KY DoR 72A135 2009 free printable template

Show details

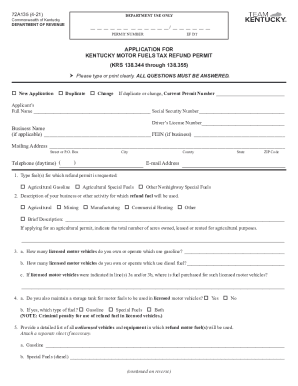

72A135 4-09 DEPARTMENT USE ONLY Commonwealth of Kentucky DEPARTMENT OF REVENUE / PERMIT NUMBER EF DT APPLICATION FOR KENTUCKY MOTOR FUELS TAX REFUND PERMIT KRS 138. I hereby certify that the information contained herein is true and correct to the best of my knowledge and belief and that the Department of Revenue will be notified within 10 days of any and all changes to the information provided herein. I understand that failure to notify the de...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 72A135

Edit your KY DoR 72A135 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 72A135 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 72A135 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY DoR 72A135. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 72A135 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 72A135

How to fill out KY DoR 72A135

01

Obtain the KY DoR 72A135 form from the Kentucky Department of Revenue’s website or local office.

02

Fill out the taxpayer identification information at the top of the form, including your name, address, and Social Security number or Federal Employer Identification Number.

03

Indicate the type of tax for which you are reporting, such as income tax or sales tax.

04

Complete the financial information sections, including income, deductions, and any other relevant financial data.

05

Ensure that all figures are accurate and properly totaled.

06

Review the completed form for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the form according to the instructions provided, either by mail, electronically, or in person.

Who needs KY DoR 72A135?

01

Individuals or businesses that need to report specific tax information to the Kentucky Department of Revenue.

02

Taxpayers who are required to disclose details about income, deductions, and tax credits applicable in Kentucky.

03

Any entity or person subject to Kentucky tax laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

Can I drive in Kentucky without a kyu?

You will need an active KYU number, as long as the GVWR exceeds 59,999 pounds. This is a crucial permit that will allow you to drive through Kentucky without penalties.

What is a 10 day trip permit in Kentucky?

The Kentucky DMV offers 10 day trip permits authorizing travel in Kentucky for any vehicle that is subject to the International Registration Plan (IRP) and 10 day fuel permits for any vehicle that is subject to the International Fuel Tax Agreement (IFTA) but is not registered under these programs.

What do you need to get a permit at the DMV in Kentucky?

REQUIRED DOCUMENTS TO BRING WHEN APPLYING FOR A PERMIT Original Birth Certificate (or certified copy) Social Security Card (must bring card as proof) 1 Proof of Residency (2- for a REAL ID) School Compliance Verification Form issued by their school. (

Do I need a trip permit in Kentucky?

Temporary Permits. If you're looking to travel on any of Kentucky's six major interstate highways or any of its numerous state routes, you will need to purchase a Kentucky Temporary Permit.

What is the weight distance permit in Kentucky?

Kentucky Weight Distance (KYU) KYU is a tax license issued for all carriers traveling on Kentucky roadways with a combined license weight greater than 59,999 pounds. The tax rate is 0.0285 cents per mile.

How much is a motorcycle permit in KY?

KY Motorcycle License Fees The fees associated with getting your Kentucky motorcycle license are as follows: Motorcycle instruction permit: $18. Motorcycle license: $48.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KY DoR 72A135 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including KY DoR 72A135. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the KY DoR 72A135 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign KY DoR 72A135. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete KY DoR 72A135 on an Android device?

Complete your KY DoR 72A135 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is KY DoR 72A135?

KY DoR 72A135 is a tax form used in the state of Kentucky for reporting and remitting certain taxes related to sales and use transactions.

Who is required to file KY DoR 72A135?

Businesses and individuals who collect sales tax in Kentucky are required to file KY DoR 72A135 to report their taxable sales and remit collected taxes.

How to fill out KY DoR 72A135?

To fill out KY DoR 72A135, you need to provide your business details, report total sales and the amount of tax collected, and ensure all sections are completed accurately before submitting it to the Kentucky Department of Revenue.

What is the purpose of KY DoR 72A135?

The purpose of KY DoR 72A135 is to ensure that businesses report their sales and use tax accurately and remit the appropriate amount to the state revenue, maintaining compliance with tax laws.

What information must be reported on KY DoR 72A135?

On KY DoR 72A135, the information that must be reported includes the total sales amount, tax collected, exemptions claimed, and business identification details.

Fill out your KY DoR 72A135 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 72A135 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.