Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form 1065?

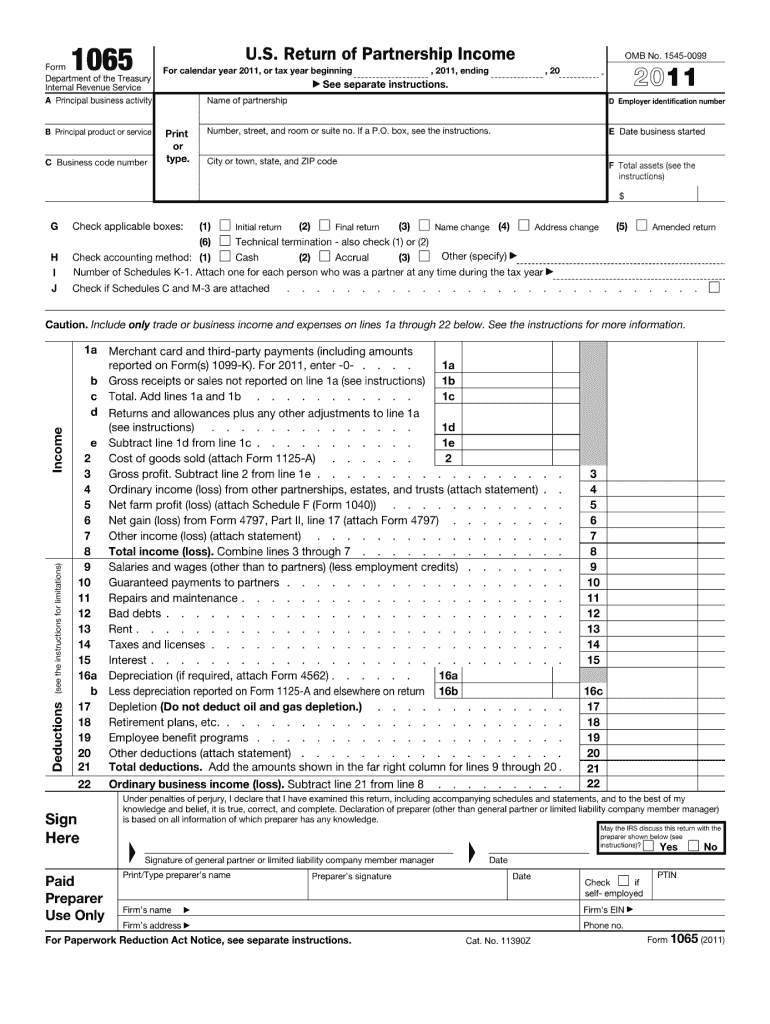

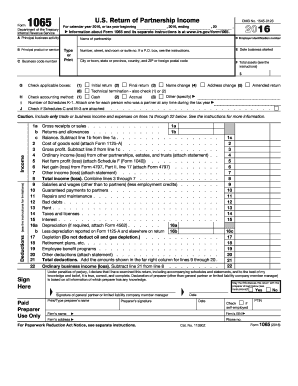

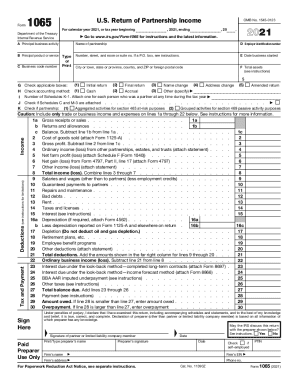

IRS Form 1065 is the U.S. Return of Partnership Income. It is a tax form used by partnerships to report their income, gains, losses, deductions, and credits. The form is filed annually to report the partnership's financial information, while individual partners report their share of the partnership's income and expenses on their own individual tax returns. Form 1065 provides the IRS with details about the partnership's activities and helps determine the overall tax liability.

Who is required to file irs form 1065?

Form 1065 is used by partnerships to report their business income, deductions, gains, losses, and other relevant information to the IRS. Therefore, any partnership with at least two partners is required to file Form 1065. Additionally, limited liability companies (LLCs) that have multiple members and are treated as partnerships for tax purposes also need to file this form.

How to fill out irs form 1065?

