Get the free *Select which life benefit CAJUN INDUSTRIES HOLDINGS, LLC ...

Show details

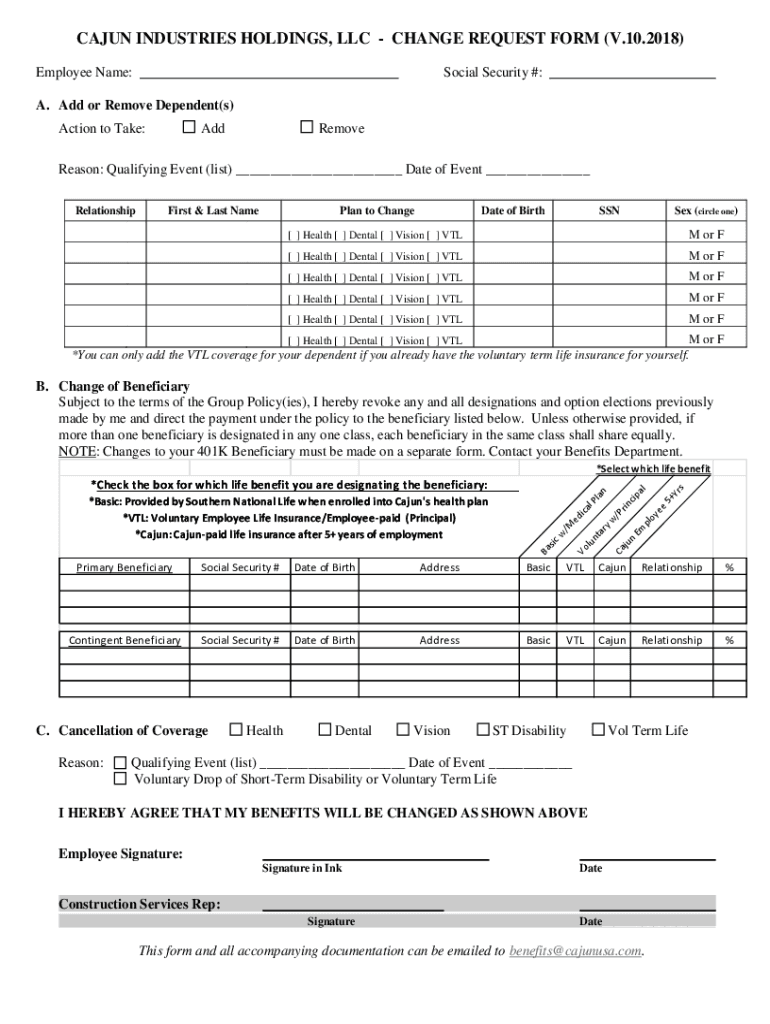

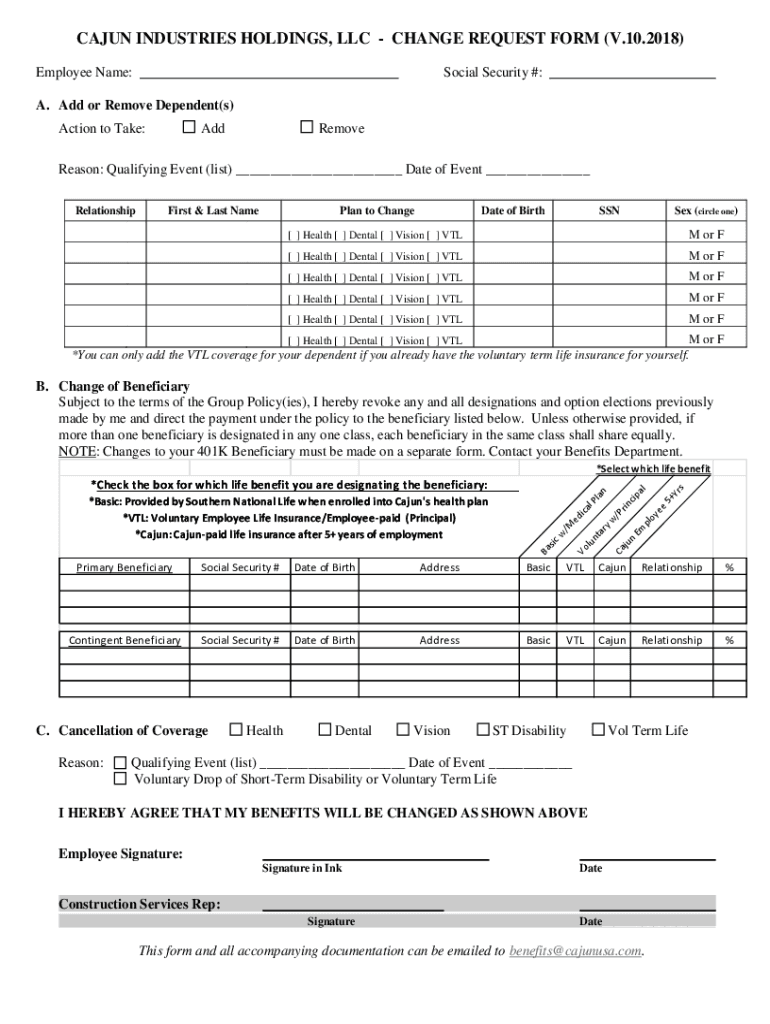

CAJUN INDUSTRIES HOLDINGS, LLC CHANGE REQUEST FORM (V.10.2018) Employee Name:Social Security #:A. Add or Remove Dependent(s) Action to Take:AddRemoveReason: Qualifying Event (list) Date of Event RelationshipFirst

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign select which life benefit

Edit your select which life benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your select which life benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit select which life benefit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit select which life benefit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out select which life benefit

How to fill out select which life benefit

01

Start by understanding the different types of life benefits that are available to you.

02

Consider your specific needs and goals. Do you want a benefit that provides financial support to your loved ones in case of your death? Or do you want a benefit that offers cash value accumulation over time?

03

Research and compare different life benefit options offered by insurance companies. Look at factors such as the coverage amount, premium costs, and any additional features or riders available.

04

Assess your budget and determine how much you can afford to pay for a life benefit. Remember to consider any potential future changes or increases in premium costs.

05

Fill out the select which life benefit form provided by the insurance company. Provide accurate and complete information about yourself and any beneficiaries you wish to designate.

06

Review the filled-out form carefully to ensure all necessary details are included and correct. Make sure to double-check the information provided to avoid any errors or ambiguities.

07

Sign and submit the completed form to the insurance company. Follow any additional submission procedures or requirements specified by the company.

08

Once your form is submitted, wait for the insurance company to process your application. They may contact you for any clarifications or additional information if needed.

09

If your application is approved, carefully review the policy document provided by the insurance company. Understand the terms and conditions, coverage limits, and any exclusions or limitations.

10

Keep a copy of the filled-out form, policy document, and any correspondence or receipts related to your life benefit for future reference.

Who needs select which life benefit?

01

