NY DTF IT-209 2020 free printable template

Show details

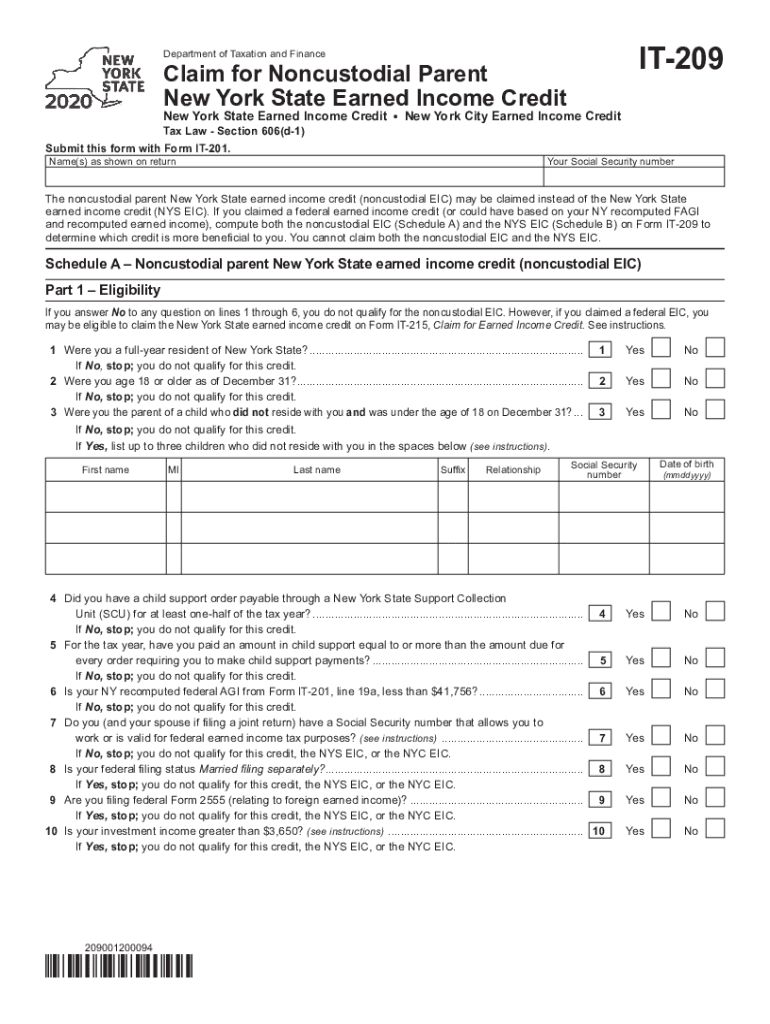

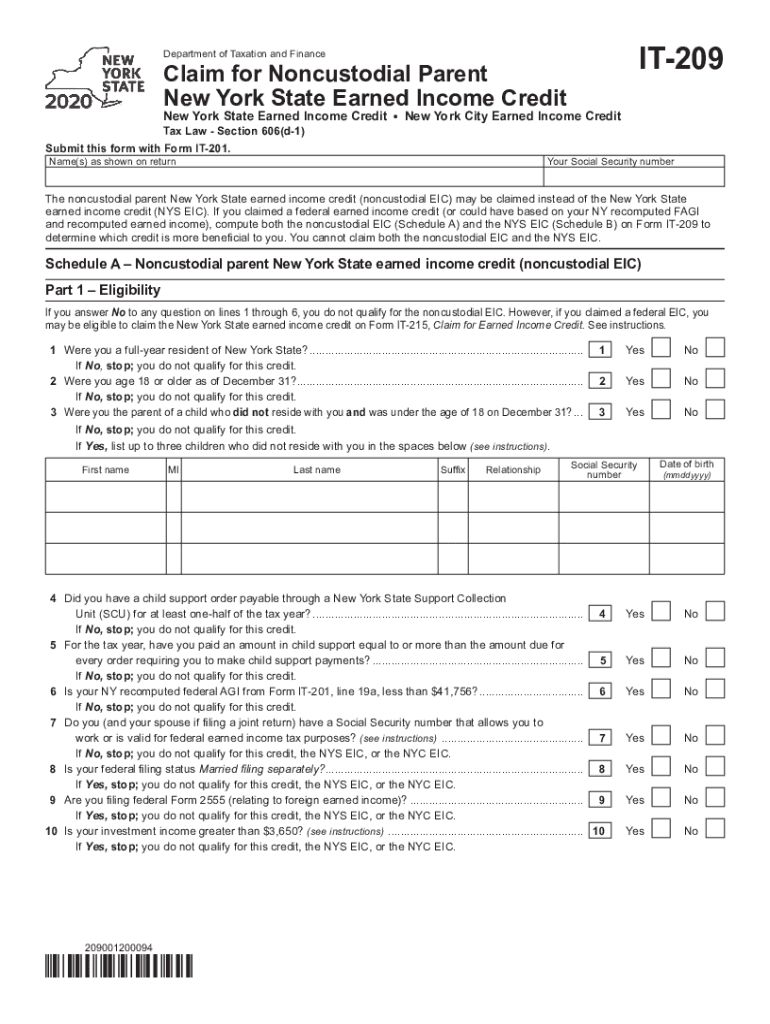

See updated information for this form on our website.IT209Department of Taxation and FinanceClaim for Noncustodial Parent New York State Earned Income Credited York State Earned Income Credit New

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-209

Edit your NY DTF IT-209 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-209 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF IT-209 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF IT-209. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-209 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-209

How to fill out NY DTF IT-209

01

Gather your personal information including your social security number, filing status, and income details.

