Get the free SKIP A PAYMENT LOAN PROMOTION

Show details

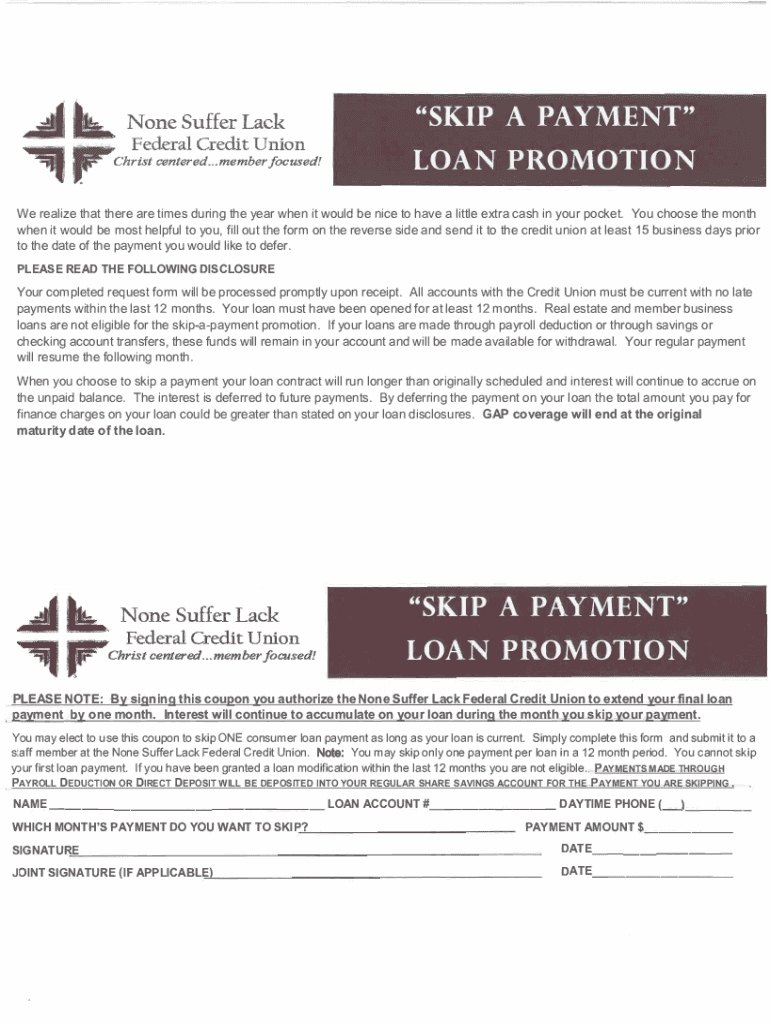

None Suffer Lack Federal Credit Union, ... Christ centered... member focused! “SKIP A PAYMENT LOAN Promotion realize that there are times during the year when it would be nice to have a little extra

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign skip a payment loan

Edit your skip a payment loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your skip a payment loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit skip a payment loan online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit skip a payment loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out skip a payment loan

How to fill out skip a payment loan

01

Contact your loan provider and request to skip a payment on your loan.

02

Provide necessary information such as loan account number, name, and contact details.

03

Understand the terms and conditions of skipping a payment, including any associated fees or interest charges.

04

Evaluate your financial situation and determine if skipping a payment is the right choice for you.

05

Get confirmation from your loan provider regarding the approval of skipping a payment.

06

Make note of the new payment schedule or any modifications to your loan agreement.

07

Set a reminder to resume regular loan payments after the skipped period.

08

Monitor your loan account to ensure that the skipped payment has been properly processed.

Who needs skip a payment loan?

01

Individuals who are facing temporary financial difficulties and are unable to make their scheduled loan payments.

02

Those who have unexpected expenses or emergencies that require immediate attention and do not have sufficient funds to cover both the loan payment and the additional expenses.