Anyone who wants to financially protect their loved ones or ensure long-term financial security may consider selecting a life benefit.

02

Individuals who have dependents, such as children or a non-working spouse, may prioritize selecting a life benefit to provide for their family's financial needs in case of their untimely death.

03

Business owners or key executives may choose to select a life benefit to protect their company's operations and provide for business continuity in the event of their passing.

04

People who want to build cash value over time or have access to funds for future needs may also find value in selecting a life benefit that offers cash accumulation features.

05

Ultimately, the decision to select a life benefit depends on an individual's personal circumstances, financial goals, and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete select which life benefit online?

pdfFiller has made it easy to fill out and sign select which life benefit. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the select which life benefit in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your select which life benefit in seconds.

Can I create an electronic signature for signing my select which life benefit in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your select which life benefit directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is select which life benefit?

The Select Which Life Benefit is a specific type of life insurance policy that allows policyholders to choose coverage options tailored to their personal financial goals and needs.

Who is required to file select which life benefit?

Individuals or entities who have opted for this specific life benefit and are claiming its tax advantages or benefits are required to file the select which life benefit documentation.

How to fill out select which life benefit?

To fill out the Select Which Life Benefit, you typically need to provide personal information, the details of your policy, coverage amounts, and any additional requested information as specified by the filing form.

What is the purpose of select which life benefit?

The purpose of the Select Which Life Benefit is to offer customizable life insurance coverage that meets the specific needs of individuals while providing potential tax benefits.

What information must be reported on select which life benefit?

The information that must be reported includes policyholder identification details, insurance coverage specifics, premium amounts, and any relevant beneficiary information.

Fill out your select which life benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Select Which Life Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.