02

Download the NY DTF IT-209 form from the New York State Department of Taxation and Finance website.

03

Fill out your name, address, and other identification information at the top of the form.

04

Report your income information in the designated sections, including wages, interest, and dividends.

05

Fill out any applicable credits or adjustments to your income as instructed on the form.

06

Calculate your total tax liability as shown in the form calculations.

07

If applicable, include any payments made or amounts owed.

08

Review the completed form for accuracy and ensure all necessary documents are attached.

09

Sign and date the form before submitting it electronically or by mail.

Who needs NY DTF IT-209?

01

Individuals who are filing their New York State income tax returns and have a need to claim certain credits or adjustments to their income.

02

Taxpayers who are specifically applying for the civil service employee credit or the volunteer firefighter/ambulance worker credit.

Fill

form

: Try Risk Free

People Also Ask about

Can both parents claim EIC for same child?

If they otherwise meet all of the requirements to claim the earned income tax credit (EITC), unmarried parents with a qualifying child may choose which parent will claim the qualifying child for the EITC. If there are two qualifying children, each parent may claim the credit based on one child.

What is the Empire Child Tax Credit?

The payment for the Empire State child credit is anywhere from 25% to 100% of the amount of the credit you received for 2021.

How much is the Child Tax Credit for 2022?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return.

What is NYS it 229 form?

What is the New York Real Property Tax Relief Credit (IT-229)? This new credit is for tax year 2021 and 2022 and 2023. This credit is for taxpayers who pay more than 6% of their income for property taxes.

Can you claim yourself as a dependent NY?

Like on your federal return, you may claim exemptions for your dependents on your New York State return. You may not claim yourself or your spouse. For more information, see the instructions for your appropriate tax form on our Income tax forms page.

What is a IT 215 form?

New York has two separate forms relating to EIC. Form IT-215 is for claiming Earned Income Credit, which is used in most situations. Form IT-209 is used for claiming Earned Income Credit when you are the noncustodial parent.

What is the Empire State Child Tax Credit?

For taxpayers who claim the federal child tax credit, the Empire State child credit is $100 for each child or 33% of the federal credit, whichever is greater. Taxpayers who don't claim the federal credit can claim $100 for each child.

How to file IT-209?

How do I claim the noncustodial EIC? You must file Form IT-209 with your NYS income tax return. If you have already filed your original return, you must file an amended NYS return and include Form IT-209 to claim the credit. are current in your payments as required by that order.

Who can be claimed as a dependent in NYS?

A qualifying person is: • A qualifying child under age 13 whom you can claim as a dependent (but see Special rule for children of divorced or separated parents on page 2). If the child turned 13 during the year, the child is a qualifying person for the part of the year he or she was under age 13.

Who is eligible for the Empire State Child Credit?

*A qualifying child must be at least four but less than 17 years old on December 31st of the tax year and must qualify for the federal child tax credit.

What is the Empire State Child credit Form?

Empire State Child Credit To claim the Empire State credit the tax filer must file form IT-213 along with the New York State income tax return.

What is a it 216 form?

Form IT-216 Claim for Child and Dependent Care Credit Tax Year 2021.

What is a IT-209 form?

Instructions for Form IT-209 Claim for Noncustodial Parent New York State Earned Income Credit Tax Year 2021.

How do I fill out the additional child tax credit?

To claim the Additional Child Tax Credit, you need to complete Schedule 8812 and attach it to your Form 1040 or Form 1040-SR.

What is an IT 213 form?

Enhanced Form IT-213, Claim for Empire State Child Credit.

What is NY it 201 form?

Form IT-201, Resident Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF IT-209 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NY DTF IT-209 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send NY DTF IT-209 to be eSigned by others?

When you're ready to share your NY DTF IT-209, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete NY DTF IT-209 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NY DTF IT-209. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NY DTF IT-209?

NY DTF IT-209 is a tax form used by New York residents to claim a tax credit for household and dependent care expenses.

Who is required to file NY DTF IT-209?

Individuals who paid for household care services or care for dependents while they worked or looked for work may be required to file NY DTF IT-209 to claim a tax credit.

How to fill out NY DTF IT-209?

To fill out NY DTF IT-209, taxpayers should gather information on their care expenses, complete personal identification details, and provide the required financial data regarding household care.

What is the purpose of NY DTF IT-209?

The purpose of NY DTF IT-209 is to allow taxpayers to claim a tax credit for qualifying household and dependent care expenses incurred while they are working.

What information must be reported on NY DTF IT-209?

NY DTF IT-209 requires reporting of taxpayer identification information, details of care expenses, the number of qualifying individuals, and any other relevant financial data.

Fill out your NY DTF IT-209 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-209 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.