PA DoR PA-40 W-2 RW 2022-2025 free printable template

Show details

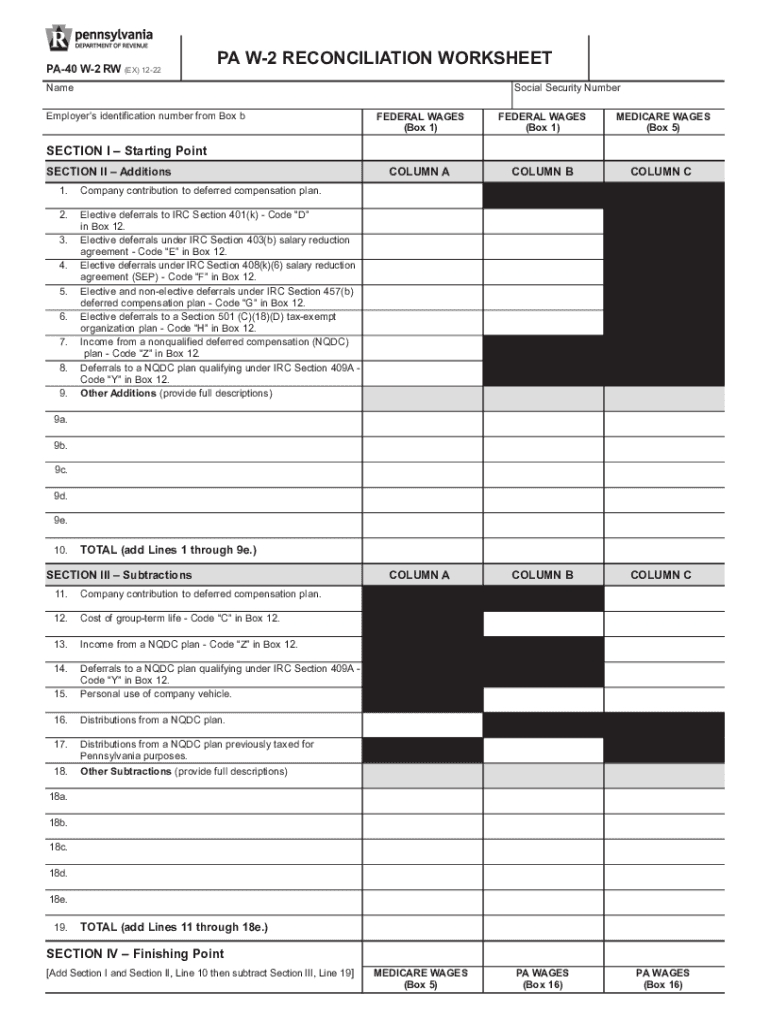

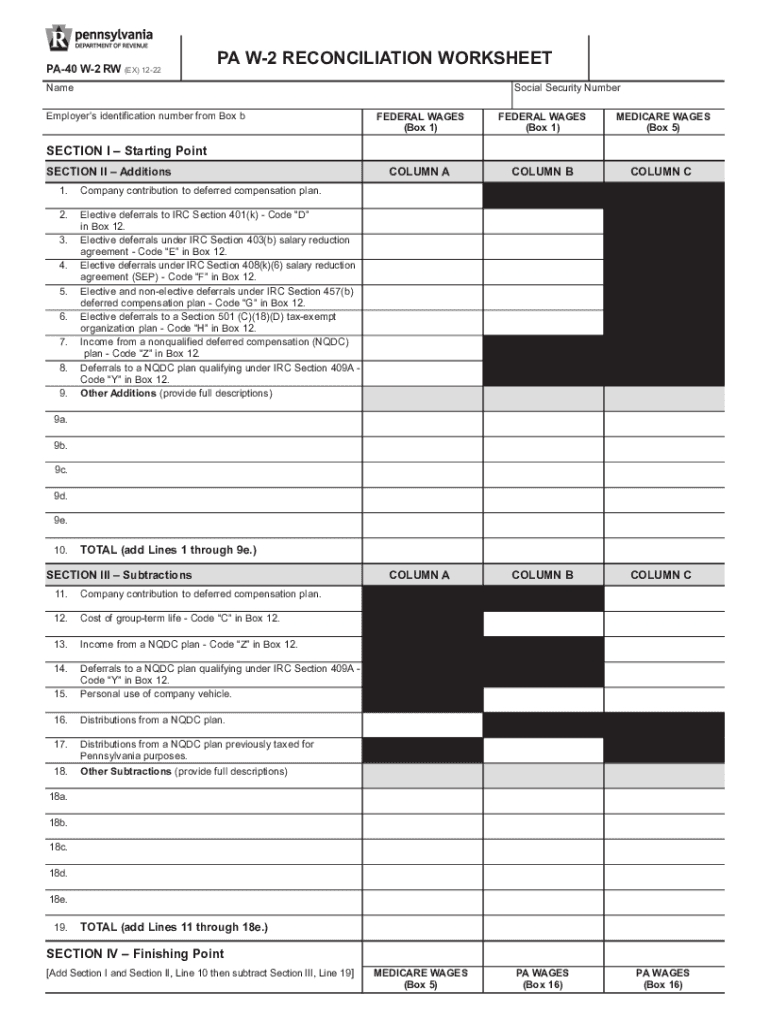

START PA40 W2 RAW (EX) 1222 HERE Nampa W2 RECONCILIATION WORKSHEET Social Security NumberEmployers identification number from Box federal WAGES (Box 1)FEDERAL WAGES (Box 1)MEDICARE WAGES (Box 5)COLUMN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa40 w2 fillable form

Edit your pa 40 w 2 rw form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w reconciliation printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pennsylvania paw2 form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pa40 w2 edit form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR PA-40 W-2 RW Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pa 40 w2 rw

How to fill out PA DoR PA-40 W-2 RW

01

Gather your W-2 forms for the tax year.

02

Visit the Pennsylvania Department of Revenue website to download the PA-40 W-2 RW form.

03

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

In the designated sections, enter the information from your W-2 forms, including employer details and wage amounts.

05

Ensure all figures are accurate and match your W-2s.

06

Double-check the completed form for any errors or omissions.

07

Sign and date the form at the bottom.

08

Submit the completed form to the Pennsylvania Department of Revenue by the required deadline.

Who needs PA DoR PA-40 W-2 RW?

01

Individuals who have earned income in Pennsylvania and received W-2 forms from their employers.

02

Taxpayers required to report wages for state tax purposes.

03

Residents and non-residents earning income in Pennsylvania.

Fill

form

: Try Risk Free

People Also Ask about

What is the mailing address for PA income tax?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

Who must file a PA-40?

A resident taxpayer is allowed a resident credit for income taxes imposed by and paid to other states based upon income that is subject to Pennsylvania personal income tax. Such taxpayers should complete PA-40 Schedule G-L, Credit for Taxes Paid by PA Resident Individuals, Estates or Trusts to other States.

Where can I get a PA-40 form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is line 40 on PA tax return?

Beginning tax year 2022, Pennsylvania established the Child and Dependent Care Enhancement Tax Credit. The PA-40 Schedule DC was created for this credit.

What is a PA form 40?

2022 Pennsylvania Income Tax Return (PA-40)

What should be included in a PA tax return?

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

Do you still attach W-2 to 1040?

