Get the free Calculating Revenue Reductions for Second Draw PPP Loans ...

Show details

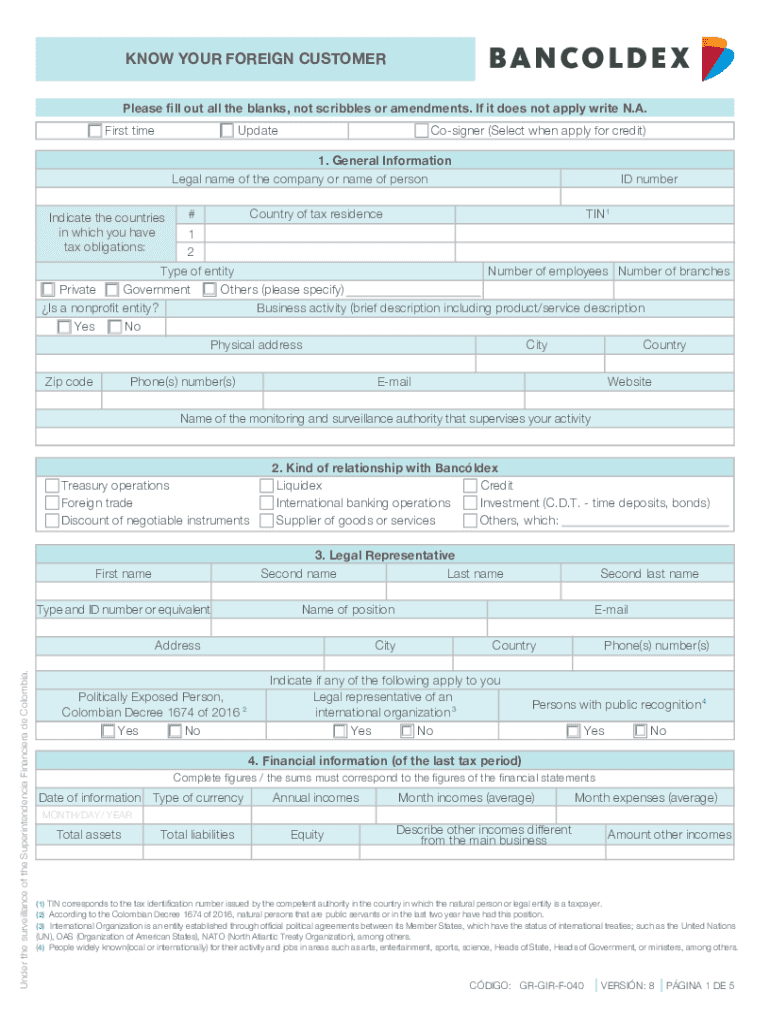

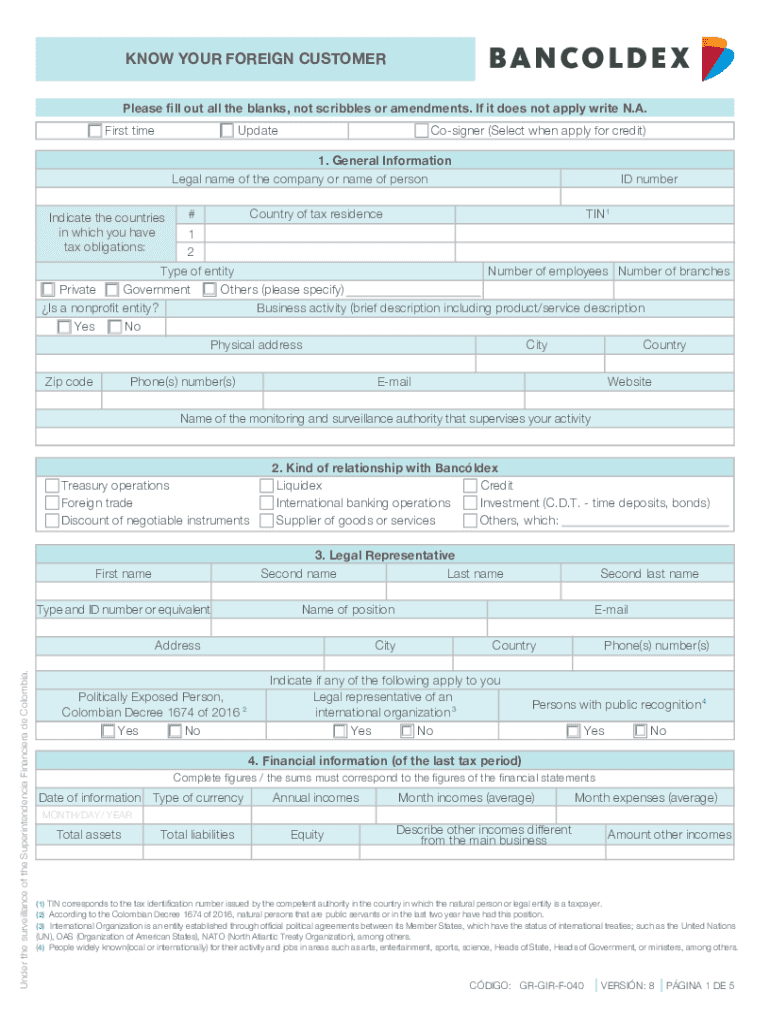

KNOW YOUR FOREIGN CUSTOMER

Please ll out all the blanks, not scribbles or amendments. If it does not apply to write N.A.

First timeUpdateCosigner (Select when apply for credit)1. General Information

Legal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calculating revenue reductions for

Edit your calculating revenue reductions for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calculating revenue reductions for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit calculating revenue reductions for online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit calculating revenue reductions for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out calculating revenue reductions for

How to fill out calculating revenue reductions for

01

Step 1: Gather your financial data, including your total revenue for the specified period and any applicable deductions or adjustments.

02

Step 2: Determine the specific criteria or calculations required for calculating revenue reductions. This may vary based on the industry or specific circumstances.

03

Step 3: Identify the factors that contribute to revenue reductions, such as customer returns, discounts, or allowances.

04

Step 4: Calculate the amount of revenue reductions for each identified factor. This may involve applying percentages, deducting specific amounts, or using other mathematical formulas.

05

Step 5: Summarize the revenue reductions for each factor to obtain the total revenue reduction for the specified period.

06

Step 6: Present the calculated revenue reductions in a clear and organized manner, including any required supporting documentation or explanations.

07

Step 7: Review the calculated revenue reductions for accuracy and ensure all necessary information has been included.

08

Step 8: Use the calculated revenue reductions for reporting purposes or to analyze the financial impact on the business.

09

Note: It is recommended to consult with a financial professional or refer to specific guidelines or regulations related to calculating revenue reductions for more accurate and reliable results.

Who needs calculating revenue reductions for?

01

Businesses and organizations of all sizes may need to calculate revenue reductions for various reasons, including financial reporting, tax purposes, performance evaluation, or compliance with industry regulations.

02

