Get the free GROUP CREDIT PROTECTION PLAN - PROPOSAL FORM.cdr

Show details

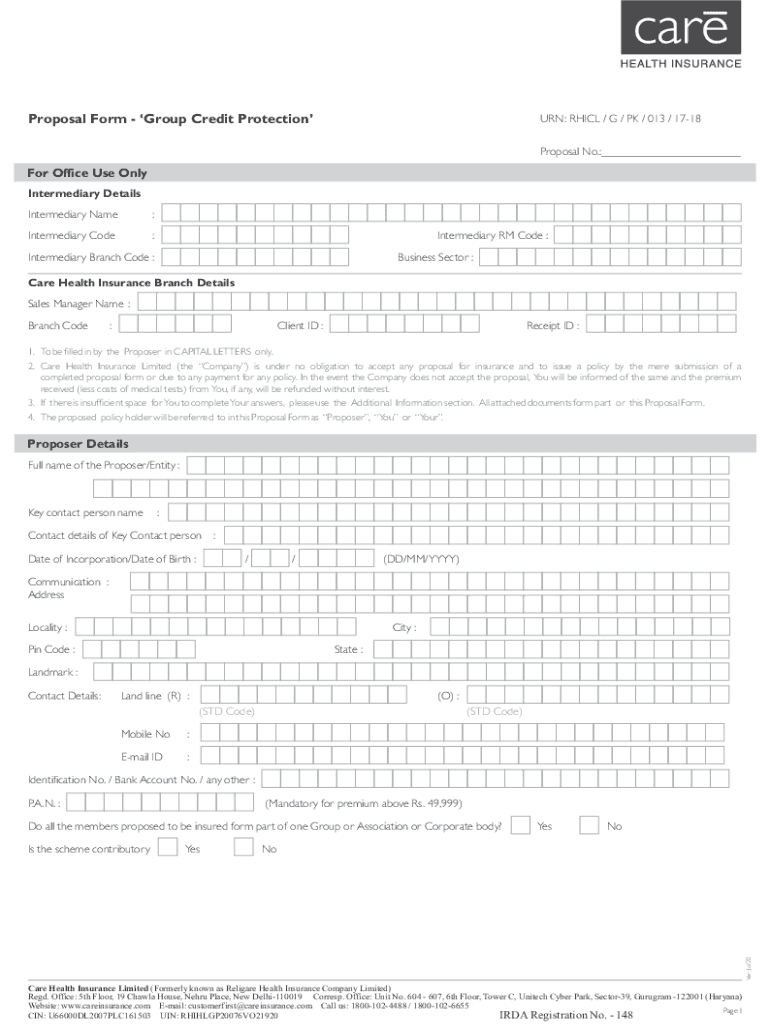

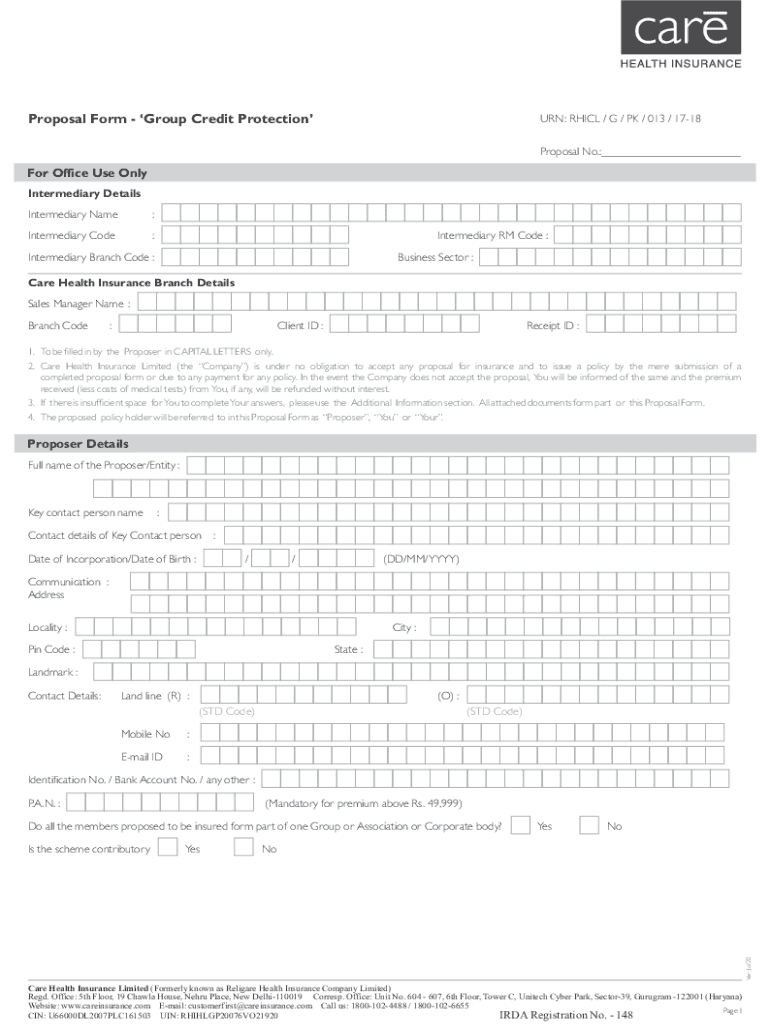

Proposal Form Group Credit Protection URN: WHICH / G / PK / 013 / 1718 Proposal No.: For Office Use Only Intermediary Details Intermediary Name:Intermediary Code:Intermediary RM Code :Intermediary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group credit protection plan

Edit your group credit protection plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group credit protection plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit group credit protection plan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit group credit protection plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group credit protection plan

How to fill out group credit protection plan

01

To fill out a group credit protection plan, follow these steps:

02

Collect necessary information: Gather all the required details of the individuals who will be enrolled in the group credit protection plan. This includes their names, contact information, social security numbers, and employment details.

03

Determine coverage options: Evaluate the various coverage options available in the group credit protection plan and select the most suitable one for your group. Consider factors such as coverage amount, duration, and premium cost.

04

Complete enrollment forms: Fill out the enrollment forms provided by the credit protection plan provider. Provide accurate information for each individual, ensuring there are no errors or omissions.

05

Review and sign agreements: Carefully review the terms and conditions, as well as any agreements related to the group credit protection plan. Understand the benefits, limitations, and cancellation policy before signing the agreements.

06

Submit the application: Submit the completed enrollment forms and agreements to the credit protection plan provider. Ensure that all required documents and information are included with the application.

07

Pay the premium: Make the necessary payment for the group credit protection plan. This may involve individual contributions from group members or a collective payment by the group organizer.

08

Receive confirmation and documents: Once the application is processed, you will receive confirmation of enrollment and the necessary policy documents. Review these documents to ensure accuracy and retain them for future reference.

09

By following these steps, you can successfully fill out a group credit protection plan.

Who needs group credit protection plan?

01

A group credit protection plan is beneficial for:

02

- Employers or organizations offering credit facilities to their employees or members