Filling out IRS Form 1065, also known as the U.S. Return of Partnership Income, requires careful attention to detail. Here are the steps to fill out Form 1065:

1. Start by entering the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

2. Fill in the information about the partnership's accounting method and the beginning and ending dates of the tax year. Indicate if the return is for a short tax year.

3. Provide the taxpayer identification information for each general partner (Name, address, and Social Security Number or EIN).

4. Complete Schedule B, which certifies that the partnership meets the requirements for filing Form 1065. This schedule provides information about the partners and their capital percentages.

5. Include the Balance Sheet and Income Statement information on Schedule L and Schedule M-1, respectively. These schedules provide details about the partnership's financial position, such as assets, liabilities, and net income. Other schedules, such as Schedule K, may be necessary depending on the partnership's specific circumstances.

6. Allocate and report the partnership's income, deductions, and credits on Schedule K-1 for each partner. Each partner will receive a separate Schedule K-1, which they will use to report their share of the partnership's items on their individual tax returns.

7. Attach any necessary supporting schedules, such as Schedule D for capital gains and losses or Schedule L for balance sheet detail.

8. Complete the signature section, including the date and title of the person signing the return.

9. If required, make a copy of the completed Form 1065 and all attachments for your records.

10. Mail the original Form 1065 to the appropriate IRS service center. The mailing address can be found in the instructions for Form 1065.

Remember to consult the official IRS instructions for Form 1065 (available on the IRS website) to ensure that you accurately complete all sections of the form and provide any additional required information based on your partnership's specific situation. It is also recommended to seek the guidance of a tax professional or accountant to ensure compliance with any complex tax rules.

What is the purpose of irs form 1065?

The purpose of IRS Form 1065 is to report the income, gains, losses, deductions, and credits of a partnership. This form is used to calculate the partnership's taxable income and to determine the amount of tax that needs to be paid or refunded. Additionally, Form 1065 provides the IRS with information about the partners and their share of the partnership's profits and losses.

What information must be reported on irs form 1065?

IRS Form 1065, also known as the U.S. Return of Partnership Income, must include the following information:

1. Basic information: The name, address, and Employer Identification Number (EIN) of the partnership.

2. Accounting method: The method used to account for income and expenses (e.g., cash or accrual).

3. Principal business activity: A description of the partnership's primary business activity.

4. Partner information: The name, address, and Social Security Number (SSN) or EIN of each partner.

5. Tax year: The beginning and ending dates of the partnership's tax year.

6. Schedule K: The partnership's total income, deductions, credits, and other information. This includes items such as ordinary business income or loss, rental real estate income, interest, dividends, and capital gains or losses.

7. Schedule M-2: The partnership's analysis of partner capital accounts.

8. Schedule K-1: This form is prepared for each partner and includes their share of the partnership's income, deductions, credits, etc.

9. Schedule L: The balance sheet of the partnership, including assets, liabilities, and partner capital accounts at the beginning and end of the tax year.

10. Schedule M-3: This schedule is required for partnerships with total assets over $10 million or that are required to file Schedule UTP (Uncertain Tax Position Statement).

11. Additional forms and schedules: Depending on the specific circumstances of the partnership, certain additional forms or schedules may also be required to be attached to Form 1065.

How can I modify irs form 1065 2011 without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including irs form 1065 2011, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete irs form 1065 2011 online?

pdfFiller has made it simple to fill out and eSign irs form 1065 2011. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit irs form 1065 2011 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute irs form 1065 2011 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS 1065?

IRS 1065 is a tax form used to report income, deductions, gains, and losses from the operation of a partnership.

Who is required to file IRS 1065?

Partnerships operating in the United States are required to file IRS 1065. This includes general partnerships, limited partnerships, and limited liability companies (LLCs) treated as partnerships for tax purposes.

How to fill out IRS 1065?

To fill out IRS 1065, start by gathering information about the partnership's income and expenses. Complete the form with details such as the partnership's name, address, and taxpayer identification number, followed by income, deductions, tax credits, and distributions to partners.

What is the purpose of IRS 1065?

The purpose of IRS 1065 is to report the financial performance of a partnership to the IRS and to inform individual partners of their share of the income or loss so they can report it on their personal tax returns.

What information must be reported on IRS 1065?

IRS 1065 requires reporting of the partnership's income, gains, losses, deductions, credits, and payments. It also includes information regarding each partner's ownership percentage and share of income or loss.