Get the free COVID-19 Small Business Relief Financing - Rapid Finance

Show details

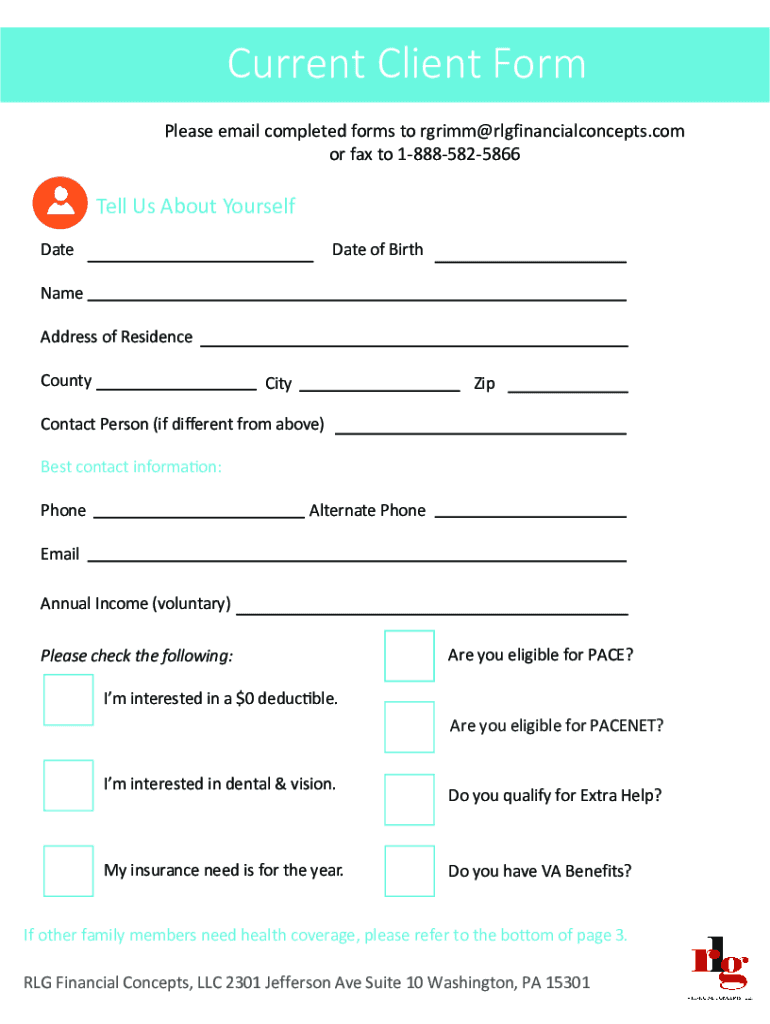

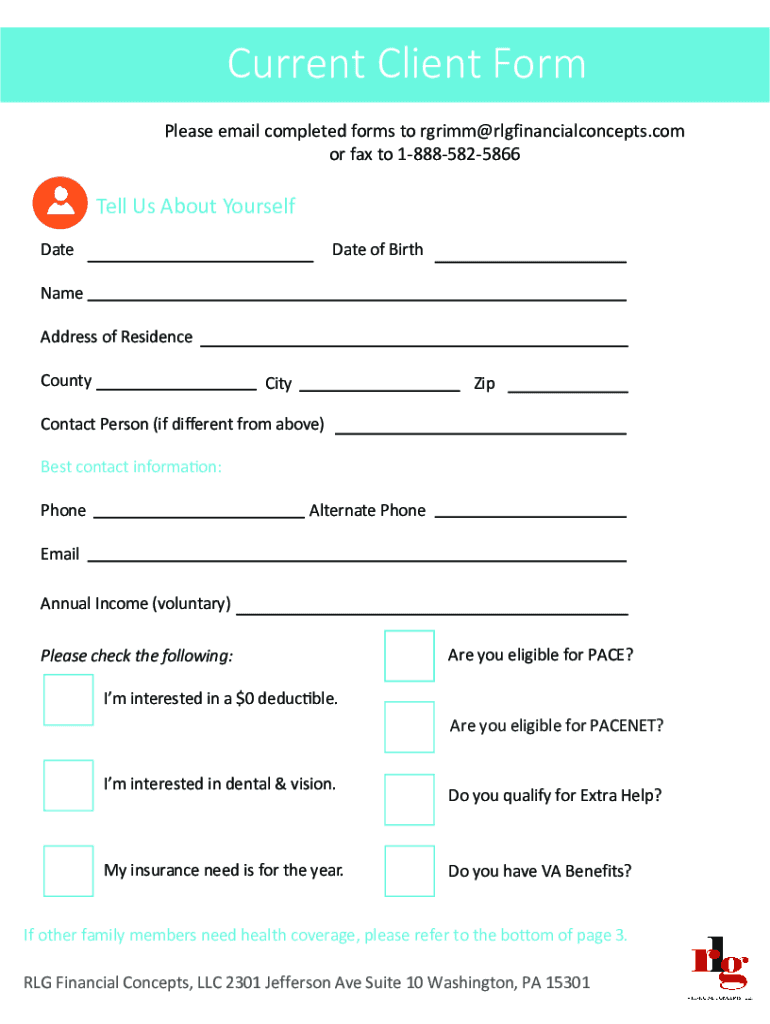

Current Client Form Please email completed forms to Grimm rlgfinancialconcepts.com or fax to 18885825866Tell Us About Yourself Date of Birthrate Address of Residence CountyCityZipContact Person (if

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign covid-19 small business relief

Edit your covid-19 small business relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your covid-19 small business relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing covid-19 small business relief online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit covid-19 small business relief. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out covid-19 small business relief

How to fill out covid-19 small business relief

01

Gather all necessary documents and information, such as identification, tax records, financial statements, and business information.

02

Determine which relief program or funding option is most suitable for your small business. Research and understand the eligibility criteria and requirements for each program.

03

Complete the application form for the chosen relief program. Provide accurate and up-to-date information about your small business, including its size, revenue, and employee count.

04

Attach all required documents and supporting evidence to the application. These may include bank statements, profit/loss statements, and documentation of financial hardship caused by the COVID-19 pandemic.

05

Review the completed application for accuracy and completeness. Double-check all the information provided and make any necessary corrections or additions.

06

Submit the application through the designated channel or platform. This may be an online portal, mailing address, or in-person submission at a government agency.

07

Follow up regularly on the status of your application. Keep track of any communication or updates from the relief program administrators.

08

If approved, carefully review the terms and conditions of the relief funding. Understand any repayment or reporting obligations that may be associated with the assistance received.

09

Utilize the relief funds responsibly and according to the program guidelines. Keep track of all expenditures and maintain proper financial records.

10

Report any changes in your business circumstances or financial situation that may affect your eligibility for the relief program. Stay informed about any reporting requirements or audits that may be conducted.

Who needs covid-19 small business relief?

01

Small businesses that have been adversely affected by the COVID-19 pandemic.

02

Businesses that have experienced a significant decline in revenue or faced financial hardship due to the pandemic.

