Get the free Charitable Contributions You Think You Can Claim but Can't ...The IRS Donation Limit...

Show details

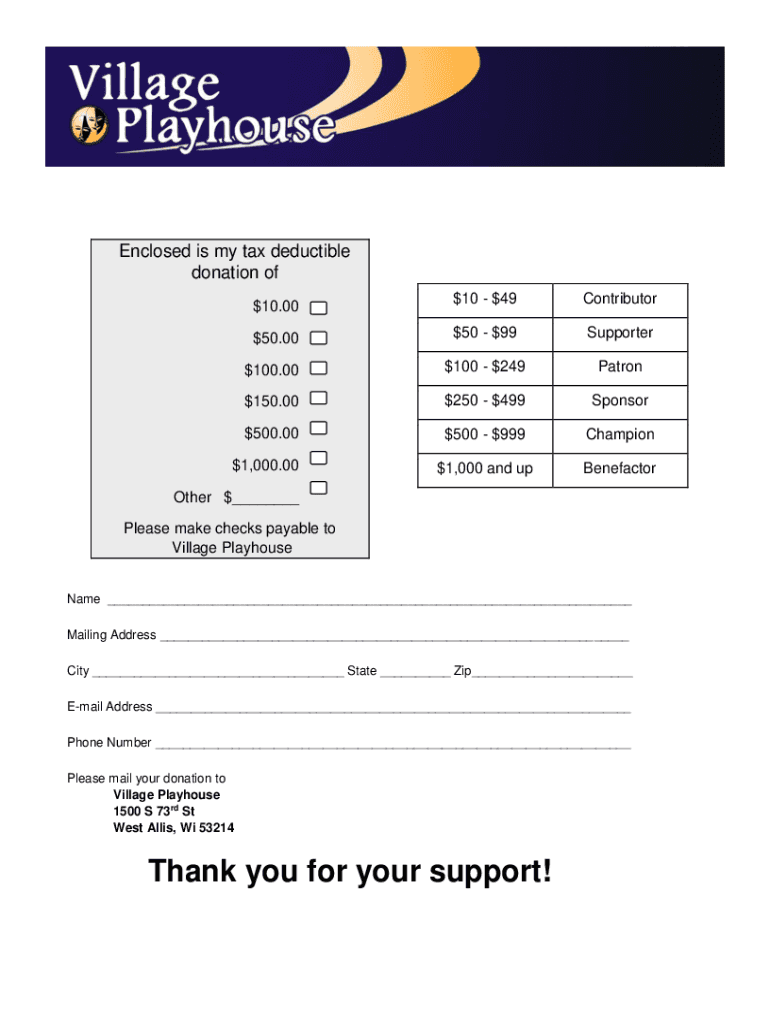

Enclosed is my tax-deductible donation of $$$10.001049Contributor$$$50.005099Supporter$$$100.00100249Patron$$$150.00250499Sponsor$$$500.00500999Champion$1,000 and upBenefactor$1,000.00 Other $ Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable contributions you think

Edit your charitable contributions you think form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable contributions you think form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable contributions you think online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable contributions you think. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable contributions you think

How to fill out charitable contributions you think

01

Gather all necessary documents related to your charitable contributions, such as donation receipts or acknowledgement letters.

02

Determine the type of charitable contribution you made. It can be a cash donation or a donation of assets like stocks, real estate, or vehicles.

03

Calculate the total value of your charitable contributions. For cash donations, use the amount you actually donated. For non-cash donations, use the fair market value of the donated assets.

04

Fill out the appropriate sections of your tax form. If you're using Form 1040, report your charitable contributions on Schedule A, Itemized Deductions.

05

Enter the total value of your charitable contributions in the designated field on the tax form, ensuring accuracy and proper documentation.

06

Keep all your supporting documents in case of an audit or review. This includes donation receipts, acknowledgement letters, and any other relevant documentation.

07

Double-check your tax return before submitting it to ensure that all your charitable contributions are accurately recorded.

08

File your tax return by the deadline, taking advantage of any applicable deductions or credits related to your charitable contributions.

09

Consider consulting a tax professional or utilizing tax software to ensure you're following all the necessary guidelines and maximizing your tax benefits from charitable contributions.

Who needs charitable contributions you think?

01

Various individuals and organizations can benefit from charitable contributions, including:

02

Non-profit organizations: Charitable contributions are essential for the sustainability and operation of non-profit organizations, allowing them to carry out their missions and provide services to those in need.

03

Individuals affected by natural disasters or emergencies: Charitable contributions can provide crucial support to individuals and communities during times of crisis, helping them recover and rebuild their lives.

04

Underprivileged individuals and families: Charitable contributions can significantly impact the lives of low-income individuals and families by providing them with essential resources, such as food, shelter, education, and healthcare.

05

Research institutions and medical organizations: Donations to research and medical organizations can support scientific advancements, medical breakthroughs, and the development of treatments or cures for various diseases.

06

Educational institutions: Charitable contributions to educational institutions can contribute to scholarships, better facilities, enhanced learning opportunities, and overall educational quality.

07

Environmental and wildlife conservation organizations: Donations to these organizations help protect and preserve our environment, promote sustainable practices, and conserve wildlife habitats.

08

Cultural and arts organizations: Charitable contributions support arts and cultural programs, exhibitions, performances, and the preservation of heritage.

09

Ultimately, anyone who wants to make a positive impact in their community or society as a whole can contribute to various causes through charitable donations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send charitable contributions you think to be eSigned by others?

To distribute your charitable contributions you think, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in charitable contributions you think?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your charitable contributions you think to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit charitable contributions you think on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share charitable contributions you think from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is charitable contributions you think?

Charitable contributions refer to donations made to nonprofit organizations or charitable entities that qualify for tax deductions under the law.

Who is required to file charitable contributions you think?

Individuals and businesses that make charitable donations and wish to claim tax deductions for those contributions are required to file charitable contributions.

How to fill out charitable contributions you think?

To fill out charitable contributions, donors should use Schedule A (Form 1040) to itemize deductions or report on Form 1099 if applicable. It's important to keep records such as receipts and documentation of the contributions.

What is the purpose of charitable contributions you think?

The purpose of charitable contributions is to provide financial support to nonprofit organizations that serve the public good, assist those in need, and fund various societal projects and initiatives.

What information must be reported on charitable contributions you think?

Donors must report the amount of the contribution, the date it was made, the organization it was given to, and any required documentation, such as receipts or letters from the organization.

Fill out your charitable contributions you think online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Contributions You Think is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.