SC PT-300A 2023 free printable template

Show details

Print Forrest Form1350

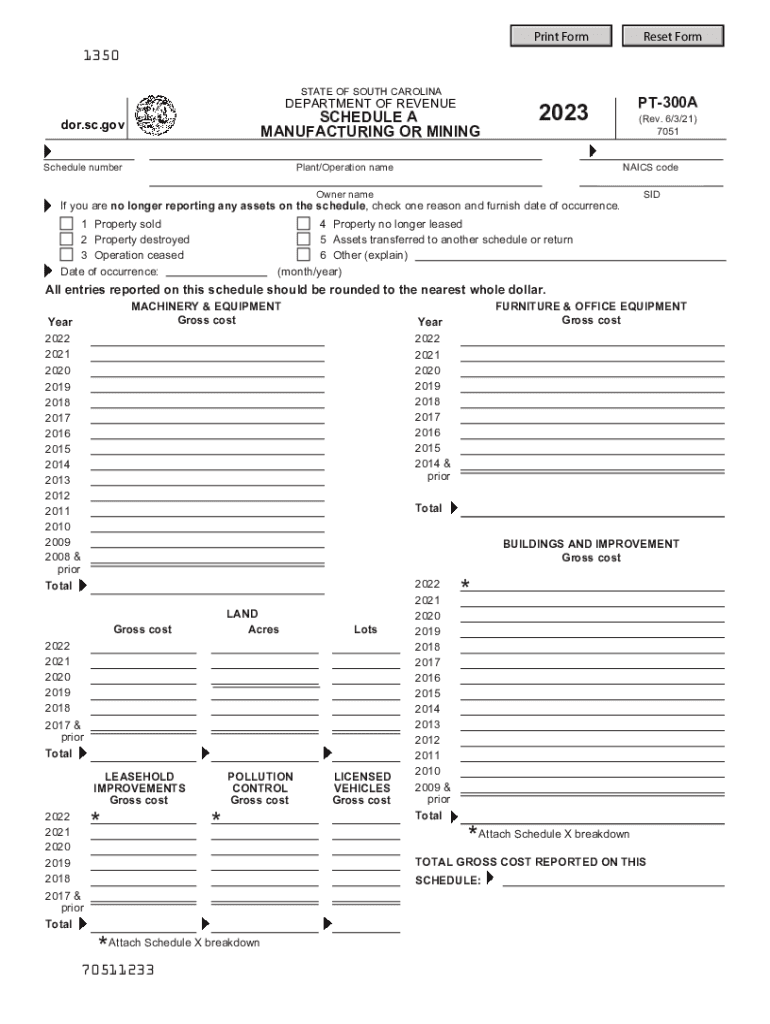

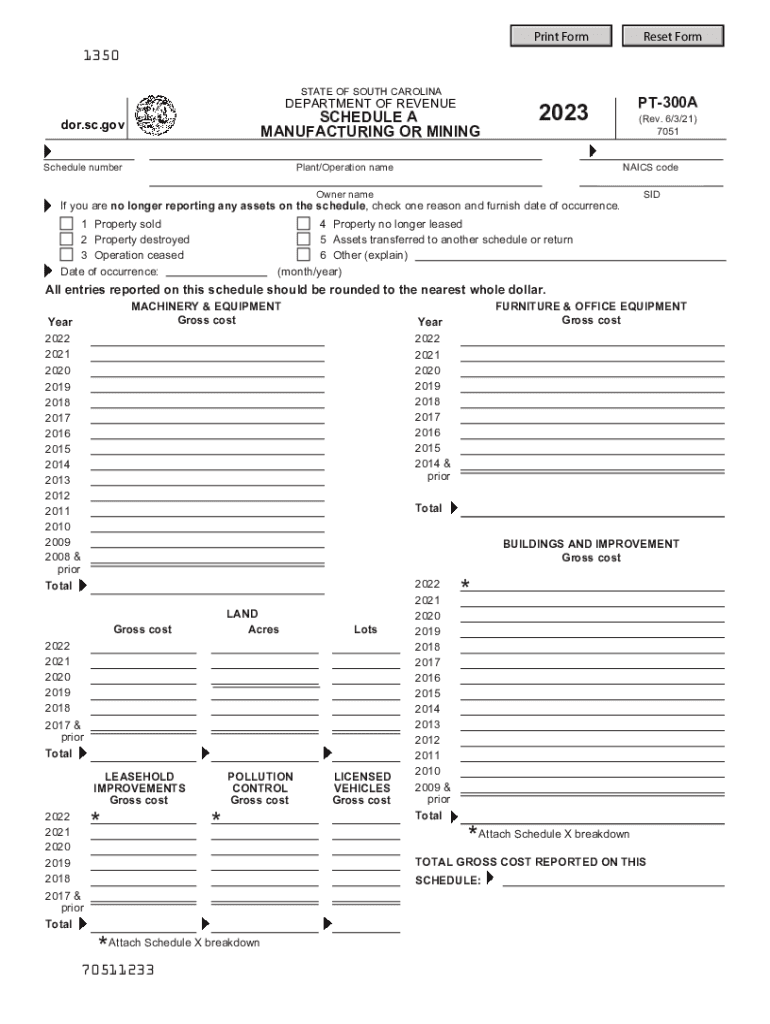

STATE OF SOUTH CAROLINADEPARTMENT OF REVENUESCHEDULE A

MANUFACTURING OR Mining.SC.gov

Schedule numberPT300A2023(Rev. 6/3/21)

7051Plant/Operation namesakes homeowner nameSIDIf

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc form pt300a schedule make

Edit your sc form pt300a schedule edit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your south carolina pt300a a manufacturing edit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2023 pt300a schedule online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2023 pt 300a form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC PT-300A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC PT-300A

How to fill out SC PT-300A

01

Start by downloading the SC PT-300A form from the official tax website.

02

Fill in your personal information in the designated sections, including your name, address, and social security number.

03

Provide details of your income for the tax year in the appropriate fields.

04

Include any deductions or credits you are eligible for on the form.

05

Review your entries for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form by the designated deadline, either electronically or through the mail.

Who needs SC PT-300A?

01

Individuals who reside in South Carolina and need to file their state income tax return.

02

Taxpayers who have received income from South Carolina sources during the tax year.

03

Residents who are claiming various deductions or credits applicable under South Carolina state law.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

What is the SC surplus refund for 2023?

As outlined in the legislation approving the rebates, the SCDOR set the rebate cap – the maximum amount taxpayers can receive – at $800. Rebates issued in March 2023 will also be capped at $800. Tax liability is what's left after subtracting your credits from the Individual Income Tax that you owe.

