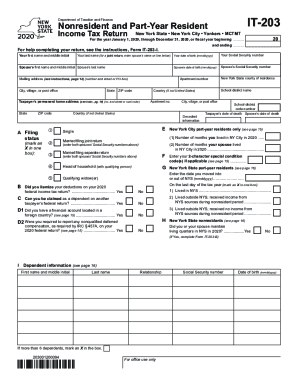

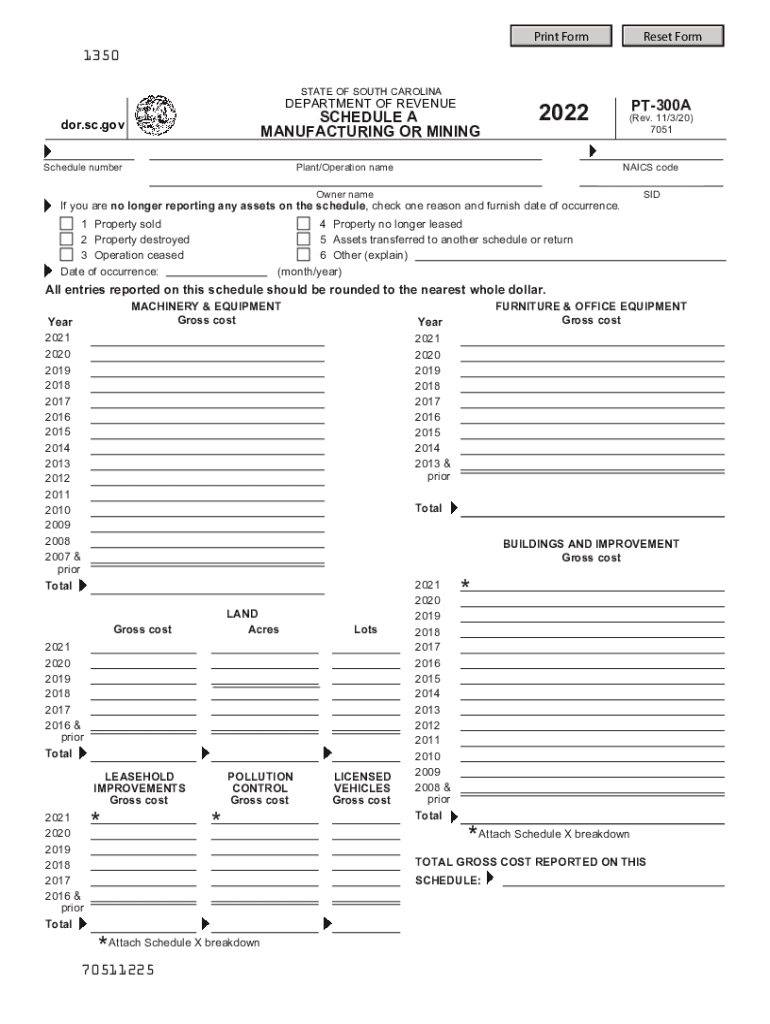

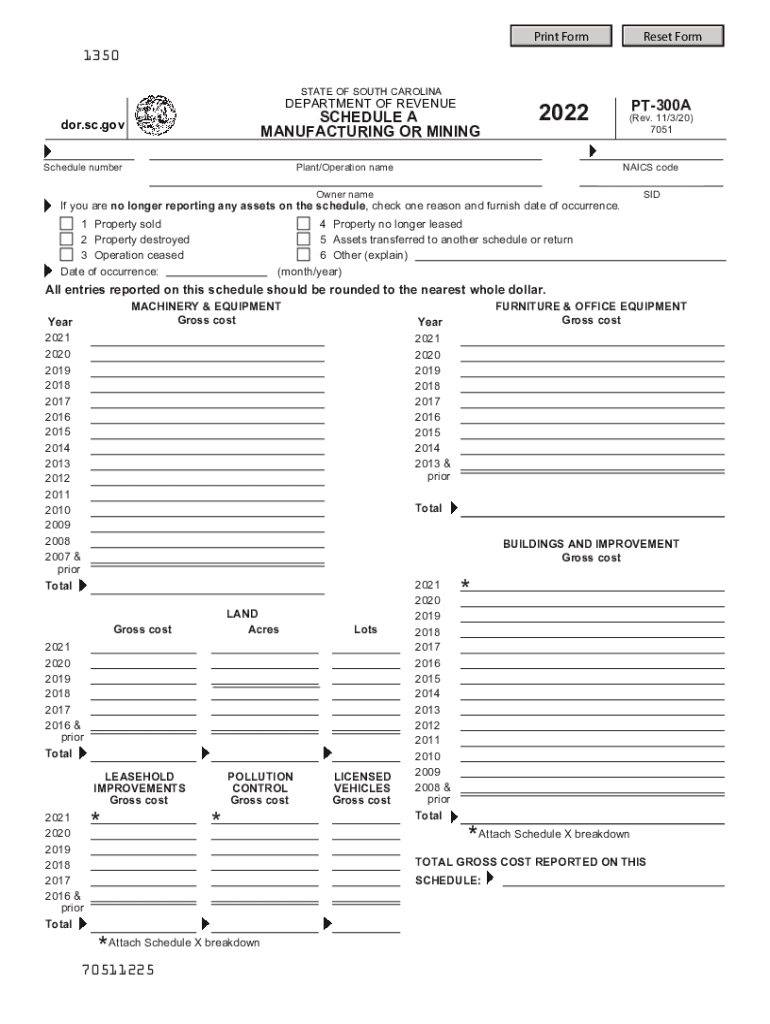

SC PT-300A 2022 free printable template

Show details

Print Forrest Form1350

STATE OF SOUTH CAROLINADEPARTMENT OF REVENUESCHEDULE A

MANUFACTURING OR Mining.SC.gov

Schedule number2022PT300A(Rev. 11/3/20)

7051Plant/Operation namesakes homeowner nameSIDIf

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC PT-300A

Edit your SC PT-300A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC PT-300A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC PT-300A online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SC PT-300A. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC PT-300A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC PT-300A

How to fill out SC PT-300A

01

Obtain the SC PT-300A form from the appropriate government agency website or office.

02

Begin by entering your personal information at the top of the form, including your full name, address, and Social Security number.

03

Fill out the sections related to your income, including any wages, self-employment income, and other sources of income.

04

Provide details about any deductions you are claiming, such as federal taxes paid, student loan interest, and other eligible deductions.

05

Carefully review the instructions provided with the form to ensure you complete all required sections.

06

Double-check your entries for accuracy and completeness before signing the form.

07

Submit the completed SC PT-300A form to the designated agency, either electronically or by mailing it to the appropriate address.

Who needs SC PT-300A?

01

Individuals or businesses in South Carolina who are required to report specific financial information for tax purposes.

02

Taxpayers seeking to claim certain deductions or credits related to their income.

03

Anyone who has received income that is subject to state taxes and needs to report it on their tax filings.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

What is the SC surplus refund for 2023?

