Get the free COVID-19 CRISIS PPP LOAN REFERRAL AGREEMENT

Show details

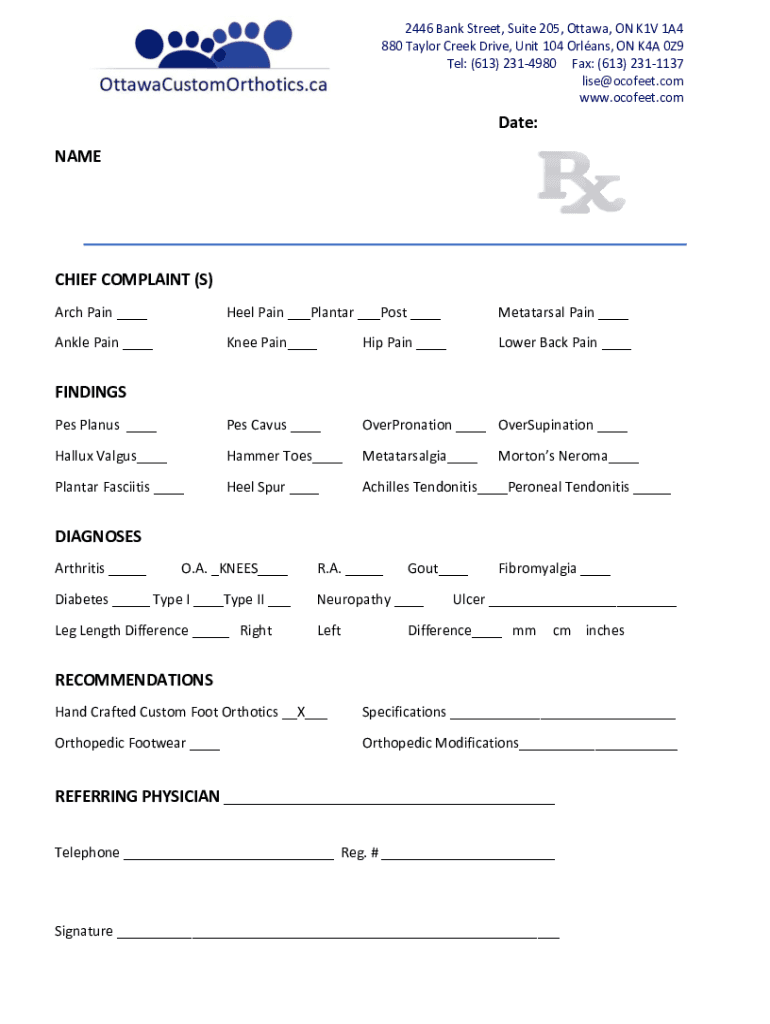

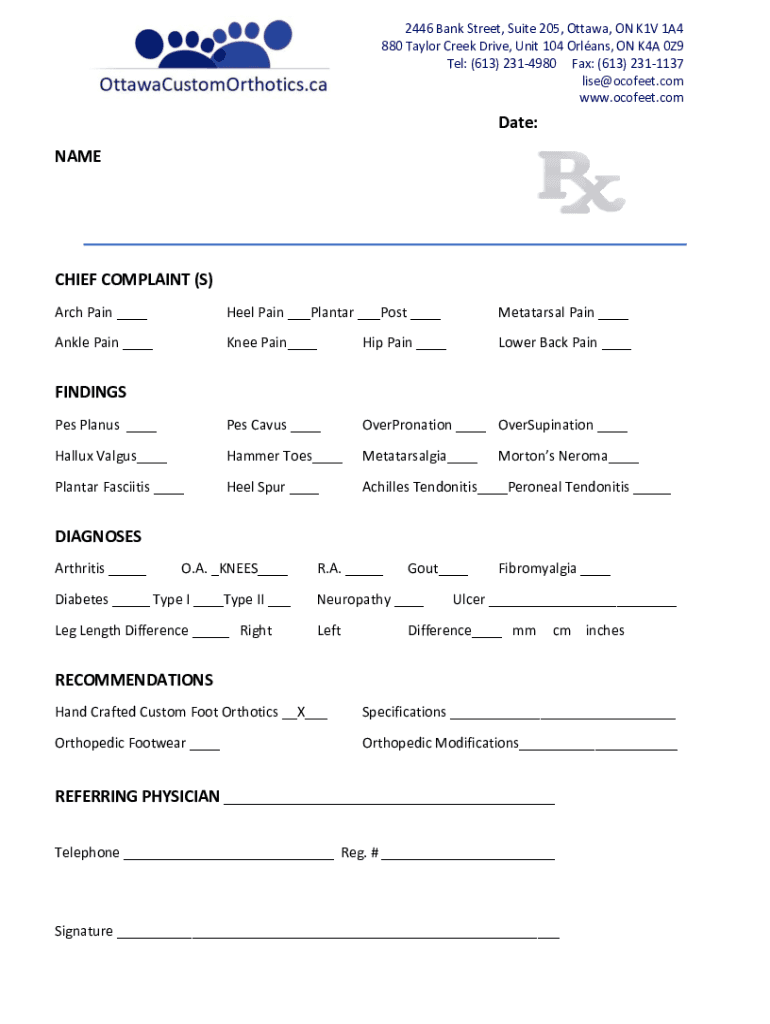

2446 Bank Street, Suite 205, Ottawa, ON K1V 1A4 880 Taylor Creek Drive, Unit 104 Orleans, ON K4A 0Z9 Tel: (613) 2314980 Fax: (613) 2311137 life ocofeet.com www.ocofeet.comDate: TALLCHIEF COMPLAINT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign covid-19 crisis ppp loan

Edit your covid-19 crisis ppp loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your covid-19 crisis ppp loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing covid-19 crisis ppp loan online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit covid-19 crisis ppp loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out covid-19 crisis ppp loan

How to fill out covid-19 crisis ppp loan

01

Step 1: Gather all the necessary documents such as payroll records, tax filings, and financial statements.

02

Step 2: Visit the Small Business Administration (SBA) website and download the PPP loan application form.

03

Step 3: Fill out the application form with accurate information including your business details, average monthly payroll costs, and requested loan amount.

04

Step 4: Attach the required supporting documents to the application, such as proof of payroll expenses.

05

Step 5: Double-check all the information provided in the application form to ensure accuracy and completeness.

06

Step 6: Submit the completed application along with all the supporting documents to an approved lender or through the SBA online application portal.

07

Step 7: Await confirmation from the lender or SBA regarding your loan approval status.

08

Step 8: If approved, carefully review the terms and conditions of the loan offer.

09

Step 9: Accept the loan offer and complete any additional requirements requested by the lender or SBA.

10

Step 10: Use the loan funds for eligible purposes, such as payroll costs, rent, utilities, and mortgage interest.

11

Step 11: Keep detailed records of how the loan funds are utilized.

12

Step 12: Apply for loan forgiveness if you meet the criteria and provide the required documentation.

13

Step 13: Stay updated on any changes or updates to the PPP loan program and comply with all regulations and requirements.

Who needs covid-19 crisis ppp loan?

01

