Get the free Schedule K-1 (Form 1065) - irs

Show details

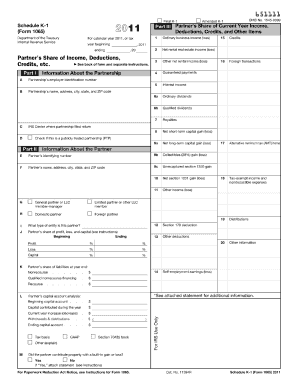

Please note that we may not be able to consider many suggestions until the subsequent revision of the product. 651113 Final K-1 Schedule K-1 Form 1065 Department of the Treasury Internal Revenue Service Part III Partner s Share of Current Year Income Deductions Credits and Other Items ending Ordinary business income loss For calendar year 2014 or tax year beginning Net rental real estate income loss Other net rental income loss Guaranteed payment...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule k-1 form 1065

Edit your schedule k-1 form 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule k-1 form 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule k-1 form 1065 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule k-1 form 1065. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule k-1 form 1065

How to fill out Schedule K-1 (Form 1065)

01

Obtain a copy of Schedule K-1 (Form 1065) from the IRS website or through your tax preparation software.

02

Fill in the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

03

Provide the partner's identifying information, including name, address, and Taxpayer Identification Number (TIN).

04

Report the partner's share of income, deductions, and credits in the appropriate boxes provided on the form.

05

Complete Part II, which requires information on the partner's capital account, including contributions and distributions.

06

Review all entries for accuracy and ensure all necessary information is included.

07

Distribute copies of the completed Schedule K-1 to each partner by the applicable deadline.

Who needs Schedule K-1 (Form 1065)?

01

Partners in a partnership who receive income, deductions, or credits must have Schedule K-1 (Form 1065) issued to them.

02

Tax practitioners who prepare partnership tax returns or assist partners in filing their personal tax returns.

03

Partnerships with multiple partners that must report each partner's share of the partnership's income.

Fill

form

: Try Risk Free

People Also Ask about

What can you write off on K1 income?

Generally, you may be allowed a deduction of up to 20% of your apportioned net qualified business income (QBI) plus 20% of your apportioned qualified REIT dividends, also known as section 199A dividends, and qualified publicly traded partnership (PTP) income from the trust or estate.

How much tax do you pay on K1 income?

The partnership only provides information to the IRS and does not pay taxes on the income reported on K-1 forms. The partnership provides each partner their Schedule K-1 form and each partner uses the information regarding their share of income, losses, deductions, and credits to file their individual tax returns.

Do I pay self-employment tax on K1 income?

Generally, a taxpayer's share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax. However, like any general rule, there are a myriad of exceptions, including one excepting a limited partner's share of ordinary income from a partnership.

Does K1 income count as earned income?

K-1 income generated from an S Corp where you materially participate is considered non-passive income. It is not necessarily earned income and it is not passive income. It is something in between, but definitely without the Social Security and Medicare tax element.

Do you pay estimated taxes on k1 income?

The partners report the information from the K-1 or K-3 on their own returns and pay any taxes due, including estimated taxes.

What is Schedule K-1 form 1065 self employment earnings?

Schedule K-1 (Form 1065) - Self-Employment Earnings. How can we help? As a general rule, the starting point for determining a general partner's self-employment earnings is the partner's distributive share of a partnership's ordinary trade or business income reported on line 1 of Schedule K-1 (Form 1065).

What is schedule K-1 form 1065 for?

Schedule K-1 is used to report the amount of income each party is responsible for in a pass-through entity, like an S corporation or partnership. Each shareholder or partner will receive a Schedule K-1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule K-1 (Form 1065)?

Schedule K-1 (Form 1065) is a tax form used to report income, deductions, and credits from partnerships to the Internal Revenue Service (IRS) and to the partners who are entitled to the income.

Who is required to file Schedule K-1 (Form 1065)?

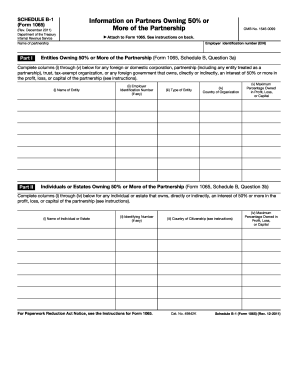

Partnerships that have multiple partners are required to file Schedule K-1 (Form 1065) to report each partner's share of the partnership's income, deductions, and credits.

How to fill out Schedule K-1 (Form 1065)?

To fill out Schedule K-1 (Form 1065), partnerships must provide the partnership's information, the partner's information, and report the specific amounts of the partner's share of the income, deductions, and credits.

What is the purpose of Schedule K-1 (Form 1065)?

The purpose of Schedule K-1 (Form 1065) is to ensure that income from partnerships is properly reported to both the IRS and the partners, allowing partners to report their share of the partnership's income on their individual tax returns.

What information must be reported on Schedule K-1 (Form 1065)?

Schedule K-1 (Form 1065) must report information such as the partnership's name and address, the partner's name and address, the partner's identification number, and the partner's share of income, credits, and deductions.

Fill out your schedule k-1 form 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule K-1 Form 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.