PA DoR PA-40 W-2 RW 2019 free printable template

Show details

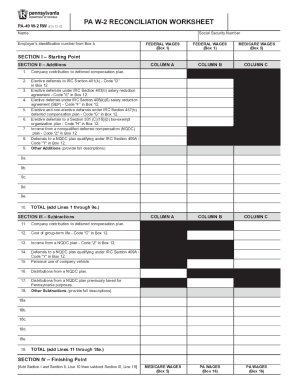

START PA40 W2 RAW (EX) 0719 (FI) HERE Nampa W2 RECONCILIATION WORKSHEET Social Security NumberEmployers identification number from Box federal WAGES (Box 1)FEDERAL WAGES (Box 1)MEDICARE WAGES (Box

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DoR PA-40 W-2 RW

Edit your PA DoR PA-40 W-2 RW form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DoR PA-40 W-2 RW form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA DoR PA-40 W-2 RW online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA DoR PA-40 W-2 RW. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR PA-40 W-2 RW Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DoR PA-40 W-2 RW

How to fill out PA DoR PA-40 W-2 RW

01

Collect all W-2 forms from your employers for the tax year.

02

Start with the PA-40 W-2 RW form, which is used to report W-2 information for multiple employers.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

For each W-2, enter the employer's name, Pennsylvania withholding, and other relevant information in the designated boxes.

05

Ensure that the total amounts from all W-2 forms match the sum you report on your Pennsylvania income tax return.

06

Double-check your entries for accuracy and completeness.

07

Sign and date the form before submitting it with your PA-40 tax return.

Who needs PA DoR PA-40 W-2 RW?

01

Individuals who have worked for multiple employers within Pennsylvania and need to report their income.

02

Taxpayers who receive W-2 forms showing Pennsylvania state income tax withheld.

03

Residents who need to reconcile their state tax obligations based on income from various sources.

Fill

form

: Try Risk Free

People Also Ask about

What is the mailing address for PA income tax?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

Who must file a PA-40?

A resident taxpayer is allowed a resident credit for income taxes imposed by and paid to other states based upon income that is subject to Pennsylvania personal income tax. Such taxpayers should complete PA-40 Schedule G-L, Credit for Taxes Paid by PA Resident Individuals, Estates or Trusts to other States.

Where can I get a PA-40 form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is line 40 on PA tax return?

Beginning tax year 2022, Pennsylvania established the Child and Dependent Care Enhancement Tax Credit. The PA-40 Schedule DC was created for this credit.

What is a PA form 40?

2022 Pennsylvania Income Tax Return (PA-40)

What should be included in a PA tax return?

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

Do you still attach W-2 to 1040?

If I file my Form 1040 or 1040-SR electronically, what do I do with my Forms W-2? You'll use the information from your Forms W-2 to complete your tax return. After filing, retain a copy of the forms for your records.

What is the PA W-2 reconciliation worksheet?

PURPOSE OF SCHEDULE Use the PA W-2 RW to provide supplemental information regarding amounts reported on federal Form W-2, Wage and Tax Statement, so that the department may reconcile the wages to determine if the proper amount of gross com- pensation income is reported for Pennsylvania personal income tax purposes.

What forms need to be attached to PA tax return?

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

Do I attach W-2 to PA 40?

All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return. Form 1099-R Filing Tips have been added to the compensation instructions for taxpayers required to include those documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PA DoR PA-40 W-2 RW directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your PA DoR PA-40 W-2 RW as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute PA DoR PA-40 W-2 RW online?

With pdfFiller, you may easily complete and sign PA DoR PA-40 W-2 RW online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in PA DoR PA-40 W-2 RW?

With pdfFiller, the editing process is straightforward. Open your PA DoR PA-40 W-2 RW in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is PA DoR PA-40 W-2 RW?

PA DoR PA-40 W-2 RW is a form used by the Pennsylvania Department of Revenue to report wage and tax information for employees and employers, specifically for state income tax purposes.

Who is required to file PA DoR PA-40 W-2 RW?

Employers in Pennsylvania are required to file the PA DoR PA-40 W-2 RW for each employee who has received wages subject to withholding for Pennsylvania income tax.

How to fill out PA DoR PA-40 W-2 RW?

To fill out PA DoR PA-40 W-2 RW, employers must provide information such as the employee's name, Social Security number, total wages, and the amount of state tax withheld. It is important to follow the instructions provided by the Pennsylvania Department of Revenue.

What is the purpose of PA DoR PA-40 W-2 RW?

The purpose of PA DoR PA-40 W-2 RW is to document the wages earned by employees and the state tax withheld, ensuring compliance with Pennsylvania tax laws.

What information must be reported on PA DoR PA-40 W-2 RW?

The PA DoR PA-40 W-2 RW must report the employee's name, Social Security number, total wages paid, state income tax withheld, and the employer's identification information.

Fill out your PA DoR PA-40 W-2 RW online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR PA-40 W-2 RW is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.