Get the free Business Financing Application - Nickel Basin

Show details

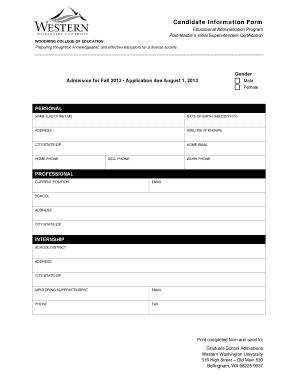

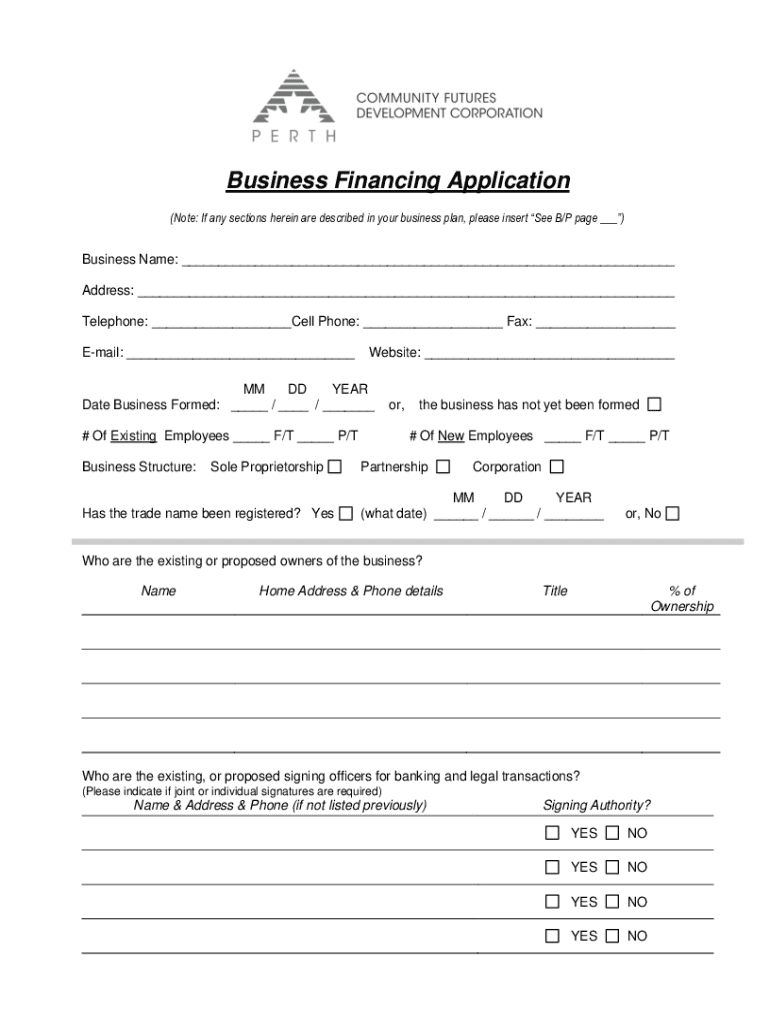

Business Financing Application (Note: If any sections herein are described in your business plan, please insert See B/P page)Business Name: Address: Telephone: Cell Phone: Fax: Email: Website: MM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business financing application

Edit your business financing application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business financing application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business financing application online

Follow the steps below to benefit from the PDF editor's expertise:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business financing application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business financing application

How to fill out business financing application

01

Start by gathering all the necessary documents and information required for the application, such as your personal and business financial statements, tax returns, cash flow projections, and any other supporting documents.

02

Research different lenders and financial institutions that offer business financing options, and choose the one that best suits your needs.

03

Fill out the application form provided by the lender, ensuring that you provide accurate and detailed information.

04

Include a comprehensive business plan showcasing your company's vision, goals, and financial projections.

05

Provide details about your business, including its legal structure, years in operation, industry, and number of employees.

06

Include information about your personal financial history, such as your credit score, assets, debts, and any previous experience with business financing.

07

Provide accurate financial statements, including your business's profit and loss statement, balance sheet, and cash flow statement.

08

Be prepared to provide collateral or guarantees, if required by the lender.

09

Review and double-check the completed application to ensure accuracy and completeness.

10

Submit the application along with all the required documents to the lender and await their decision.

Who needs business financing application?

01

Business owners who require funding for expanding their operations.

02

Entrepreneurs who want to start a new business or open a new location.

03

Companies looking to purchase new equipment or inventory.

04

Startups seeking capital to launch their products or services.

05

Businesses experiencing cash flow issues or facing financial difficulties.

06

Entrepreneurs planning to acquire another company or merge with existing businesses.

07

Owners looking to refinance existing debts or pay for unexpected expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business financing application in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your business financing application and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify business financing application without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like business financing application, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit business financing application on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share business financing application on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is business financing application?

A business financing application is a formal request submitted by a business to financial institutions or lenders seeking funds for operations, expansion, or specific projects.

Who is required to file business financing application?

Any business entity seeking financial assistance, including small businesses, startups, and established companies, is required to file a business financing application.

How to fill out business financing application?

To fill out a business financing application, gather required documents, provide accurate business information, detail the loan purpose, outline financials, and submit the application as per the lender's guidelines.

What is the purpose of business financing application?

The purpose of a business financing application is to evaluate the financial needs of a business and its potential to repay the borrowed funds, allowing lenders to make informed decisions.

What information must be reported on business financing application?

Information typically required includes business name, address, ownership details, financial statements, credit history, purpose of the loan, and any collateral offered.

Fill out your business financing application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Financing Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.