Get the free BUY TO LET MORTGAGE - Intermediaries

Show details

BUY T O LE T M O R T GA GE

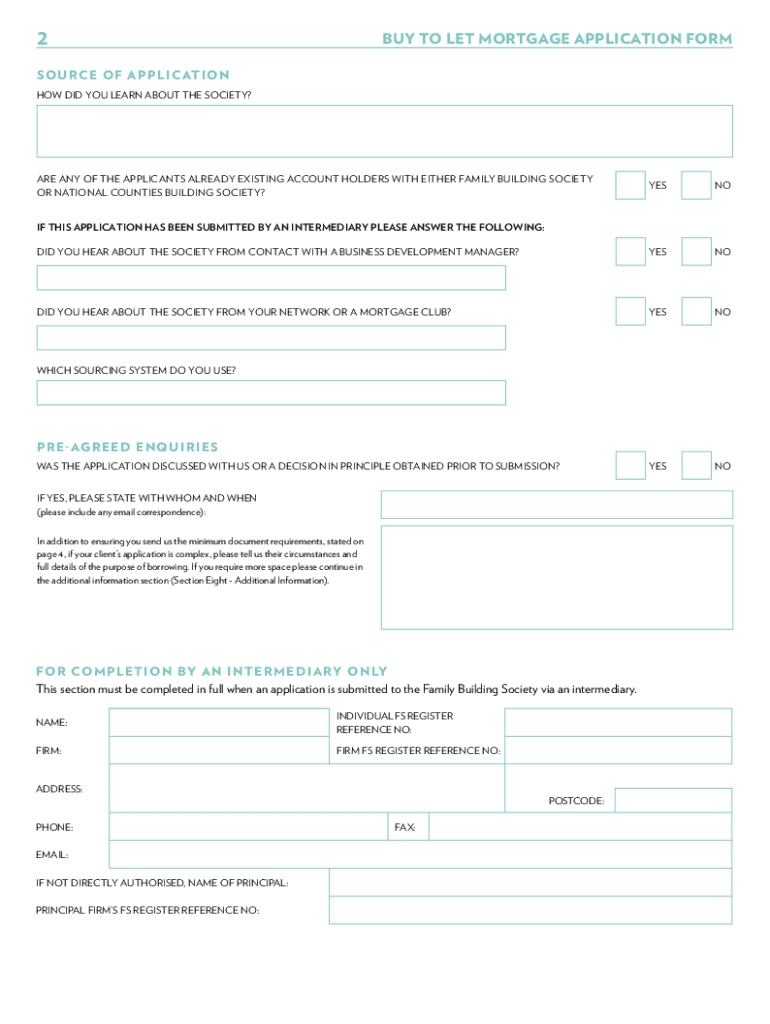

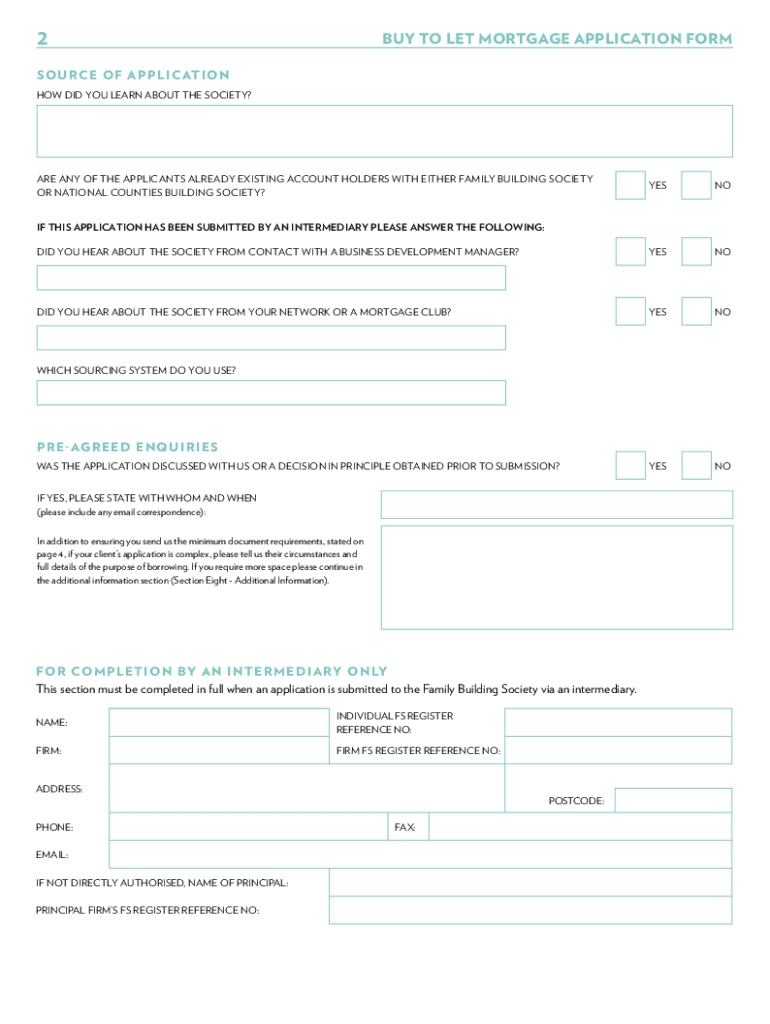

A P P L I C A T I O N F ORM2BUY TO LET MORTGAGE APPLICATION RESOURCE OF APPLICATION

HOW DID YOU LEARN ABOUT THE SOCIETY?ARE ANY OF THE APPLICANTS ALREADY EXISTING ACCOUNT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buy to let mortgage

Edit your buy to let mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buy to let mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing buy to let mortgage online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit buy to let mortgage. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out buy to let mortgage

How to fill out buy to let mortgage

01

Start by identifying a property that you wish to purchase as an investment and ensure it is suitable for renting out.

02

Research different mortgage lenders and compare their buy to let mortgage terms and interest rates.

03

Prepare the necessary documentation such as proof of income, personal identification, and property details.

04

Submit an application for the buy to let mortgage and provide all required information and documentation.

05

Wait for the mortgage lender's decision on your application.

06

If approved, review the mortgage offer and ensure you understand the terms and conditions.

07

Arrange for any necessary property surveys and valuations.

08

Complete the legal process, including signing the mortgage agreement and other relevant contracts.

09

Pay any required fees and deposits to secure the mortgage.

10

Ensure you have appropriate landlord insurance in place.

11

Monitor the rental market to determine the appropriate rent for your property.

12

Find suitable tenants for your property through advertising and conducting tenant screenings.

13

Manage the ongoing mortgage repayments and rental income to ensure financial stability.

14

Consider seeking professional advice from financial advisors or property experts to optimize your buy to let mortgage strategy.

Who needs buy to let mortgage?

01

Individuals who want to invest in a property and generate rental income can benefit from a buy to let mortgage.

02

Landlords who wish to expand their property portfolio.

03

Those who believe in long-term property appreciation and potential capital growth.

04

Individuals with a solid credit history and financial stability to qualify for a mortgage.

05

