Get the free Direct versus indirect costs in a nonprofit budget ...

Show details

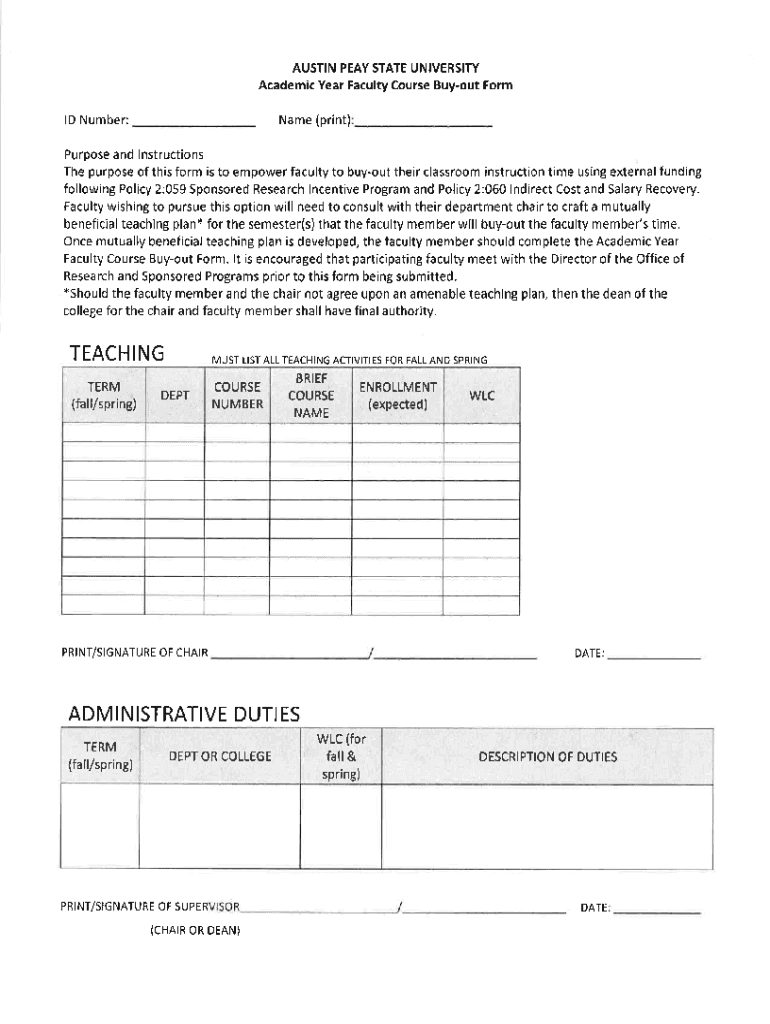

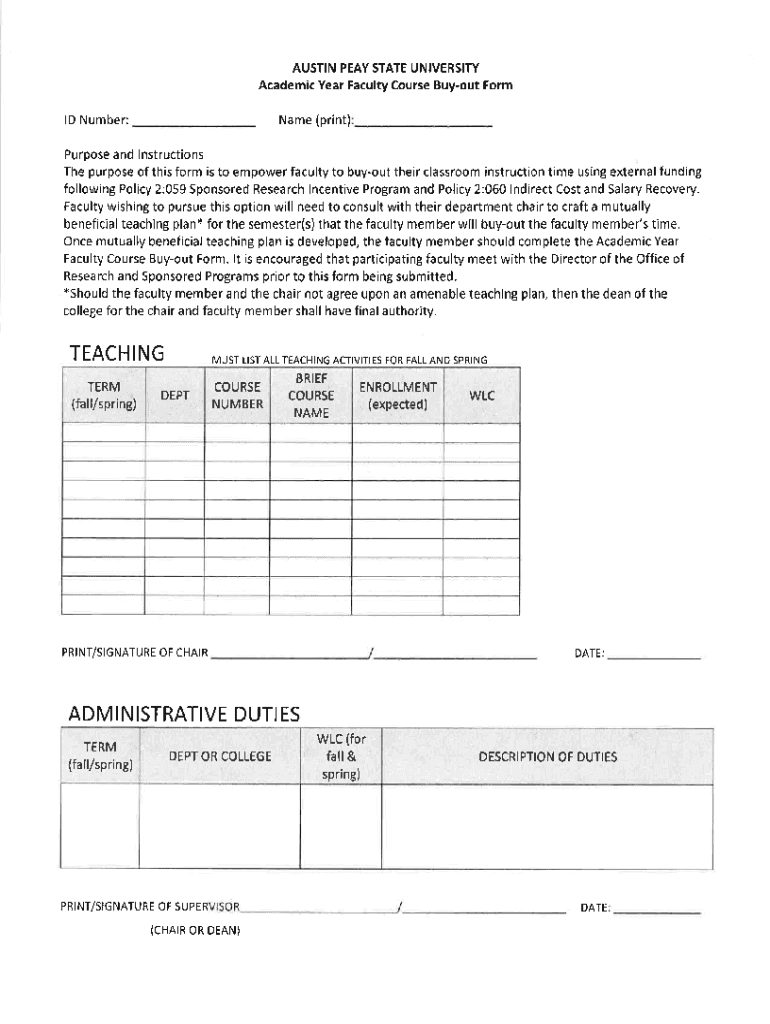

GRANT ACTIVITIESBase Alarmist LIST ALL GRANULATED ACTIVITIES Indirect Costs×BUYOUT Indirect DOLLARS PERCENT I Indirect CONVERSE TOTAL Indirect BRIEF GRANT ARE USED GE OF Costs 10% Costs 35% Costs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct versus indirect costs

Edit your direct versus indirect costs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct versus indirect costs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct versus indirect costs online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit direct versus indirect costs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct versus indirect costs

How to fill out direct versus indirect costs

01

To fill out direct versus indirect costs, follow the steps below:

02

Identify the direct costs: These are the costs that can be directly attributed to a specific project or activity. Examples of direct costs include labor costs, materials, and equipment specific to the project.

03

Determine the indirect costs: These are the costs that are not directly tied to a specific project but still contribute to its overall expense. Indirect costs may include overhead expenses like rent, utilities, and administrative staff salaries.

04

Allocate the indirect costs: Allocate the indirect costs to the specific project by using an appropriate allocation method. This can be based on the proportion of direct labor hours or the square footage used for the project, for example.

05

Calculate the total costs: Add up the direct costs and the allocated indirect costs to get the total project cost.

06

Document the costs: Keep a detailed record of both the direct and indirect costs, including any calculations or allocation methods used.

07

Review and adjust: Periodically review the direct and indirect costs to ensure accuracy and make any necessary adjustments.

Who needs direct versus indirect costs?

01

Direct versus indirect costs are needed by various individuals and organizations involved in project management and financial analysis. Some parties who may require this information include:

02

- Project managers: They need to understand the breakdown of direct and indirect costs to accurately plan and budget for projects.

03

- Accountants: They use direct and indirect cost information to prepare financial statements and analyze the profitability of projects.

04

- Investors and stakeholders: They often seek detailed cost breakdowns to assess the financial feasibility and potential return on investment of projects.