What is South Carolina corporate tax rate 2020?

South Carolina also has a flat 5.00 percent corporate income tax rate. South Carolina has a 6.00 percent state sales tax rate, a max local sales tax rate of 3.00 percent, and an average combined state and local sales tax rate of 7.43 percent.

Is the SC $800 tax rebate taxable?

ing to the IRS, South Carolinians who have received the state tax rebate don't have to report it for federal tax purposes “if the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit.”

What is the $800 tax rebate in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find SC PT-300A?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the SC PT-300A in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in SC PT-300A without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit SC PT-300A and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the SC PT-300A in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your SC PT-300A and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is SC PT-300A?

SC PT-300A is a tax form used in South Carolina for reporting the income of partnerships, LLCs, and other entities for tax purposes.

Who is required to file SC PT-300A?

Entities such as partnerships and multi-member LLCs are required to file SC PT-300A if they conduct business in South Carolina and have income.

How to fill out SC PT-300A?

To fill out SC PT-300A, entities must provide their business information, income details, and allocation of income among partners or members as instructed on the form.

What is the purpose of SC PT-300A?

The purpose of SC PT-300A is to report the income, deductions, and credits of partnerships and multi-member LLCs to the South Carolina Department of Revenue.

What information must be reported on SC PT-300A?

SC PT-300A requires reporting of entity identification details, income, deductions, distributions to partners, and other relevant tax information.

Fill out your SC PT-300A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC PT-300a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.