Accountants, financial analysts, and business owners often need to understand and calculate revenue reductions to assess the financial health of a company, make informed business decisions, or meet specific requirements set by regulatory authorities.

03

Investors and stakeholders may also require revenue reduction calculations to evaluate the profitability and performance of a business before making investment decisions.

04

Government agencies and auditing firms might request revenue reduction calculations during financial audits or investigations to ensure compliance with accounting standards and regulations.

05

Overall, anyone involved in financial analysis, management, or reporting may need to calculate revenue reductions at some point to gain insights into the financial performance and stability of a business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in calculating revenue reductions for without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your calculating revenue reductions for, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the calculating revenue reductions for in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your calculating revenue reductions for right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit calculating revenue reductions for on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit calculating revenue reductions for.

What is calculating revenue reductions for?

Calculating revenue reductions is used to assess the impact of certain factors, such as tax credits or specific deductions, on a business's overall revenue.

Who is required to file calculating revenue reductions for?

Businesses and organizations that qualify for specific tax reliefs, credits, or have experienced revenue losses may be required to file calculating revenue reductions.

How to fill out calculating revenue reductions for?

To fill out calculating revenue reductions, gather necessary financial documents, follow the required guidelines provided by tax authorities, and use the appropriate forms to report your revenue adjustments.

What is the purpose of calculating revenue reductions for?

The purpose is to provide an accurate representation of a business's taxable income by accounting for eligible reductions, helping to determine tax obligations.

What information must be reported on calculating revenue reductions for?

Information such as total revenue, eligible deductions, specific tax credits claimed, and any revenue losses must be reported.

Fill out your calculating revenue reductions for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calculating Revenue Reductions For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.