Get the free Form 10-K for Fiscal Year Ended December 31, 2004

Show details

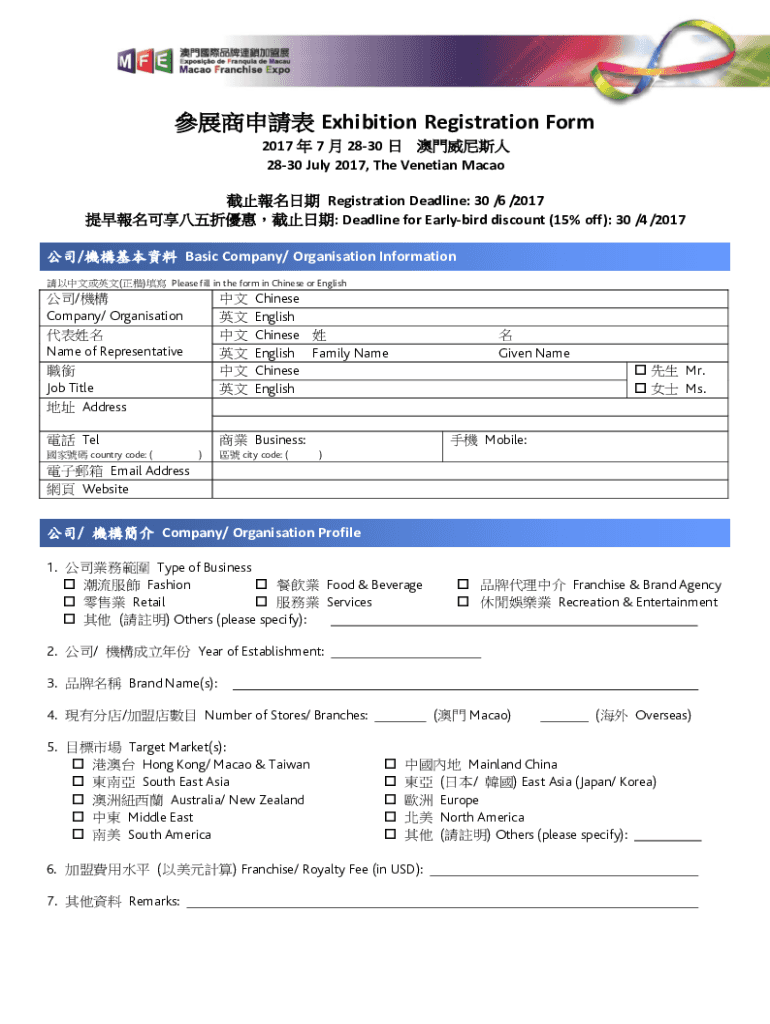

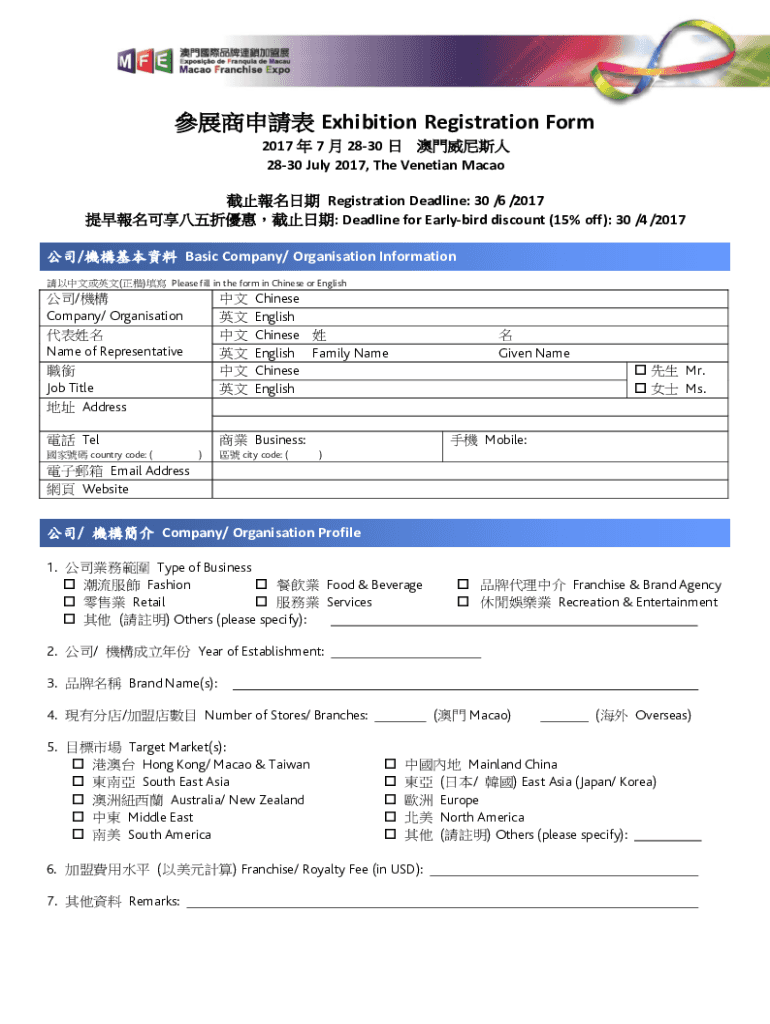

Exhibition Registration Form 2017 7 2830 2830 July 2017, The Venetian Macao Registration Deadline: 30 /6 /2017 : Deadline for Early bird discount (15% off): 30 /4 /2017 / Basic Company/ Organization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10-k for fiscal

Edit your form 10-k for fiscal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 10-k for fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 10-k for fiscal online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 10-k for fiscal. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 10-k for fiscal

How to fill out form 10-k for fiscal

01

Start by obtaining a copy of the form 10-K for fiscal. This form can usually be found on the website of the Securities and Exchange Commission (SEC).

02

Carefully read the instructions provided with the form 10-K to understand the requirements and guidelines for filling it out.

03

Begin by entering the fiscal year-end date in the designated section of the form.

04

Provide the required information about the company, including its name, address, and state of incorporation.

05

Complete the Business section, which includes details about the company's operations, products or services, and markets.

06

Fill out the Risk Factors section, where you should disclose any potential risks that could affect the company's performance.

07

Provide a Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A), which explains the company's financial performance and future prospects.

08

Complete the Financial Statements section, including balance sheets, income statements, and cash flow statements.

09

Disclose any supplementary financial information or exhibits required by the SEC.

10

Carefully review the completed form 10-K to ensure accuracy and completeness before submitting it to the SEC.

Who needs form 10-k for fiscal?

01

Various entities and individuals may need form 10-K for fiscal, including:

02

- Publicly traded companies in the United States are required by the SEC to file form 10-K annually to disclose their financial performance and provide other relevant information.

03

- Investors and analysts who want to evaluate a company's financial health and prospects use form 10-K to obtain detailed financial and business-related information.

04

