1, 2022First $12,5002 percent1.85 percentNext $37,5004 percent3.50 percentOver $50,0006 percent4.25 percent6 more rows

How do you check my tax status if I owe?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

What will the 2022 tax rates be?

The 2022 Income Tax Brackets (Taxes due April 2023) For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

How do I find out if I owe money to Revenue?

How to check if you are due a tax refund or owe tax for a previous year. You can use myAccount to check whether you have paid the correct amount of tax in the previous 4 years. You can see a statement that shows if you have paid too much tax or too little tax. This is called a Preliminary End of Year Statement.

How are long term capital gains taxed 2022?

Based on filing status and taxable income, long-term capital gains for tax year 2022 (the same rate as in 2021) will be taxed at 0%, 15% and 20%. Short-term gains are taxed as ordinary income.

Are capital gains subject to state income tax?

Capital gains are taxable at both the federal level and the state level. At the federal level, capital gains are taxed at a lower rate than personal income.

Does Louisiana have county taxes?

Louisiana has state sales tax of 4.45%, and allows local governments to collect a local option sales tax of up to 7%.Louisiana County-Level Sales Taxes. County NameTax RateCameron Parish4.45%Catahoula Parish11.45%Chicot County10.45%Claiborne Parish10.45%61 more rows

Are long term capital gains taxed by state?

Long-term capital gains tax rates are typically lower than short-term rates. In addition to paying capital gains tax at the federal levels, a majority of U.S. states also have an additional tax rate between 2.90% and 13.30%.

What states allow local income tax?

States with local income tax Alabama. Arkansas. California. Colorado. Delaware. Indiana. Iowa. Kentucky.

Do I have to pay Louisiana state taxes?

Resident Individual Income Tax Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return, IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana.

Does Louisiana have local income tax?

Overview of Louisiana Taxes Louisiana has three state income tax brackets that range from 2.00% to 6.00%. Though sales taxes in Louisiana are high, the state's income tax rates are close to the national average. No Louisiana cities charge local income taxes on top of the state rates.

How are long term capital gains taxed in Louisiana?

Louisiana allows taxpayers to deduct federal income taxes from their state taxable income. The Combined Rate accounts for State and Local tax rates on capital gains income, the 3.8 percent Surtax on capital gains and the marginal effect of Pease Limitations.

What states don't have local income tax?

Which Are the Tax-Free States? As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

What is Louisiana state income tax rate?

For returns submitted electronically, taxpayers due refunds can expect them within 45 days of the filing date.January 10, 2022. Tax BracketTax Years 2009-2021Tax Years 2022 and After$0 - $25,0002.00%1.85%$25,001 - $100,0004.00%3.50%$100,001 and over6.00%4.25% Jan 10, 2022

How much is Louisiana state and federal taxes?

Your Income Taxes Breakdown TaxMarginal Tax Rate2021 Taxes*Federal22.00%$9,600FICA7.65%$5,777State5.97%$3,795Local3.88%$2,4924 more rows • Dec 23, 2021

What is the state tax withholding in Louisiana?

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $12,5001.85%Over $12,500 but not over $50,000$231.25 plus 3.50% of excess over $12,500Over $50,000$1,543.75 plus 4.25% of excess over $50,000 Feb 25, 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify LA LTC LAT05 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including LA LTC LAT05, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get LA LTC LAT05?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the LA LTC LAT05. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out LA LTC LAT05 on an Android device?

Use the pdfFiller Android app to finish your LA LTC LAT05 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is LA LTC LAT05?

LA LTC LAT05 is a form used in Louisiana for tax reporting purposes related to certain long-term care insurance policies.

Who is required to file LA LTC LAT05?

Insurance companies that provide long-term care insurance policies in Louisiana are required to file LA LTC LAT05.

How to fill out LA LTC LAT05?

To fill out LA LTC LAT05, policy providers must provide specific details about their long-term care insurance policies, including policyholder information, coverage details, and premium amounts.

What is the purpose of LA LTC LAT05?

The purpose of LA LTC LAT05 is to collect data on long-term care insurance policies in Louisiana to ensure compliance with state regulations and to aid in statistical analysis.

What information must be reported on LA LTC LAT05?

Information that must be reported on LA LTC LAT05 includes the name and address of the insured, policy number, date of issue, coverage amounts, types of coverage, and premium information.

Fill out your LA LTC LAT05 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA LTC lat05 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.