Get the free New Hampshire Trust Laws

Show details

New Hampshire Trust Laws Statutes and Commentary Order Former Hampshire Trust Laws is available at $40.00 / each (S&H included), and may be purchased through Perfecta Trust (via check) or directly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new hampshire trust laws

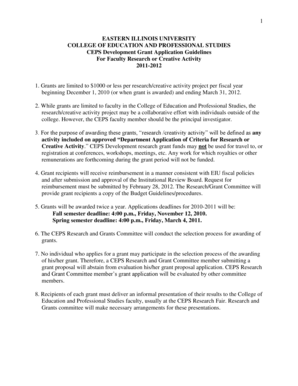

Edit your new hampshire trust laws form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new hampshire trust laws form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new hampshire trust laws online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new hampshire trust laws. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new hampshire trust laws

How to fill out new hampshire trust laws

01

To fill out New Hampshire trust laws, follow these steps:

02

Familiarize yourself with the specific trust laws of New Hampshire. Each state may have different regulations regarding trusts, so it is important to understand the requirements and guidelines in New Hampshire.

03

Determine the type of trust you want to create. New Hampshire offers various types of trusts, such as revocable trusts, irrevocable trusts, charitable trusts, and more. Understand the purpose and benefits of each type and choose the one that suits your needs.

04

Consult with an experienced attorney. Trust laws can be complex, so it is advisable to seek legal advice from a knowledgeable attorney who specializes in trusts in New Hampshire. They can guide you through the entire process and ensure compliance with all legal requirements.

05

Gather the necessary information and documentation. To fill out the trust forms accurately, you will need details such as the names and contact information of trustees and beneficiaries, assets to be included in the trust, and any specific instructions or conditions you want to include.

06

Complete the trust forms. Use the provided trust forms or consult your attorney to draft the necessary legal documents. Ensure that all information is filled out accurately and according to the requirements of New Hampshire trust laws.

07

Review and revise the documents. Before finalizing the trust, carefully review all the details to ensure accuracy and clarity. Make any necessary revisions or amendments to reflect your intentions accurately.

08

Execute the trust. Once you are satisfied with the trust documents, sign them in the presence of a notary public. Depending on the type of trust, additional steps may be required, such as funding the trust with assets or notifying beneficiaries.

09

Maintain and update the trust. Trusts may require periodic reviews and updates to adapt to changing circumstances or new laws. Stay informed about any amendments or revisions that may be necessary to ensure the trust remains valid and effective.

10

Remember, it is crucial to consult with a qualified professional to ensure compliance with all legal requirements and to address your specific needs and goals.

Who needs new hampshire trust laws?

01

New Hampshire trust laws are beneficial for various individuals and entities, including:

02

- Individuals who wish to protect their assets and provide for their loved ones after their passing. Trusts can offer efficient estate planning solutions and help avoid probate.

03

- Business owners who want to secure their business assets and plan for succession or transfer of ownership.

04

- Charitable organizations or individuals interested in making philanthropic contributions or establishing charitable trusts.

05

- High-net-worth individuals who want to minimize estate taxes and protect their wealth for future generations.

06

- Families with minor children or individuals with special needs beneficiaries who require long-term financial protection and management.

07

- Individuals concerned about privacy and confidentiality, as trusts offer a level of confidentiality that may not be possible with other types of estate planning tools.

08

- Anyone seeking flexibility and control over the distribution of assets and the management of their estate.

09

It is important to consult with a legal and financial advisor to determine whether New Hampshire trust laws are appropriate for your specific situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new hampshire trust laws to be eSigned by others?

Once your new hampshire trust laws is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in new hampshire trust laws without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your new hampshire trust laws, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete new hampshire trust laws on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your new hampshire trust laws, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is new hampshire trust laws?

New Hampshire trust laws govern the creation, administration, and regulation of trusts within the state. They outline how trusts can be established, the powers and duties of trustees, and the rights of beneficiaries.

Who is required to file new hampshire trust laws?

Typically, trustees of a trust are required to file any necessary documents as dictated by New Hampshire trust laws. This may include those managing irrevocable trusts or certain types of taxable trusts.

How to fill out new hampshire trust laws?

Filling out New Hampshire trust law documents generally involves completing forms that provide information about the trust's purpose, assets, trustee, and beneficiaries. Legal guidance may be beneficial to ensure accuracy and compliance.

What is the purpose of new hampshire trust laws?

The purpose of New Hampshire trust laws is to provide a legal framework for the creation and operation of trusts. They aim to protect the interests of beneficiaries, ensure that trusts are managed properly, and provide clarity and consistency in trust administration.

What information must be reported on new hampshire trust laws?

Trustees must report information including the names of the trust's beneficiaries, a description of the trust property, and the terms of the trust. Tax information may also be required depending on the type of trust.

Fill out your new hampshire trust laws online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hampshire Trust Laws is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.