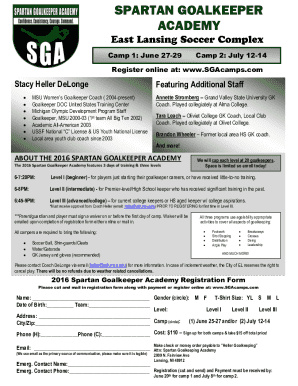

Get the free PDF Pre-Authorized Tax Form - Stirling-Rawdon

Show details

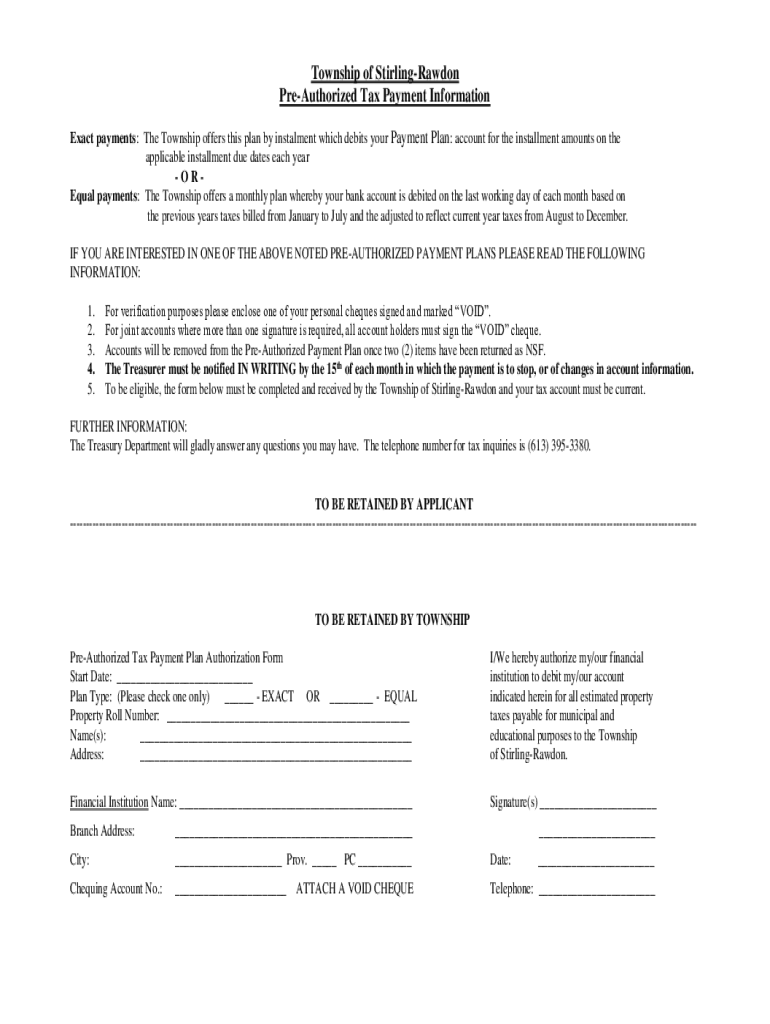

Township of StirlingRawdon

PreAuthorized Tax Payment Information

Exact payments: The Township offers this plan by installment which debits your Payment Plan: account for the installment amounts on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdf pre-authorized tax form

Edit your pdf pre-authorized tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdf pre-authorized tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdf pre-authorized tax form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pdf pre-authorized tax form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdf pre-authorized tax form

How to fill out pdf pre-authorized tax form

01

To fill out a pdf pre-authorized tax form, follow these steps:

02

Open the pdf file using a pdf reader or editor software.

03

Locate the fillable fields in the form. These are usually indicated by highlighted areas or text boxes.

04

Click on the first fillable field to activate it.

05

Enter the required information in the field. This may include your name, address, social security number, income details, and any other necessary tax information.

06

Use the tab key or mouse to navigate through the form and fill out all the required fields. Make sure to double-check your entries for accuracy.

07

If there are checkboxes in the form, click on them to select the appropriate options.

08

If there are any drop-down menus or selection lists, choose the correct option from the available choices.

09

If there are sections for providing additional information or attachments, carefully read the instructions and provide the necessary documents or explanations.

10

Once you have completed filling out the form, save it to your computer or device.

11

Print a copy of the filled form if required by the instructions or for your own records.

12

Submit the filled form as instructed, either by mailing it to the designated address or by submitting it electronically.

Who needs pdf pre-authorized tax form?

01

The pdf pre-authorized tax form is needed by individuals or entities who want to authorize the automatic deduction of taxes from their bank account. This form is typically used by taxpayers who want to set up a recurring payment arrangement with the tax authorities, ensuring timely and hassle-free tax payments. It may be required by individuals who pay estimated taxes, businesses that file quarterly tax returns, or anyone who prefers the convenience of automated tax payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdf pre-authorized tax form for eSignature?

When you're ready to share your pdf pre-authorized tax form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute pdf pre-authorized tax form online?

With pdfFiller, you may easily complete and sign pdf pre-authorized tax form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit pdf pre-authorized tax form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing pdf pre-authorized tax form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is pdf pre-authorized tax form?

The PDF pre-authorized tax form is a document that allows taxpayers to authorize prepayments of their taxes, ensuring that their tax liabilities are settled in a timely manner.

Who is required to file pdf pre-authorized tax form?

Individuals or businesses that expect to owe a significant amount of taxes and prefer to make prepayments or have estimated taxes withheld are generally required to file this form.

How to fill out pdf pre-authorized tax form?

To fill out the PDF pre-authorized tax form, individuals should enter their personal information, tax identification number, and specify the amount they wish to pre-authorize. Follow the instructions provided for accurate completion.

What is the purpose of pdf pre-authorized tax form?

The purpose of the PDF pre-authorized tax form is to facilitate the prepayment of taxes, helping taxpayers manage their tax obligations more effectively and reduce the risk of late penalties.

What information must be reported on pdf pre-authorized tax form?

The information typically required on the form includes the taxpayer's name, address, tax identification number, payment amounts, and the tax period for which the pre-authorization is being requested.

Fill out your pdf pre-authorized tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdf Pre-Authorized Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.