Get the free Charity Navigator - IRS Data for Point Blue Conservation Science

Show details

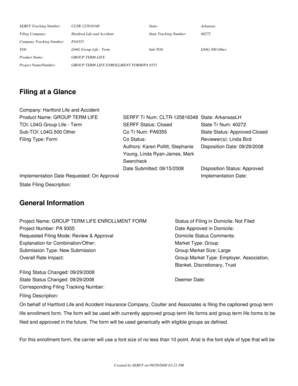

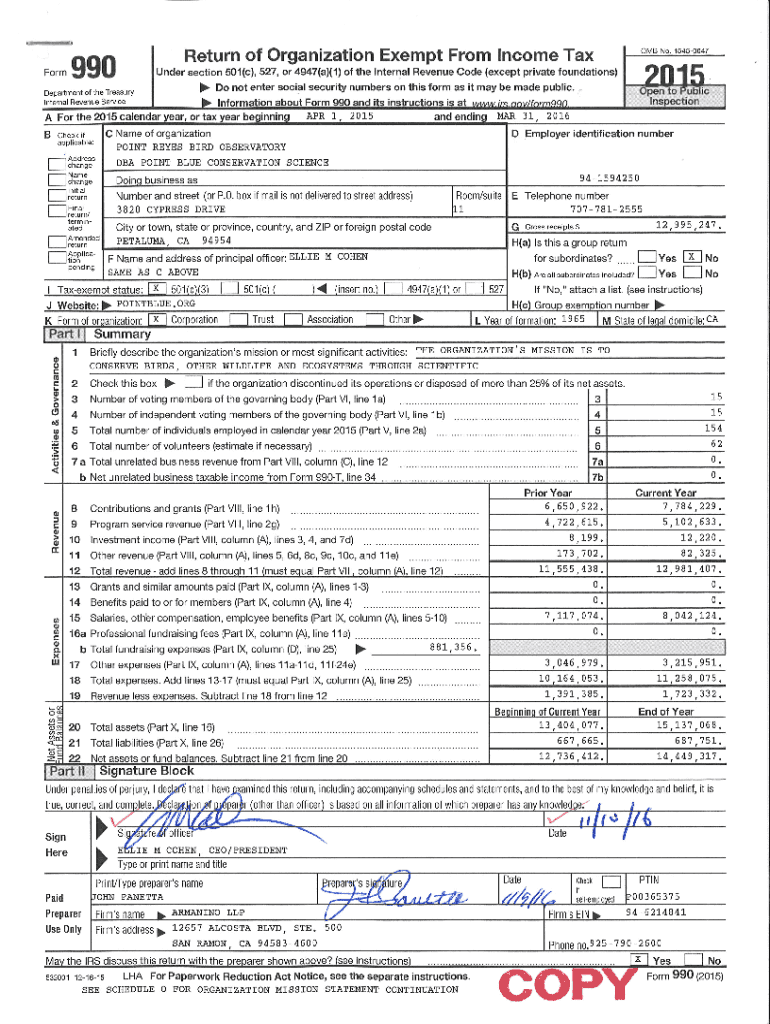

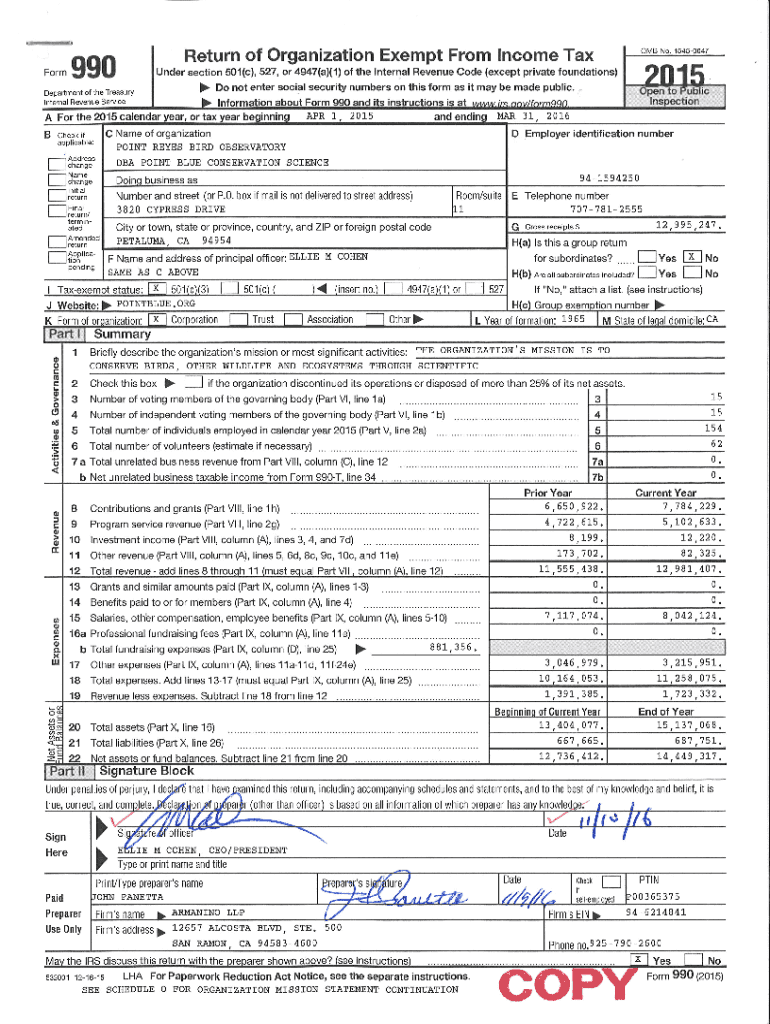

POINT REYES BIRD OBSERVATORY DBA POINT BLUE CONSERVATION SCIENCE Form 990 (2015) Part III Statement of Program Service Accomplishments941594250Page 2Check if Schedule O contains a response or note

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charity navigator - irs

Edit your charity navigator - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charity navigator - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charity navigator - irs online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charity navigator - irs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charity navigator - irs

How to fill out charity navigator - irs

01

To fill out Charity Navigator - IRS, follow these steps:

02

Go to the Charity Navigator website (https://www.charitynavigator.org/)

03

Click on the 'IRS Data' tab at the top of the page.

04

On the IRS Data page, you will find various options to search for charities based on different criteria.

05

To search for a specific charity, you can use the 'Search for a Charity' box and enter the charity's name or EIN (Employer Identification Number).

06

You can also use the 'Search for Charities by Rating' box to find charities based on their ratings.

07

Once you have entered the necessary information, click on the 'Search' button to retrieve the results.

08

The search results will provide you with detailed information about the charity, including its rating, financial data, accountability & transparency, and more.

09

You can further explore the details of a specific charity by clicking on its name in the search results.

10

To view the IRS Form 990 for a specific charity, click on the 'IRS Filings' tab on the charity's profile page.

11

On the IRS Filings page, you will find a list of available tax documents. Click on the desired year to access and view the IRS Form 990.

12

You can also download the IRS Form 990 by clicking on the 'Download' button next to the document.

13

After filling out Charity Navigator - IRS, you can use the information obtained to make an informed decision about supporting a charity.

Who needs charity navigator - irs?

01

Charity Navigator - IRS can be useful for anyone who wants to research and evaluate charitable organizations before making a donation. It can help:

02