As outlined in the legislation approving the rebates, the SCDOR set the rebate cap – the maximum amount taxpayers can receive – at $800. Rebates issued in March 2023 will also be capped at $800. Tax liability is what's left after subtracting your credits from the Individual Income Tax that you owe.

What is South Carolina corporate tax rate 2020?

South Carolina also has a flat 5.00 percent corporate income tax rate. South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.43 percent.

Is the SC $800 tax rebate taxable?

ing to the IRS, South Carolinians who have received the state tax rebate don't have to report it for federal tax purposes “if the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit.”

What is the $800 tax rebate in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC PT-300A from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including SC PT-300A, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete SC PT-300A on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your SC PT-300A. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit SC PT-300A on an Android device?

The pdfFiller app for Android allows you to edit PDF files like SC PT-300A. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is SC PT-300A?

SC PT-300A is a form used by the South Carolina Department of Revenue for reporting income and profit or loss from business operations.

Who is required to file SC PT-300A?

Taxpayers who operate a business in South Carolina and have income to report are required to file SC PT-300A.

How to fill out SC PT-300A?

To fill out SC PT-300A, provide the requested information such as business details, income, expenses, and any applicable deductions, ensuring all calculations are accurate.

What is the purpose of SC PT-300A?

The purpose of SC PT-300A is to report the income and expenses of partnerships and pass-through entities for state tax purposes.

What information must be reported on SC PT-300A?

SC PT-300A requires reporting of business name, address, federal identification number, income, deductions, and details of each partner or shareholder.

Fill out your SC PT-300A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC PT-300a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.