03

People who have a reliable and legitimate reason to skip a payment, such as a sudden loss of income or a medical emergency.

04

Borrowers who have a good repayment history and have built trust with their loan provider.

05

Individuals who have exhausted all other available options to manage their financial situation and need a temporary relief from loan payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find skip a payment loan?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the skip a payment loan in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in skip a payment loan?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your skip a payment loan and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit skip a payment loan on an iOS device?

Create, modify, and share skip a payment loan using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is skip a payment loan?

A skip a payment loan is a financial agreement that allows borrowers to temporarily postpone or skip one or more loan payments without negatively affecting their credit score.

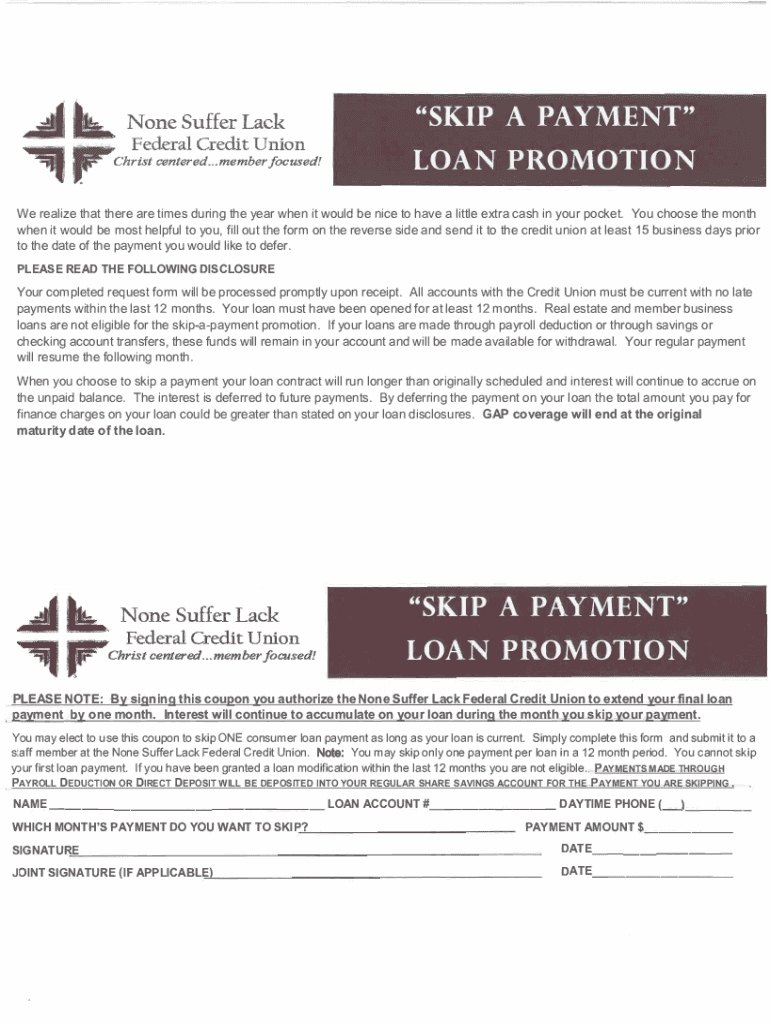

Who is required to file skip a payment loan?

Typically, borrowers who are facing temporary financial hardships or unexpected expenses may choose to file for a skip a payment loan, but not everyone is required to do so.

How to fill out skip a payment loan?

To fill out a skip a payment loan, borrowers usually need to complete a request form provided by their lender, detailing their account information and the reason for the request.

What is the purpose of skip a payment loan?

The purpose of a skip a payment loan is to provide financial relief to borrowers experiencing difficulties, allowing them to manage their cash flow more effectively.

What information must be reported on skip a payment loan?

Information that may need to be reported on a skip a payment loan includes borrower details, loan account information, the requested payment postponement dates, and reason for the request.

Fill out your skip a payment loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Skip A Payment Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.