03

Entrepreneurs or business owners who are struggling to meet their financial obligations, pay their employees, or cover essential operating expenses.

04

Small businesses that are at risk of permanent closure or bankruptcy without financial assistance.

05

Businesses that do not qualify for other forms of government aid or support programs.

06

Small businesses in industries heavily impacted by public health measures, such as hospitality, tourism, retail, and entertainment.

07

Minority-owned or disadvantaged businesses that have faced disproportionate challenges during the pandemic.

08

Startups or newly established businesses that have not yet established a strong financial foundation.

09

Small businesses that require funds to implement safety measures, adapt their operations, or invest in new technologies to comply with changing health regulations.

10

Businesses located in regions or communities with high levels of COVID-19 transmission or strict lockdown measures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit covid-19 small business relief in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing covid-19 small business relief and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the covid-19 small business relief in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your covid-19 small business relief in minutes.

Can I create an electronic signature for signing my covid-19 small business relief in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your covid-19 small business relief right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is covid-19 small business relief?

Covid-19 small business relief refers to financial assistance programs designed to help small businesses impacted by the pandemic.

Who is required to file covid-19 small business relief?

Small businesses that have been affected by the pandemic and meet certain criteria are required to file for covid-19 small business relief.

How to fill out covid-19 small business relief?

To fill out covid-19 small business relief, businesses need to provide information about their financial situation and how they have been impacted by the pandemic.

What is the purpose of covid-19 small business relief?

The purpose of covid-19 small business relief is to provide financial support to small businesses that have been adversely affected by the pandemic.

What information must be reported on covid-19 small business relief?

The information that must be reported on covid-19 small business relief includes financial statements, revenue losses, employee details, and other relevant financial information.

Fill out your covid-19 small business relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Covid-19 Small Business Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.