Get the free Licensed Post Office Insurance Application

Show details

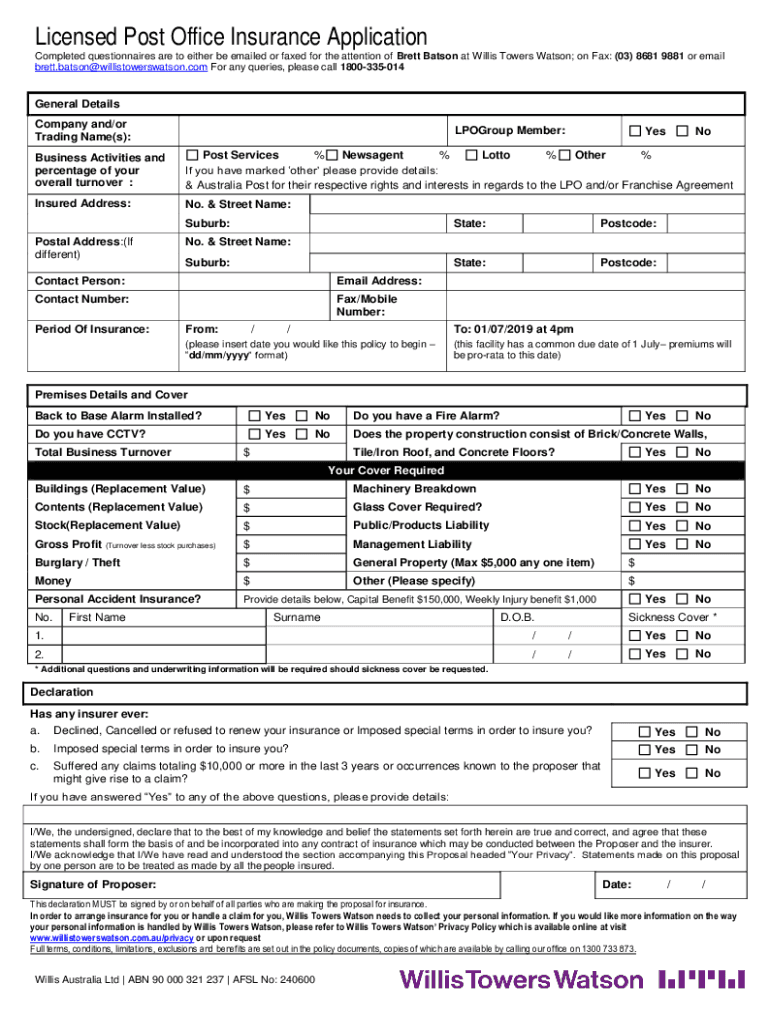

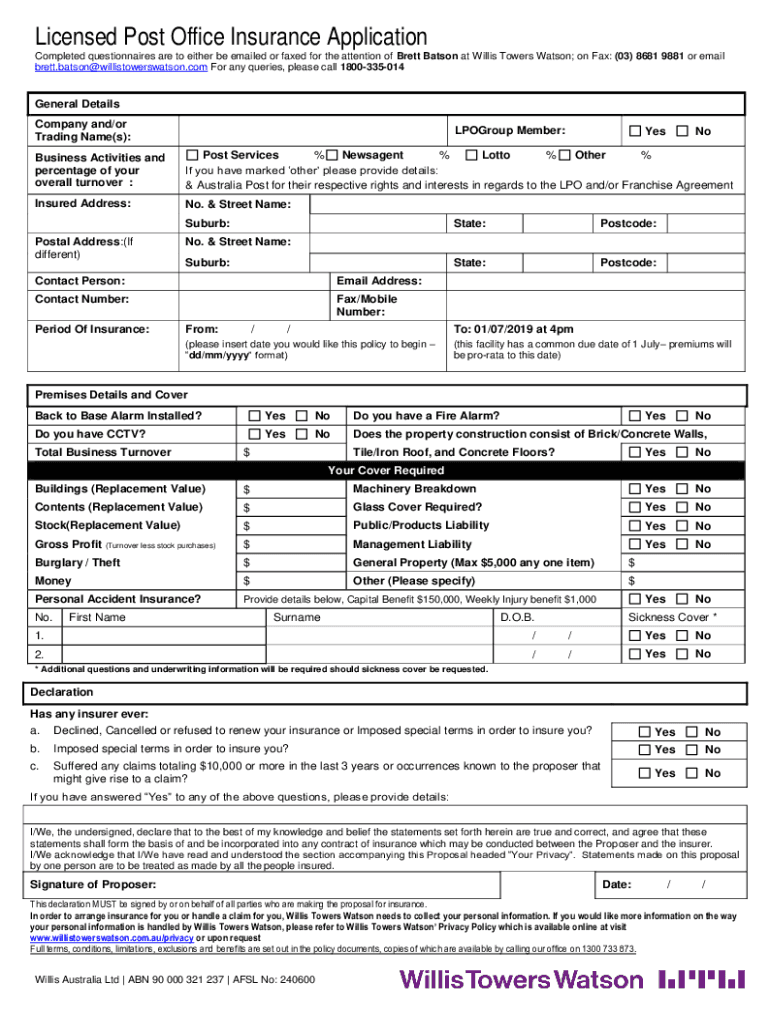

Licensed Post Office Insurance Application

Completed questionnaires are to either be emailed or faxed for the attention of Brett Batson at Willis Towers Watson; on Fax: (03) 8681 9881 or email

brett.batson@willistowerswatson.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign licensed post office insurance

Edit your licensed post office insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your licensed post office insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing licensed post office insurance online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit licensed post office insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out licensed post office insurance

How to fill out licensed post office insurance

01

Step 1: Gather all the necessary information and documents such as the post office license, proof of ownership, and insurance forms.

02

Step 2: Research and choose an insurance provider that offers licensed post office insurance.

03

Step 3: Contact the insurance provider and inquire about their application process for post office insurance.

04

Step 4: Fill out the insurance application form accurately and provide all the required details.

05

Step 5: Attach any supporting documents that may be required, such as proof of income or past claims history.

06

Step 6: Review the completed application form and supporting documents for any errors or missing information.

07

Step 7: Submit the filled-out application form and supporting documents to the insurance provider through their preferred method (online, mail, or in-person).

08

Step 8: Wait for the insurance provider to process your application and assess the risk associated with insuring your licensed post office.

09

Step 9: Once your application is reviewed, the insurance provider will provide you with a quote for the insurance coverage.

10

Step 10: Review the insurance quote, including the coverage details, premium amount, and any additional terms or conditions.

11

Step 11: If you are satisfied with the quote, you can proceed to accept it by signing the necessary agreements and making the required payment.

12

Step 12: After accepting the quote and making the payment, you will receive the licensed post office insurance policy documents.

13

Step 13: Keep the insurance policy documents safe and accessible for future reference and in case of any claims or disputes.

Who needs licensed post office insurance?

01

