Get the free My Estate and Legacy Planner - Estate Planning Lawyer

Show details

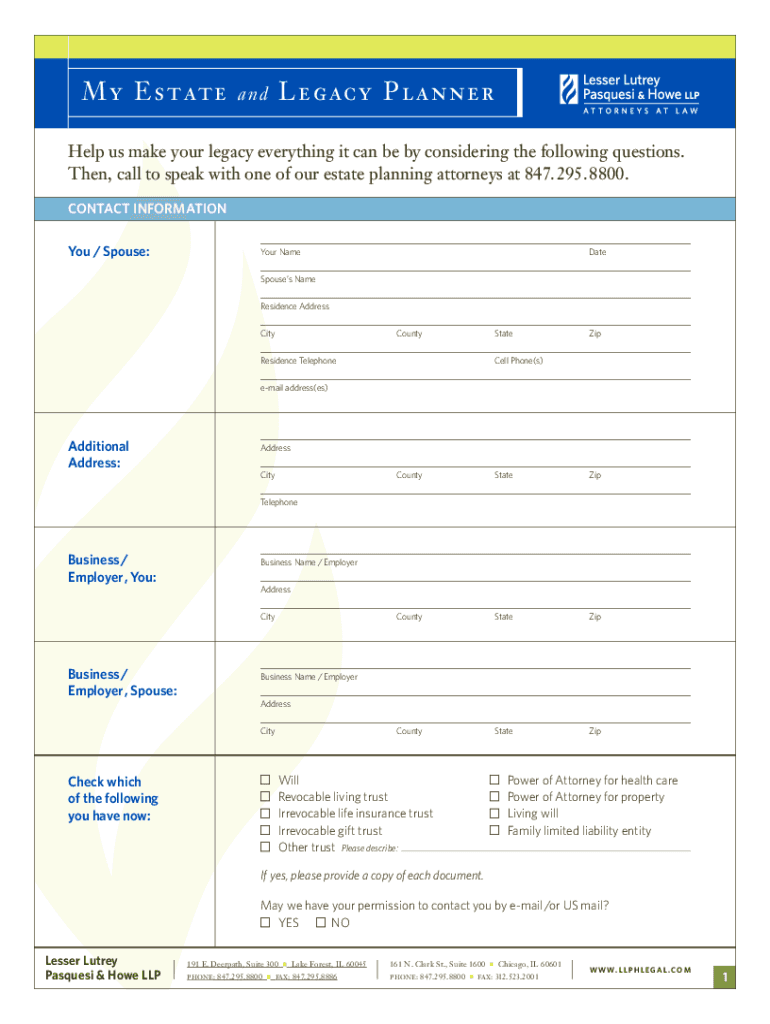

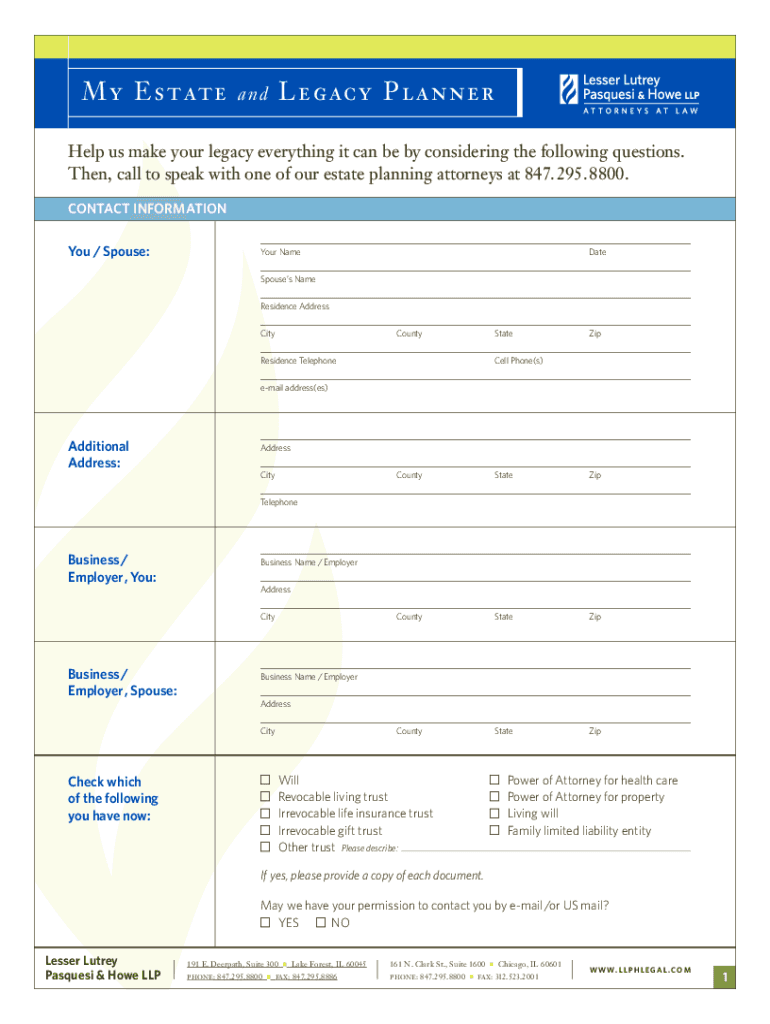

My Estately a CY PLA nnerandHelp us make your legacy everything it can be by considering the following questions.

Then, call to speak with one of our estate planning attorneys at 847.295. 8800.

CONTACT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign my estate and legacy

Edit your my estate and legacy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your my estate and legacy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit my estate and legacy online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit my estate and legacy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out my estate and legacy

How to fill out my estate and legacy

01

Start by making an inventory of all your assets, including properties, investments, bank accounts, and personal belongings.

02

Create a will or trust to outline your wishes for the distribution of your estate. Consult with an attorney to ensure legality and proper documentation.

03

Designate beneficiaries for your assets and clearly specify the distribution percentages or specific items for each beneficiary.

04

Consider appointing an executor to oversee the distribution process and ensure your wishes are carried out correctly.

05

Review and update your estate plan regularly, especially after major life events such as marriage, divorce, or the birth of children.

06

Consult with a financial advisor to optimize your estate and legacy planning, taking into account taxes, inheritance laws, and potential charitable contributions.

Who needs my estate and legacy?

01

Anyone who wants to ensure the proper distribution of their assets and belongings after their passing.

02

Individuals who wish to minimize potential disputes between family members or potential beneficiaries.

03

People who want to support specific causes or charities through their estate.

04

