KY DoR 72A135 2021-2025 free printable template

Show details

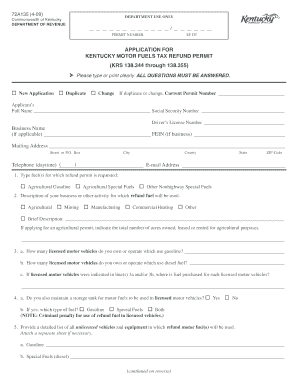

72A135 (421)DEPARTMENT USE ONLY Commonwealth of Kentucky DEPARTMENT OF REVENUE____________ ____________ /____________PERMIT NUMBERED APPLICATION FOR KENTUCKY MOTOR FUELS TAX REFUND PERMIT (MRS 138.344

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ky motor permit form

Edit your kentucky fuels tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 72a135 form 2021-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 72a135 form 2021-2025 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 72a135 form 2021-2025. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 72A135 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 72a135 form 2021-2025

How to fill out KY DoR 72A135

01

Obtain the KY DoR 72A135 form from the Kentucky Department of Revenue's website or office.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Provide the details of the property for which the form is being completed, including the address and property identification number if applicable.

04

Indicate the purpose of the form in the designated section (e.g., for tax exemption or special assessment).

05

Attach any required supporting documents that are specified in the instructions.

06

Review your form for completeness and accuracy before signing and dating it.

07

Submit the completed form to the appropriate office as indicated in the instructions, either by mail or in person.

Who needs KY DoR 72A135?

01

Individuals or organizations seeking to apply for a property tax exemption in Kentucky.

02

Property owners needing to report changes or claim special assessments regarding their property.

03

Taxpayers who are required to disclose specific information for tax purposes related to property ownership.

Fill

form

: Try Risk Free

People Also Ask about

What state has the cheapest gas tax?

Alaska had one of the lowest effective gas taxes on gas in the United States at 14 U.S. cents per gallon as of January 2021. At that same time, gas price in Alaska was at 2.61 U.S. cents per gallon.

Is Kentucky suspending the gas tax?

Beshear Stops State Gas Tax Hike, Providing Relief to Kentuckians at the Pump. FRANKFORT, Ky. (June 2, 2022) – Today, Gov. Andy Beshear's administration filed an emergency regulation to freeze the state gas tax and to prevent a 2-cent increase per gallon that would have taken effect July 1.

Does Kentucky have a fuel tax?

In addition to (or instead of) traditional sales taxes, gasoline and other Fuel products are subject to excise taxes on both the Kentucky and Federal levels. Excise taxes on Fuel are implemented by every state, as are excises on alcohol and tobacco products.

What state has highest tax on gas?

As of 2023, Alaska has the lowest gas tax in the nation, with a rate of $0.09 per gallon. The state benefits from its abundant oil reserves and relies heavily on revenue generated from oil production rather than gas taxes. On the other end of the spectrum, Pennsylvania has the highest gas tax rate at $0.61 per gallon.

What state has the most taxes on gas?

Gas tax and price in select U.S. states 2022 California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon.

What is Kentucky natural gas tax?

Laws and Regulations An excise tax rate of 9% of the average wholesale price on a per gallon basis applies to all special fuels, including diesel, natural gas, propane, ethanol, biodiesel, hydrogen, and any other combustible gases and liquids, excluding gasoline, used to propel motor vehicles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 72a135 form 2021-2025 online?

Filling out and eSigning 72a135 form 2021-2025 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit 72a135 form 2021-2025 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 72a135 form 2021-2025 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my 72a135 form 2021-2025 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 72a135 form 2021-2025 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is KY DoR 72A135?

KY DoR 72A135 is a tax form used in Kentucky for reporting the state's gross receipts tax.

Who is required to file KY DoR 72A135?

Businesses and individuals who are engaged in activities that generate gross receipts in Kentucky are required to file KY DoR 72A135.

How to fill out KY DoR 72A135?

To fill out KY DoR 72A135, you need to provide information including your business details, total gross receipts, and any applicable deductions or exemptions.

What is the purpose of KY DoR 72A135?

The purpose of KY DoR 72A135 is to report and remit the gross receipts tax owed to the state of Kentucky.

What information must be reported on KY DoR 72A135?

The information that must be reported on KY DoR 72A135 includes the taxpayer's identification information, total gross receipts, deductions, and the total amount of tax due.

Fill out your 72a135 form 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

72A135 Form 2021-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.