05

- Government agencies and auditors: They may require direct and indirect cost information for compliance purposes and to ensure proper use of funds.

06

- Researchers and analysts: They utilize direct and indirect cost data to study cost trends, perform cost-benefit analyses, and make informed business decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find direct versus indirect costs?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific direct versus indirect costs and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in direct versus indirect costs without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your direct versus indirect costs, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit direct versus indirect costs on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign direct versus indirect costs. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is direct versus indirect costs?

Direct costs are expenses that can be directly attributed to a specific project or activity, such as materials and labor. Indirect costs are expenses that are not directly attributable to a specific project, such as overhead costs like utilities and administrative salaries.

Who is required to file direct versus indirect costs?

Organizations that receive funding from government grants, contracts, or certain types of financial assistance are typically required to file both direct and indirect costs in accordance with accounting standards and regulations.

How to fill out direct versus indirect costs?

To fill out direct and indirect costs, organizations must categorize their expenses into direct costs (like project-specific expenses) and indirect costs (like administrative or overhead expenses), then report them on the appropriate financial forms or statements, often following guidelines provided by the funding agency.

What is the purpose of direct versus indirect costs?

The purpose of distinguishing between direct and indirect costs is to allocate expenses accurately for budgeting, financial reporting, and reimbursement purposes, ensuring that funding is used properly and expenses are justified.

What information must be reported on direct versus indirect costs?

Organizations must report specific details such as the nature of direct costs (items, labor, etc.), the basis for allocating indirect costs, the calculation methods used, and any supporting documentation that is required for transparency and audit purposes.

Fill out your direct versus indirect costs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Versus Indirect Costs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.