Get the free Canadian Giving Options & Instructions - Give TeachBeyond

Show details

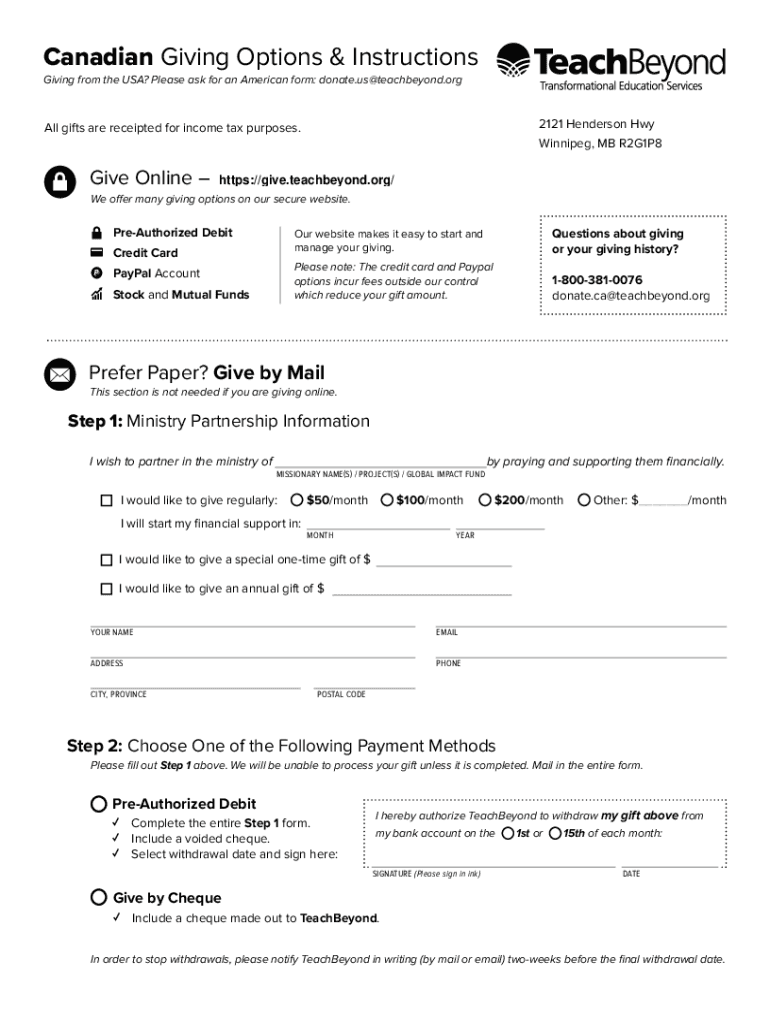

Canadian Giving Options & Instructions Giving from the USA? Please ask for an American form: donate.us teach beyond.org2121 Henderson Hwy Winnipeg, MB R2G1P8All gifts are receipted for income tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canadian giving options ampampamp

Edit your canadian giving options ampampamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canadian giving options ampampamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit canadian giving options ampampamp online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit canadian giving options ampampamp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canadian giving options ampampamp

How to fill out canadian giving options ampampamp

01

To fill out Canadian giving options, follow these steps:

02

Start by obtaining the necessary forms from the Canadian giving organization or charity you wish to support.

03

Fill out your personal information, including your name, address, and contact details.

04

Indicate the amount you wish to donate and choose the method of payment (cheque, credit card, or online transfer).

05

If you are eligible for tax benefits, provide the required information to receive the tax receipt.

06

Review the completed form to ensure all the details are accurate.

07

Sign the form and submit it by mail or electronically, depending on the instructions provided.

08

Keep a copy of the filled-out form for your records.

09

Optionally, consider setting up recurring donations or specifying how you would like your donation to be used, if applicable.

10

Remember to consult the specific instructions provided by the Canadian giving organization you are supporting for any additional requirements or special considerations.

Who needs canadian giving options ampampamp?

01

Anyone who wants to support Canadian causes or charities can benefit from Canadian giving options.

02

This includes individuals who:

03

- Are Canadian residents

04

- Wish to donate to Canadian charities or organizations

05

- Want to receive tax benefits by making eligible donations

06

- Prefer to support causes in their local communities or across Canada

07

Canadian giving options provide a convenient and reliable way to contribute to various initiatives and help make a positive impact on Canadian society.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send canadian giving options ampampamp for eSignature?

Once your canadian giving options ampampamp is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit canadian giving options ampampamp in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing canadian giving options ampampamp and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete canadian giving options ampampamp on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your canadian giving options ampampamp, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is canadian giving options ampampamp?

Canadian giving options refer to various methods and strategies available to individuals and organizations in Canada for donating to charities, including monetary contributions, goods, services, and planned gifts.

Who is required to file canadian giving options ampampamp?

Individuals and organizations that make charitable donations or engage in fundraising activities in Canada are generally required to file documentation related to their giving through designated forms, especially if they wish to claim tax credits.

How to fill out canadian giving options ampampamp?

To fill out Canadian giving options, individuals must typically complete the applicable tax forms provided by the Canada Revenue Agency (CRA) that detail the amount donated, the recipient charity, and any relevant receipts or documentation.

What is the purpose of canadian giving options ampampamp?

The purpose of Canadian giving options is to facilitate charitable contributions, provide tax benefits to donors, and support the operations of registered charities and non-profit organizations in Canada.

What information must be reported on canadian giving options ampampamp?

Information that must be reported includes the total amount donated, the name of the charity, the date of donation, and any official receipts received for tax purposes.

Fill out your canadian giving options ampampamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canadian Giving Options Ampampamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.