- Individuals who want to ensure their donations are going to reputable and accountable charities.

03

- Donors who want to assess a charity's financial health, transparency, and effectiveness.

04

- Philanthropists and foundations looking to fund projects and programs that align with their goals and values.

05

- Grant-makers who want to make informed decisions and ensure their funding is making a meaningful impact.

06

- Businesses and corporations interested in supporting charitable causes as part of their corporate social responsibility efforts.

07

In summary, anyone interested in making informed decisions about charitable giving can benefit from using Charity Navigator - IRS to research and assess charitable organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find charity navigator - irs?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the charity navigator - irs in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the charity navigator - irs form on my smartphone?

Use the pdfFiller mobile app to fill out and sign charity navigator - irs. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out charity navigator - irs on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your charity navigator - irs, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is charity navigator - irs?

Charity Navigator is a nonprofit organization that evaluates and rates the financial health and accountability of public charities in the United States, while the IRS (Internal Revenue Service) is the federal agency that collects taxes and administers the tax law.

Who is required to file charity navigator - irs?

Public charities that are recognized as tax-exempt by the IRS are required to file annual reports, which are evaluated by Charity Navigator.

How to fill out charity navigator - irs?

To fill out the information for Charity Navigator related to IRS filings, charities must typically complete IRS Form 990, which includes financial details and operational information.

What is the purpose of charity navigator - irs?

The purpose of Charity Navigator is to provide transparency and accountability in the charitable sector by evaluating and rating nonprofits for potential donors.

What information must be reported on charity navigator - irs?

Charities must report financial statements, program service accomplishments, governance policies, and compliance with legal standards on IRS Form 990.

Fill out your charity navigator - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charity Navigator - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.