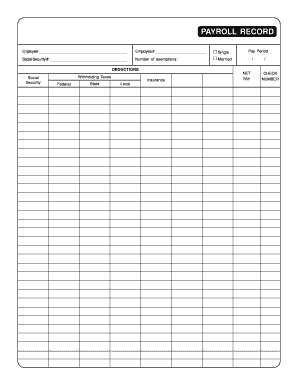

MO Certified Payroll Report - Kansas City 2000-2025 free printable template

Show details

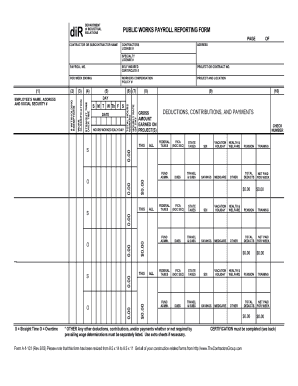

CERTIFIED PAYROLL REPORT Project Number PR001 Project Title Stable Work 2904 FINAL SHEET 1 OF 2 GRANT AGENCY PROJECT NO.: DEPARTMENT PROJECT OR CONTRACT NO.: PR001 LOCATION: Boston DESCRIPTION: Payroll

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign payroll report

Edit your payroll report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll report online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit payroll report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll report

How to fill out MO Certified Payroll Report - Kansas City

01

Obtain the MO Certified Payroll Report form from the official Missouri Department of Labor website or your project manager.

02

Fill in the project details: include project name, location, and employer information.

03

Enter the contractor's and subcontractor's name, address, and identification number.

04

List all employees working on the project on separate rows: include their names, Social Security numbers, classifications, and hourly wage rates.

05

Record the number of hours worked each week for each employee, along with the total wages paid for the reporting period.

06

Include any deductions made from employee wages such as taxes, benefits, etc.

07

Sign and date the report at the end, certifying that the information provided is accurate.

08

Submit the completed report to the relevant authorities as specified in your project agreement.

Who needs MO Certified Payroll Report - Kansas City?

01

All contractors and subcontractors working on public works projects in Kansas City must submit the MO Certified Payroll Report to ensure compliance with state wage laws.

02

Government agencies overseeing these projects require the report to verify that workers are being paid according to the prevailing wage rates.

Fill

form

: Try Risk Free

People Also Ask about

What is prevailing wage in Massachusetts?

In Massachusetts, prevailing wages are paid on any state or locally funded project over $1,000. This includes projects for school districts, universities, local government, etc. Rates are provided by the awarding authority and should be included in the project bid documents and contract.

How do I make a payroll report?

How To Create a Payroll Report Choose the Time Period for the Report. Payroll reports always summarize information over a period of time, such as a week, month, or year. Outline the Information You Need to Collect. Enter Data in Your Spreadsheet or Generate a Report with Software. Analyze Your Report.

What is a payroll summary report?

What is a payroll summary report? Payroll summary reports provide a snapshot of a business's payroll obligations during a specific time frame. For each employee, it includes details on wage earnings, tax withholdings, benefit deductions and taxes owed by the employer.

Does Paychex do certified payroll?

Ideal for employers with union employees and Certified Payroll projects: HCM TradeSeal extends Paychex to support union Certified Payroll needs.

What should be included in a payroll report?

A payroll report is a document that employers use to verify their tax liabilities or cross-check financial data. It may include such information as pay rates, hours worked, overtime accrued, taxes withheld from wages, employer tax contributions, vacation balances and more.

How do I write a payroll summary report?

How To Create a Payroll Report Choose the Time Period for the Report. Payroll reports always summarize information over a period of time, such as a week, month, or year. Outline the Information You Need to Collect. Enter Data in Your Spreadsheet or Generate a Report with Software. Analyze Your Report.

What is a payroll detail report?

A payroll report is a document that businesses use to provide specific payroll information to government agencies, and keep on file for their own pay records. These reports show the pay rate, total pay, taxes withheld, overtime incurred, overall benefit costs and more information about the company's employees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit payroll report from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your payroll report into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete payroll report online?

pdfFiller has made it simple to fill out and eSign payroll report. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit payroll report online?

The editing procedure is simple with pdfFiller. Open your payroll report in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is MO Certified Payroll Report - Kansas City?

The MO Certified Payroll Report - Kansas City is a document that contractors and subcontractors are required to submit to report the wages paid to employees on public works projects in Kansas City, Missouri.

Who is required to file MO Certified Payroll Report - Kansas City?

All contractors and subcontractors performing work on public works projects in Kansas City, as well as those working on projects funded by public money, are required to file the MO Certified Payroll Report.

How to fill out MO Certified Payroll Report - Kansas City?

To fill out the MO Certified Payroll Report, you need to complete the form with information regarding the project, employee classifications, hours worked, wages paid, and any deductions. Ensure that the form is signed and dated by an authorized representative.

What is the purpose of MO Certified Payroll Report - Kansas City?

The purpose of the MO Certified Payroll Report is to ensure compliance with state labor laws, particularly the payment of prevailing wages on public works projects, and to maintain transparency regarding labor practices.

What information must be reported on MO Certified Payroll Report - Kansas City?

The information required includes the contractor's name and address, project details, employee names, classifications, hours worked, gross wages, deductions, and net wages paid.

Fill out your payroll report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.