Parents or guardians who want to provide for the financial well-being of their children or dependents.

05

Anyone who wants to have control over how their estate is managed and distributed, rather than relying on default laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in my estate and legacy without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing my estate and legacy and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit my estate and legacy on an iOS device?

Use the pdfFiller mobile app to create, edit, and share my estate and legacy from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete my estate and legacy on an Android device?

On Android, use the pdfFiller mobile app to finish your my estate and legacy. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is my estate and legacy?

Your estate refers to all the assets and liabilities you own at the time of your death, while your legacy encompasses the values, teachings, and impact you leave behind for future generations.

Who is required to file my estate and legacy?

Typically, the executor or personal representative of your estate is required to file any necessary estate tax returns and legal documents related to your legacy.

How to fill out my estate and legacy?

You will need to gather necessary information about your assets, liabilities, and beneficiaries and may require assistance from an attorney or financial advisor to fill out the appropriate forms correctly.

What is the purpose of my estate and legacy?

The purpose of your estate is to distribute your assets according to your wishes, while your legacy reflects the lasting influence you have on others and the values you passed on.

What information must be reported on my estate and legacy?

You must report details on all assets, liabilities, bequests, beneficiary information, and any taxes that may be owed.

Fill out your my estate and legacy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

My Estate And Legacy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.