Licensed post office insurance is needed by individuals or entities who own or operate a licensed post office.

02

This includes post office owners, managers, or operators who want to protect their business and assets against various risks.

03

Licensed post office insurance provides coverage for potential liabilities, property damage, theft, loss of income, legal expenses, and other unforeseen events.

04

It is essential for post office owners to have insurance to ensure financial protection and peace of mind in case of any unfortunate incidents.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in licensed post office insurance without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your licensed post office insurance, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the licensed post office insurance form on my smartphone?

Use the pdfFiller mobile app to fill out and sign licensed post office insurance. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete licensed post office insurance on an Android device?

Complete licensed post office insurance and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is licensed post office insurance?

Licensed post office insurance is a type of insurance coverage specifically designed for licensed postal service providers to protect their operations, assets, and employees against various risks including theft, damage, or liability.

Who is required to file licensed post office insurance?

Licensed postal service providers operating in regulated areas are generally required to file for licensed post office insurance as part of their compliance with regulatory standards.

How to fill out licensed post office insurance?

To fill out licensed post office insurance, one typically needs to provide relevant business information, details of the coverage desired, any existing policies, and signature authorization, often using a designated form provided by the licensing authority.

What is the purpose of licensed post office insurance?

The purpose of licensed post office insurance is to mitigate financial risks associated with postal operations, ensuring that businesses can recover from losses due to unforeseen events, enhancing operational stability and consumer trust.

What information must be reported on licensed post office insurance?

Information that must be reported includes the type of coverage requested, details on the business operations, value of assets, incidents or claims history, and any pertinent regulatory compliance documentation.

Fill out your licensed post office insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Licensed Post Office Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.