Get the free Gifts of Securities & Mutual Funds - Toronto City Mission

Show details

GIFTS OF SECURITIES DONATING APPRECIATED STOCKS, MUTUAL FUNDS, OR STOCK OPTIONS,

YOU PAY NO TAX ON THE CAPITAL GAINS AND RECEIVE A TAX RECEIPT FOR

THE FAIR MARKET VALUE OF THE SECURITIES.

Gifts of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts of securities ampamp

Edit your gifts of securities ampamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts of securities ampamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gifts of securities ampamp online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gifts of securities ampamp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts of securities ampamp

How to fill out gifts of securities ampamp

01

To fill out gifts of securities ampamp, follow these steps:

02

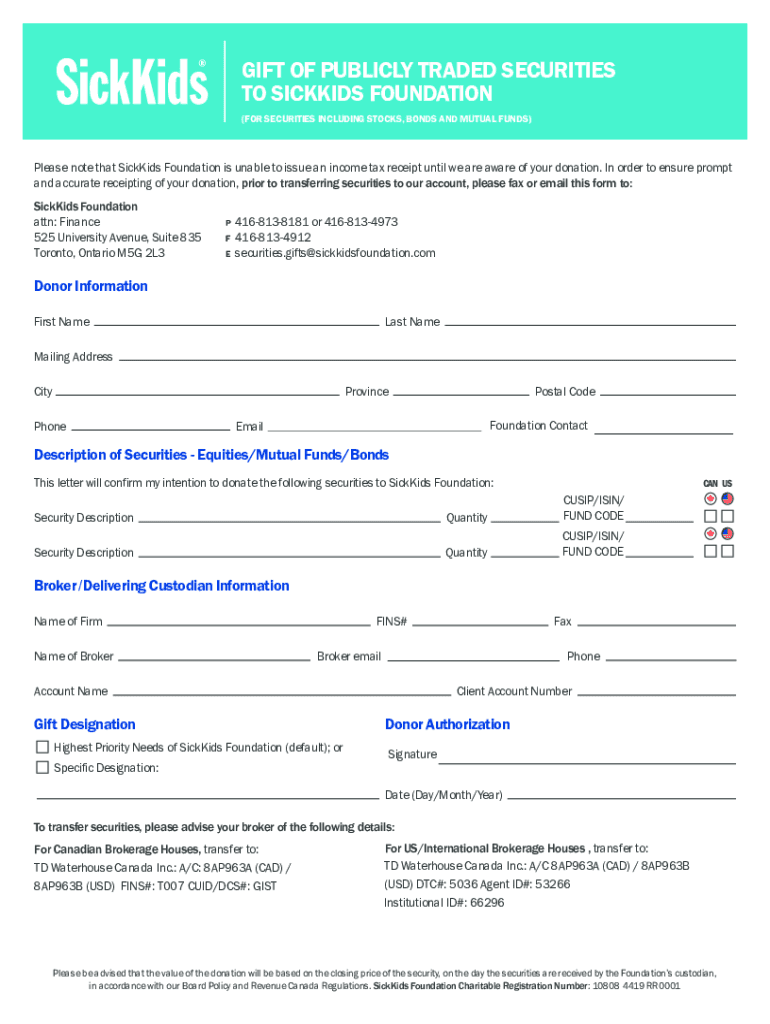

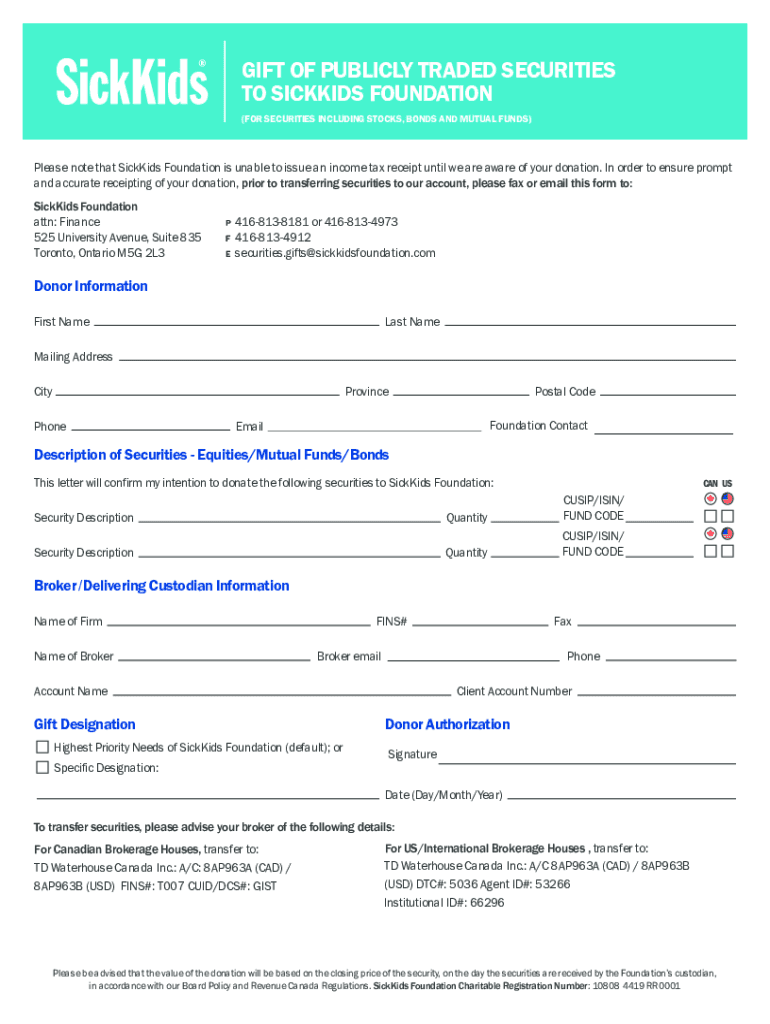

Gather all the necessary documentation, including the stock certificates or ownership statements for the securities you wish to donate.

03

Contact the organization or charity to which you want to make the donation and inquire about their process for accepting gifts of securities.

04

Fill out any required forms or applications provided by the organization, providing all the necessary information and details about the securities being donated.

05

If necessary, have the securities properly transferred to the organization's designated brokerage account. This may involve contacting your broker or financial institution to facilitate the transfer.

06

Ensure that all necessary parties involved in the transfer process are aware of the donation and have the required information to complete the transaction.

07

Double-check all the details and information provided before submitting the forms or completing the transfer.

08

Keep copies of all documentation and communication related to the gift of securities for your records.

09

Once the donation process is complete, follow up with the organization to confirm the receipt of the securities and to obtain any acknowledgment or tax documentation, if applicable.

Who needs gifts of securities ampamp?

01

Gifts of securities ampamp can be beneficial for various entities, including:

02

- Non-profit organizations and charities: They often rely on donations to fund their programs and services. Gifts of securities can provide them with much-needed financial support.

