Get the free Unreimbursed Medical Expenses deadline ... - District 87

Show details

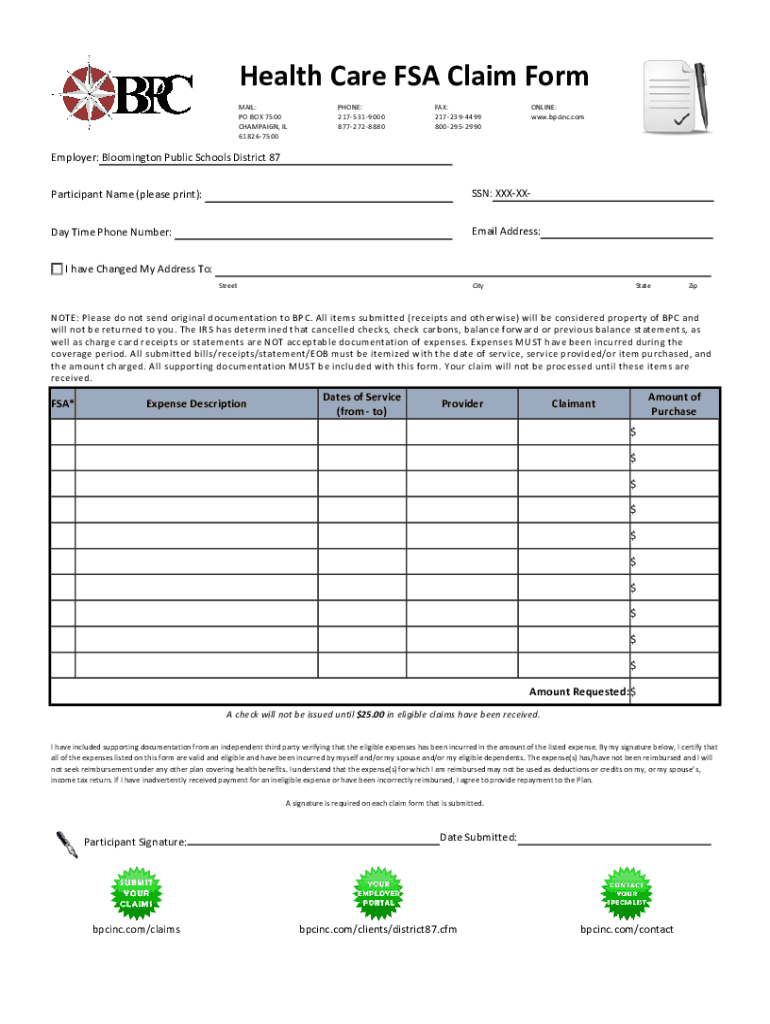

HealthCareFSAClaimForm MAIL: POBOX7500 CHAMPAIGN, IL 618267500PHONE: 2175319000 8772728880FAX: 2172394499 8002952990Employer:BloomingtonPublicSchoolsDistrict87ONLINE: www.bpcinc.com ParticipantName(please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unreimbursed medical expenses deadline

Edit your unreimbursed medical expenses deadline form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unreimbursed medical expenses deadline form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unreimbursed medical expenses deadline online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unreimbursed medical expenses deadline. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unreimbursed medical expenses deadline

How to fill out unreimbursed medical expenses deadline

01

Gather all your medical receipts and documents related to the unreimbursed medical expenses.

02

Make sure you have all the necessary information, such as the date of service, the provider's name and address, and the total amount paid.

03

Determine if you are eligible to deduct unreimbursed medical expenses. Consult the Internal Revenue Service (IRS) guidelines or a tax professional if you are unsure.

04

Prepare your tax return forms, including Schedule A if you are filing using Form 1040.

05

Fill out the appropriate sections of Schedule A to report your unreimbursed medical expenses. Be thorough and accurate in documenting each expense.

06

Calculate the total amount of your unreimbursed medical expenses and enter it in the designated field on your tax return form.

07

Ensure you meet the deadline for filing your tax return. The deadline is typically April 15th, but it may vary depending on the year and any extensions granted by the IRS.

08

Double-check your tax return for any errors or omissions before submitting it.

09

Keep copies of all your medical receipts and tax return documents for future reference and possible audits.

10

Submit your tax return and any required payment by the deadline to avoid penalties or interest charges.

Who needs unreimbursed medical expenses deadline?

01

Anyone who has incurred unreimbursed medical expenses and is eligible to deduct them on their tax return needs to comply with the unreimbursed medical expenses deadline.

02

This may include individuals who paid for medical procedures, treatments, medications, or other healthcare-related expenses out of pocket.

03

It is important for these individuals to report their unreimbursed medical expenses accurately and within the specified deadline to potentially receive a tax deduction or other financial benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send unreimbursed medical expenses deadline to be eSigned by others?

When you're ready to share your unreimbursed medical expenses deadline, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit unreimbursed medical expenses deadline in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your unreimbursed medical expenses deadline, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit unreimbursed medical expenses deadline on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share unreimbursed medical expenses deadline on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is unreimbursed medical expenses deadline?

The deadline for claiming unreimbursed medical expenses varies depending on the tax year and specific tax form used, but it typically aligns with the federal tax filing deadline, which is usually April 15th.

Who is required to file unreimbursed medical expenses deadline?

Taxpayers who wish to claim unreimbursed medical expenses on their tax return must file if their total medical expenses exceed the percentage of their adjusted gross income (AGI) set by the IRS.

How to fill out unreimbursed medical expenses deadline?

To fill out unreimbursed medical expenses, taxpayers should gather records of all qualifying medical expenses and complete the appropriate sections of Form 1040 Schedule A (Itemized Deductions).

What is the purpose of unreimbursed medical expenses deadline?

The purpose is to allow taxpayers to deduct certain medical expenses that were not covered by insurance, thereby reducing their taxable income.

What information must be reported on unreimbursed medical expenses deadline?

Taxpayers must report total medical expenses, including costs for doctors, hospital stays, prescriptions, and certain transportation costs related to medical care, while ensuring they meet the IRS requirements.

Fill out your unreimbursed medical expenses deadline online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unreimbursed Medical Expenses Deadline is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.