Get the free Central Florida Estate Planning CouncilMember of The ...

Show details

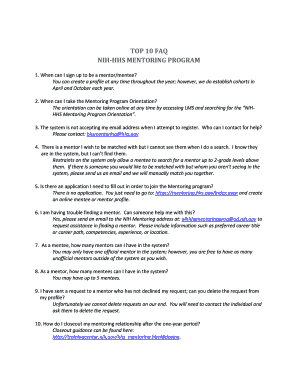

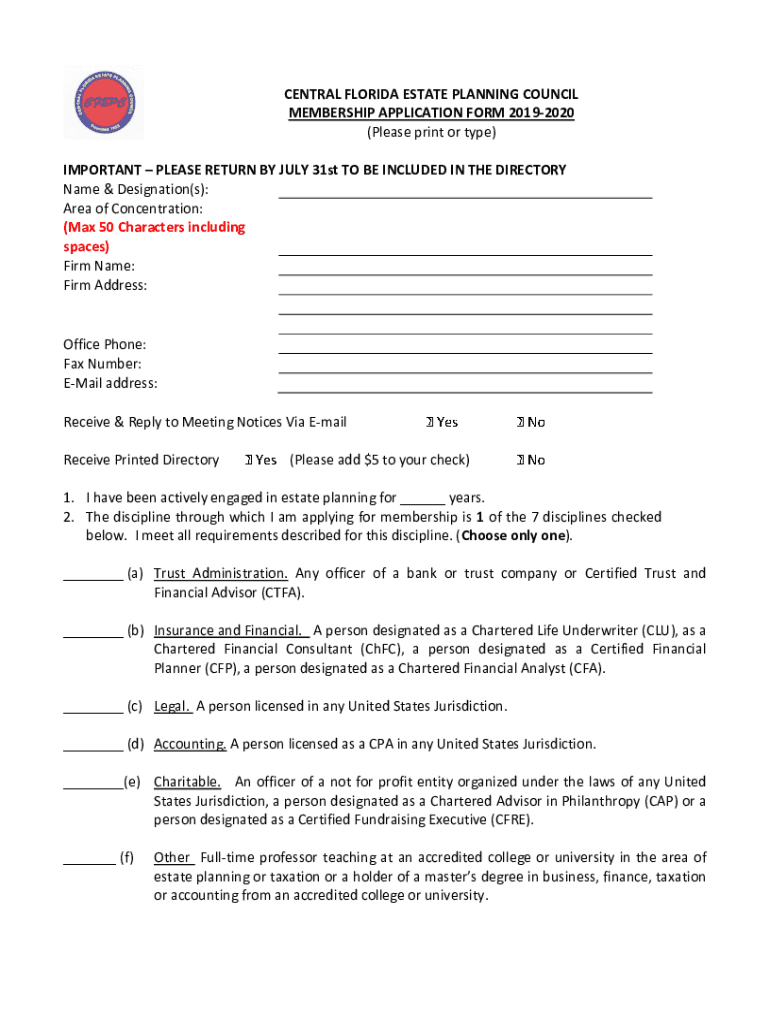

CENTRAL FLORIDA ESTATE PLANNING COUNCIL MEMBERSHIP APPLICATION FORM 20192020 (Please print or type) IMPORTANT PLEASE RETURN BY JULY 31st TO BE INCLUDED IN THE DIRECTORY Name & Designation(s): Area

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign central florida estate planning

Edit your central florida estate planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central florida estate planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit central florida estate planning online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit central florida estate planning. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out central florida estate planning

How to fill out central florida estate planning

01

Gather necessary documents such as identification, property deeds, and financial statements.

02

Consult with an attorney specializing in estate planning in Central Florida.

03

Discuss your goals and objectives for the estate plan with the attorney.

04

Provide information about your assets, beneficiaries, and any specific instructions or requests.

05

Work with the attorney to draft the necessary legal documents, such as a will, trusts, or power of attorney.

06

Review and revise the documents as needed to ensure they accurately reflect your wishes.

07

Sign the documents in the presence of witnesses and/or a notary public as required by law.

08

Inform your chosen beneficiaries and executor about your estate plan and provide them with copies of relevant documents.

09

Store the original copies of the estate plan in a safe and easily accessible location, while also making sure trusted individuals know where to find them if needed.

10

Periodically review and update your estate plan as life circumstances change, such as births, deaths, marriages, or divorces.

Who needs central florida estate planning?

01

Anyone who owns property or has assets in Central Florida may benefit from estate planning.

02

Individuals who want to ensure their assets are distributed according to their wishes after their death can benefit from having an estate plan.

03

Parents who want to designate guardians for their minor children or create trusts to provide for their children's future can benefit from estate planning.

04

Those who want to minimize estate taxes and avoid probate can benefit from proper estate planning.

05

Business owners who want to protect their business and plan for succession can benefit from estate planning.

06

People who want to provide for charities or make specific bequests can benefit from having an estate plan.

07

Individuals who want to plan for incapacity and ensure their healthcare and financial decisions are handled according to their wishes can benefit from estate planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit central florida estate planning from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like central florida estate planning, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out central florida estate planning using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign central florida estate planning and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out central florida estate planning on an Android device?

Use the pdfFiller mobile app to complete your central florida estate planning on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is central florida estate planning?

Central Florida estate planning refers to the process of arranging for the management and distribution of an individual's assets and properties after their death, typically involving the creation of legal documents such as wills and trusts.

Who is required to file central florida estate planning?

Individuals with substantial assets, dependents, or specific wishes regarding the distribution of their estate typically need to engage in estate planning in Central Florida.

How to fill out central florida estate planning?

Filling out Central Florida estate planning documents generally involves gathering information about your assets, beneficiaries, and any specific instructions before consulting an attorney or using simplified legal forms to create wills or trusts.

What is the purpose of central florida estate planning?

The purpose of Central Florida estate planning is to ensure that an individual's wishes are honored regarding asset distribution, minimize taxes and legal fees, and provide for dependents or specific causes after their death.

What information must be reported on central florida estate planning?

Information that must be reported includes a list of assets, details of beneficiaries, instructions for guardianship if applicable, and any specific bequests or conditions related to the estate.

Fill out your central florida estate planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Florida Estate Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.