IL PTAX-324 2007 free printable template

Show details

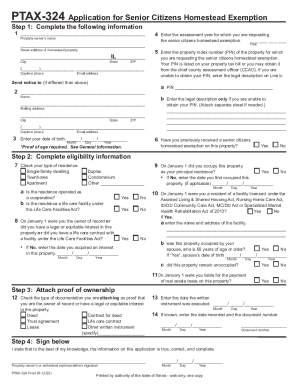

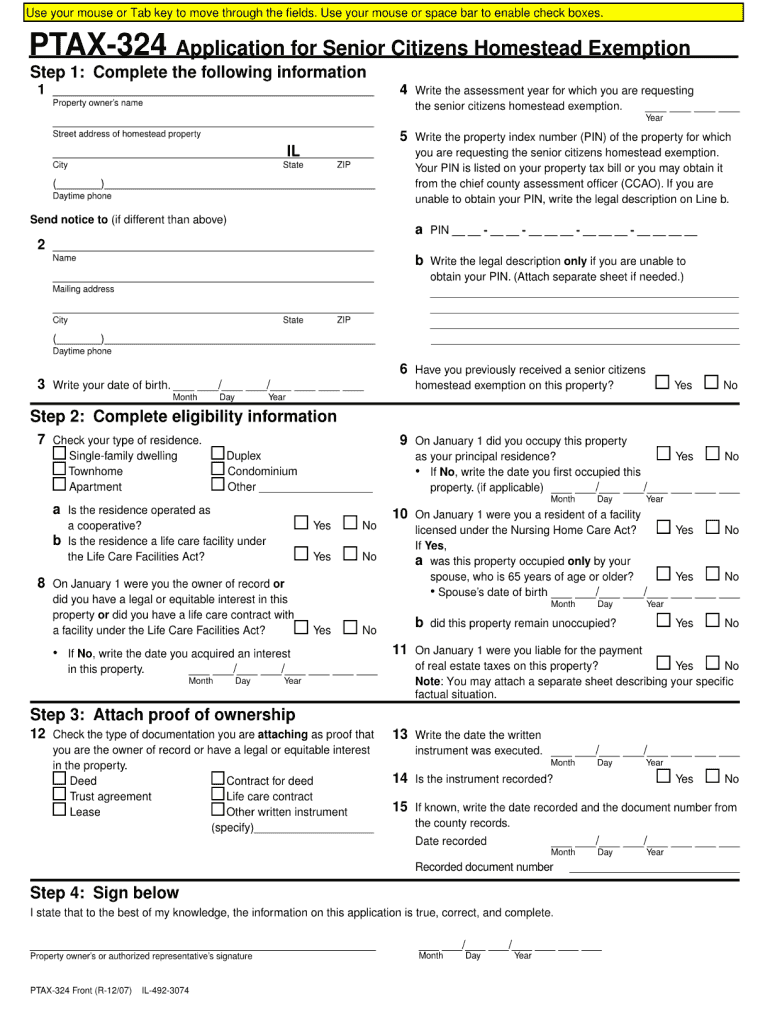

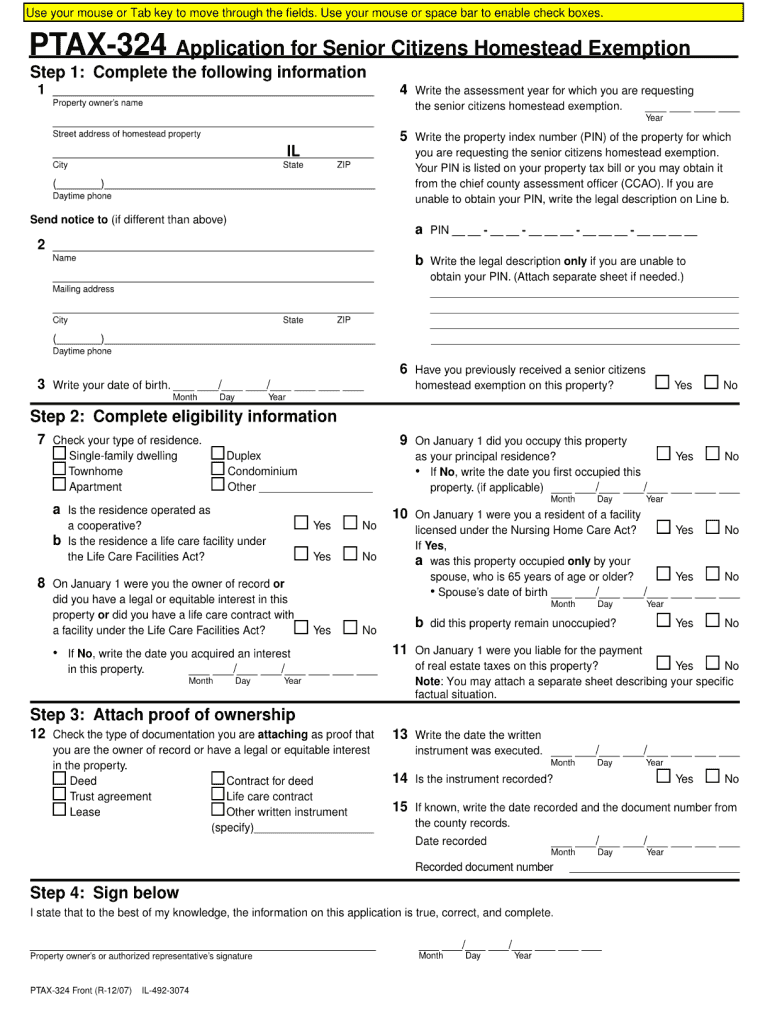

If you have any questions please call 618 594-6610 Mail your completed Form PTAX-324 to Clinton 850 Fairfax St Carlyle 62231 Official use. PTAX-324 Front R-04/13 Document number Step 4 Sign below 14 If known write the date recorded and the document number. Form PTAX-324 General Information What is the Senior Citizens Homestead Exemption 200/15-170 provides for an annual 5 000 reduction in the equalized assessed value of the property that you own ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PTAX-324

Edit your IL PTAX-324 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PTAX-324 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL PTAX-324 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IL PTAX-324. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-324 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PTAX-324

How to fill out IL PTAX-324

01

Download the IL PTAX-324 form from the official website.

02

Read the instructions carefully before filling out the form.

03

Provide the required personal information such as your name, address, and contact details.

04

Enter the property information, including the property address and parcel number.

05

Indicate the reason for filing the form in the designated section.

06

Attach any necessary documentation to support your claims or requests.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submitting it.

Who needs IL PTAX-324?

01

Property owners looking to challenge their property assessments.

02

Individuals seeking to claim property tax exemptions.

03

Anyone needing to report changes or updates related to their property.

Fill

form

: Try Risk Free

People Also Ask about

How much does homestead exemption save in Illinois?

The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook County or $5,000 in all other counties.

