Get the free How VAT affects charities (VAT Notice 701/1) - GOV.UK

Show details

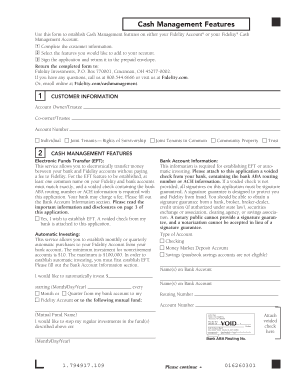

FUNDRAISING

GALA

Love of Dog

FOR DONATION FOREPART 1

DONOR RECONTACT INFORMATION

(AS IT SHOULD APPEAR ON PRINT/PROMOTIONAL MATERIALS)CONTACT NAMEWEBSITEADDRESS

CITY/PROVINCEPOSTAL CODEPHONEEMAILDATE

INCOME

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how vat affects charities

Edit your how vat affects charities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how vat affects charities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how vat affects charities online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit how vat affects charities. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how vat affects charities

How to fill out how vat affects charities

01

Start by understanding the basics of VAT (Value Added Tax) and how it works. VAT is a consumption tax that is charged on most goods and services sold by businesses in the UK.

02

Research the specific VAT rules and regulations that apply to charities. Charities may be eligible for certain exemptions or reduced rates of VAT depending on the nature of their activities.

03

Keep track of all the income and expenses related to your charity's activities. This includes any sales, donations, or grants received as well as any purchases or services acquired.

04

Determine the VAT liability of your charity by assessing whether your activities fall within the scope of VAT. Some activities may be VAT-exempt or eligible for reduced rates.

05

Register for VAT if your charity's taxable turnover exceeds the registration threshold. Once registered, you will be required to charge VAT on applicable goods or services and submit VAT returns to HM Revenue and Customs.

06

Familiarize yourself with the VAT reliefs and exemptions available to charities, such as the zero-rate relief for certain supplies like donated goods or fundraising events.

07

Keep accurate records of all VAT transactions, including invoices, receipts, and records of VAT paid and received. This will facilitate the preparation of VAT returns and help you comply with reporting requirements.

08

Consult with a VAT specialist or seek professional advice if you have any questions or uncertainties regarding how VAT affects your charity.

09

Stay updated on any changes or updates to VAT legislation and compliance requirements that may impact your charity's obligations.

10

Regularly review your charity's VAT position to ensure ongoing compliance and optimize VAT recovery opportunities.

Who needs how vat affects charities?

01

Charities, non-profit organizations, and individuals involved in the administration or financial management of charities may benefit from understanding how VAT affects charities.

02

Accountants, tax advisors, or professionals providing financial consultancy services to charities may also need to be familiar with how VAT impacts their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in how vat affects charities without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your how vat affects charities, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit how vat affects charities straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing how vat affects charities.

How do I fill out the how vat affects charities form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign how vat affects charities. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is how VAT affects charities?

VAT can affect charities by influencing their ability to reclaim VAT on purchases and whether they need to charge VAT on certain goods and services they provide.

Who is required to file how VAT affects charities?

Charities that have taxable supplies over the VAT threshold are required to file for VAT and report the impact on their operations.

How to fill out how VAT affects charities?

Filling out how VAT affects charities involves completing the VAT return forms with accurate data regarding income, expenditure, and any VAT reclaimed.

What is the purpose of how VAT affects charities?

The purpose is to ensure charities understand their obligations and rights regarding VAT, helping them manage their finances efficiently.

What information must be reported on how VAT affects charities?

Charities must report total taxable income, VAT charged on sales, VAT reclaimed on purchases, and any exemptions applicable.

Fill out your how vat affects charities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Vat Affects Charities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.