03

- Financial institutions providing loans or credit to groups

04

- Professional associations or unions that want to provide credit protection benefits to their members

05

- Any group or organization that wishes to protect its members from financial hardship due to credit-related issues or unforeseen events.

06

In summary, anyone who wants to safeguard their group or members against potential credit risks should consider a group credit protection plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit group credit protection plan on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign group credit protection plan on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete group credit protection plan on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your group credit protection plan. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit group credit protection plan on an Android device?

The pdfFiller app for Android allows you to edit PDF files like group credit protection plan. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is group credit protection plan?

A group credit protection plan is an insurance policy that provides coverage to a group of individuals, typically borrowers, which protects them against the risk of being unable to repay their debts due to unforeseen circumstances such as death, disability, or unemployment.

Who is required to file group credit protection plan?

Entities offering group credit protection plans, such as financial institutions and insurance companies, are typically required to file these plans with the appropriate regulatory authorities.

How to fill out group credit protection plan?

To fill out a group credit protection plan, individuals or entities must provide detailed information including the names of the group members, the coverage amounts, terms of the policy, and any applicable conditions. It usually requires forms provided by the insurance provider or regulatory body.

What is the purpose of group credit protection plan?

The purpose of a group credit protection plan is to mitigate the financial risk for lenders and borrowers by providing a safety net for loan repayments in the event of a borrower’s death, disability, or other qualifying events that impact their ability to make payments.

What information must be reported on group credit protection plan?

Information that must be reported includes the identities of group members, the specifics of the coverage provided, premium amounts, the terms of the plan, and any relevant exclusions or conditions.

Fill out your group credit protection plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Credit Protection Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.