How do I apply for disabled veterans property tax exemption in Illinois?

Illinois veterans or their spouses should contact their local Veteran Service Officer for information to apply for the specially-adapted housing property tax and mobile home tax exemption benefits.

What is senior citizen homeowners exemption Illinois?

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

How do I get senior discount on property taxes in Illinois?

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

Who qualifies for homeowners exemption in Illinois?

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IL PTAX-324?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IL PTAX-324 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit IL PTAX-324 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IL PTAX-324, you can start right away.

Can I edit IL PTAX-324 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share IL PTAX-324 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is IL PTAX-324?

IL PTAX-324 is a form used in the State of Illinois for reporting property tax exemptions.

Who is required to file IL PTAX-324?

Individuals or entities that are claiming a property tax exemption under certain conditions in Illinois are required to file IL PTAX-324.

How to fill out IL PTAX-324?

To fill out IL PTAX-324, provide the required information regarding the property, the owner, and the specific exemption being claimed.

What is the purpose of IL PTAX-324?

The purpose of IL PTAX-324 is to formally document and request property tax exemptions for eligible properties in Illinois.

What information must be reported on IL PTAX-324?

The information that must be reported on IL PTAX-324 includes property details, ownership information, the type of exemption sought, and any supporting documentation required for verification.

Fill out your IL PTAX-324 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PTAX-324 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.