Small businesses that have been adversely affected by the COVID-19 pandemic.

02

Self-employed individuals, independent contractors, and sole proprietors.

03

Nonprofit organizations, including churches and religious organizations.

04

Businesses experiencing financial hardship due to the crisis and require funds to retain employees and cover essential expenses.

05

Businesses that were in operation before February 15, 2020, and have employees for whom they are paying salaries or wages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit covid-19 crisis ppp loan online?

With pdfFiller, the editing process is straightforward. Open your covid-19 crisis ppp loan in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit covid-19 crisis ppp loan straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing covid-19 crisis ppp loan right away.

How do I complete covid-19 crisis ppp loan on an Android device?

On an Android device, use the pdfFiller mobile app to finish your covid-19 crisis ppp loan. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is covid-19 crisis ppp loan?

The COVID-19 crisis PPP loan is a government-backed loan program aimed at providing financial assistance to small businesses to help them retain employees and cover certain operating expenses during the COVID-19 pandemic.

Who is required to file covid-19 crisis ppp loan?

Small businesses, non-profit organizations, independent contractors, and self-employed individuals are eligible to apply for the COVID-19 crisis PPP loan.

How to fill out covid-19 crisis ppp loan?

To fill out the COVID-19 crisis PPP loan, applicants must provide information about their business, payroll expenses, and demonstrate economic need due to the pandemic.

What is the purpose of covid-19 crisis ppp loan?

The purpose of the COVID-19 crisis PPP loan is to provide financial assistance to small businesses to help them retain employees and cover certain operating expenses during the COVID-19 pandemic.

What information must be reported on covid-19 crisis ppp loan?

Information such as payroll expenses, number of employees retained, and economic impact due to the pandemic must be reported on the COVID-19 crisis PPP loan application.

Fill out your covid-19 crisis ppp loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Covid-19 Crisis Ppp Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.