People who are willing to handle the responsibilities of being a landlord, such as property management and tenant selection.

06

Those who have conducted thorough research and analysis of the local rental market to ensure profitability.

07

Investors who are looking for additional income streams and want to diversify their investment portfolio.

08

Individuals who have a good understanding of the risks and rewards associated with property investment.

09

People who are willing to commit to the long-term nature of buy to let mortgages, as they usually have longer repayment periods.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my buy to let mortgage in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your buy to let mortgage as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my buy to let mortgage in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your buy to let mortgage directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out buy to let mortgage on an Android device?

Use the pdfFiller Android app to finish your buy to let mortgage and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is buy to let mortgage?

A buy to let mortgage is a specific type of loan designed for individuals who wish to purchase property in order to rent it out to tenants. This type of mortgage is typically structured differently compared to a standard residential mortgage.

Who is required to file buy to let mortgage?

Individuals or entities that have taken out a buy to let mortgage to finance the purchase of rental property are required to file for this type of mortgage. This includes landlords and property investors.

How to fill out buy to let mortgage?

To fill out a buy to let mortgage application, you will need to provide personal information, financial details, rental income estimates, and information about the property you intend to purchase. It is advisable to consult with a mortgage advisor for guidance.

What is the purpose of buy to let mortgage?

The purpose of a buy to let mortgage is to provide funding for individuals or businesses aiming to purchase properties for the purpose of renting them out, thus generating rental income.

What information must be reported on buy to let mortgage?

The information that must be reported includes personal identification details, financial status, expected rental income, details about the property, and any existing mortgage commitments.

Fill out your buy to let mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buy To Let Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.