- Regulators and government agencies may require form 10-K to monitor and regulate the activities of publicly traded companies.

05

- Creditors and lenders may request form 10-K to assess a company's creditworthiness and financial stability.

06

- Researchers and academicians may use form 10-K for studying financial trends and conducting industry analysis.

07

- Law firms and legal professionals may refer to form 10-K in legal proceedings or due diligence processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 10-k for fiscal in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form 10-k for fiscal and you'll be done in minutes.

How do I edit form 10-k for fiscal on an Android device?

The pdfFiller app for Android allows you to edit PDF files like form 10-k for fiscal. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I fill out form 10-k for fiscal on an Android device?

Use the pdfFiller mobile app and complete your form 10-k for fiscal and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is form 10-k for fiscal?

Form 10-K is an annual report required by the Securities and Exchange Commission (SEC) that provides a comprehensive overview of a company's financial performance, including audited financial statements, a narrative overview of the business, management discussion, and other disclosures.

Who is required to file form 10-k for fiscal?

Publicly traded companies in the United States that are registered with the SEC are required to file Form 10-K.

How to fill out form 10-k for fiscal?

To fill out Form 10-K, a registrant must complete various sections including business overview, risk factors, properties, legal proceedings, financial statements, and management's discussion and analysis, adhering to the guidelines set forth by the SEC.

What is the purpose of form 10-k for fiscal?

The purpose of Form 10-K is to provide investors with detailed information about a company's financial condition, results of operations, and any relevant risks associated with the business.

What information must be reported on form 10-k for fiscal?

Form 10-K must report financial statements, management's discussion and analysis, information about the company's directors and executives, corporate governance, risk factors, and disclosures related to executive compensation, among other details.

Fill out your form 10-k for fiscal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 10-K For Fiscal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.