03

- Individual donors: Donating securities can offer potential tax advantages for individuals, such as capital gains tax savings or potential deductions.

04

- Investors: Some investors may choose to donate securities as a philanthropic gesture to support causes or organizations they believe in.

05

- Financial advisors and brokers: They can assist clients in navigating the process of donating securities and provide guidance on the potential benefits and implications.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gifts of securities ampamp directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your gifts of securities ampamp and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I get gifts of securities ampamp?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific gifts of securities ampamp and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out gifts of securities ampamp on an Android device?

Use the pdfFiller mobile app and complete your gifts of securities ampamp and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is gifts of securities ampamp?

Gifts of securities refer to the transfer of ownership of stocks or other financial instruments from one individual to another without any exchange of money.

Who is required to file gifts of securities ampamp?

Individuals who make gifts of securities that exceed the annual exclusion limit, as well as those who receive such gifts may be required to report the transactions.

How to fill out gifts of securities ampamp?

To fill out gifts of securities, one typically needs to complete IRS Form 709, detailing the donor's information, recipient's information, the value of the securities transferred, and any applicable exclusions.

What is the purpose of gifts of securities ampamp?

The purpose of gifts of securities is to allow individuals to transfer assets to others while potentially reducing their taxable estate and providing financial support to the recipients.

What information must be reported on gifts of securities ampamp?

The information that must be reported includes the donor's details, recipient's details, description and value of the securities gifted, and any prior contributions to the recipient.

Fill out your gifts of securities ampamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts Of Securities Ampamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.