If I file my Form 1040 or 1040-SR electronically, what do I do with my Forms W-2? You'll use the information from your Forms W-2 to complete your tax return. After filing, retain a copy of the forms for your records.

What is the PA W-2 reconciliation worksheet?

PURPOSE OF SCHEDULE Use the PA W-2 RW to provide supplemental information regarding amounts reported on federal Form W-2, Wage and Tax Statement, so that the department may reconcile the wages to determine if the proper amount of gross com- pensation income is reported for Pennsylvania personal income tax purposes.

What forms need to be attached to PA tax return?

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

Do I attach W-2 to PA 40?

All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return. Form 1099-R Filing Tips have been added to the compensation instructions for taxpayers required to include those documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pa 40 w2 rw?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your pa 40 w2 rw to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the pa 40 w2 rw in Gmail?

Create your eSignature using pdfFiller and then eSign your pa 40 w2 rw immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out pa 40 w2 rw using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign pa 40 w2 rw and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is PA DoR PA-40 W-2 RW?

PA DoR PA-40 W-2 RW is a tax form used in Pennsylvania to report wages and withholding tax information for residents who are filing their state income tax returns.

Who is required to file PA DoR PA-40 W-2 RW?

Employees who have had state income tax withheld from their wages are required to file PA DoR PA-40 W-2 RW as part of their Pennsylvania state income tax return.

How to fill out PA DoR PA-40 W-2 RW?

To fill out PA DoR PA-40 W-2 RW, you need to enter your personal information, including your name, address, and Social Security number, as well as the wage information provided on your W-2 forms, including wages earned and taxes withheld.

What is the purpose of PA DoR PA-40 W-2 RW?

The purpose of PA DoR PA-40 W-2 RW is to provide the Pennsylvania Department of Revenue with the necessary information to assess individual state income tax filings and ensure proper withholding.

What information must be reported on PA DoR PA-40 W-2 RW?

The information that must be reported on PA DoR PA-40 W-2 RW includes total wages earned, state income tax withheld, and other relevant earnings and tax details from W-2 forms.

Fill out your pa 40 w2 rw online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa 40 w2 Rw is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.