Get the free 26 CFR 601.201: Rulings and determination letters.

Show details

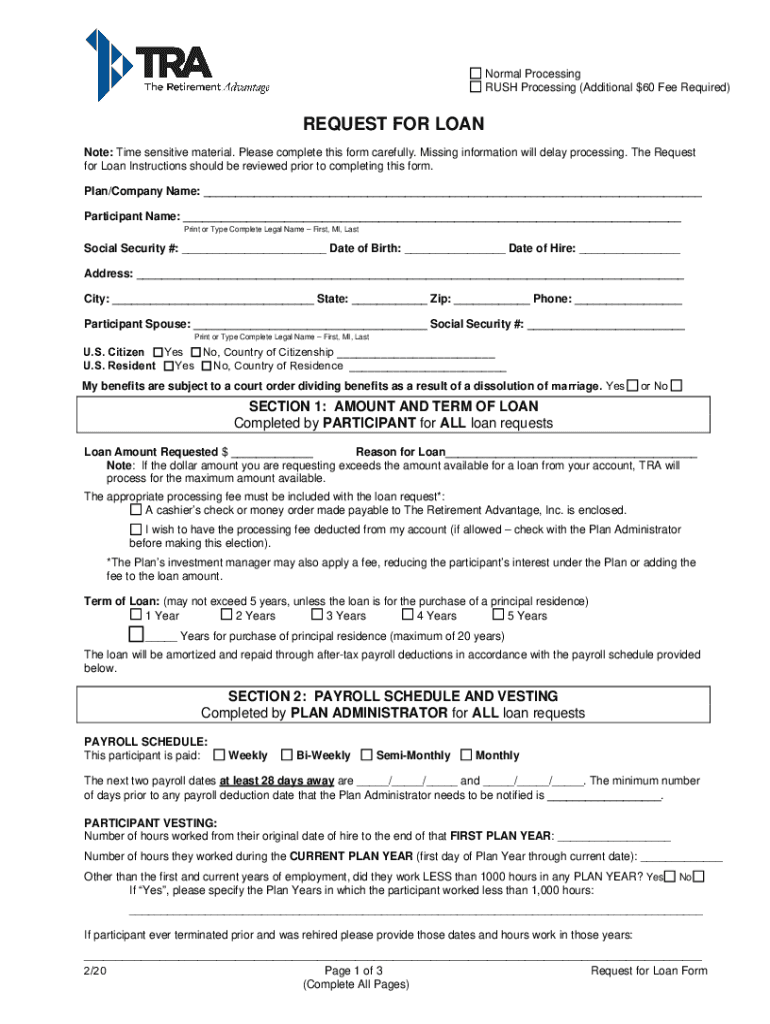

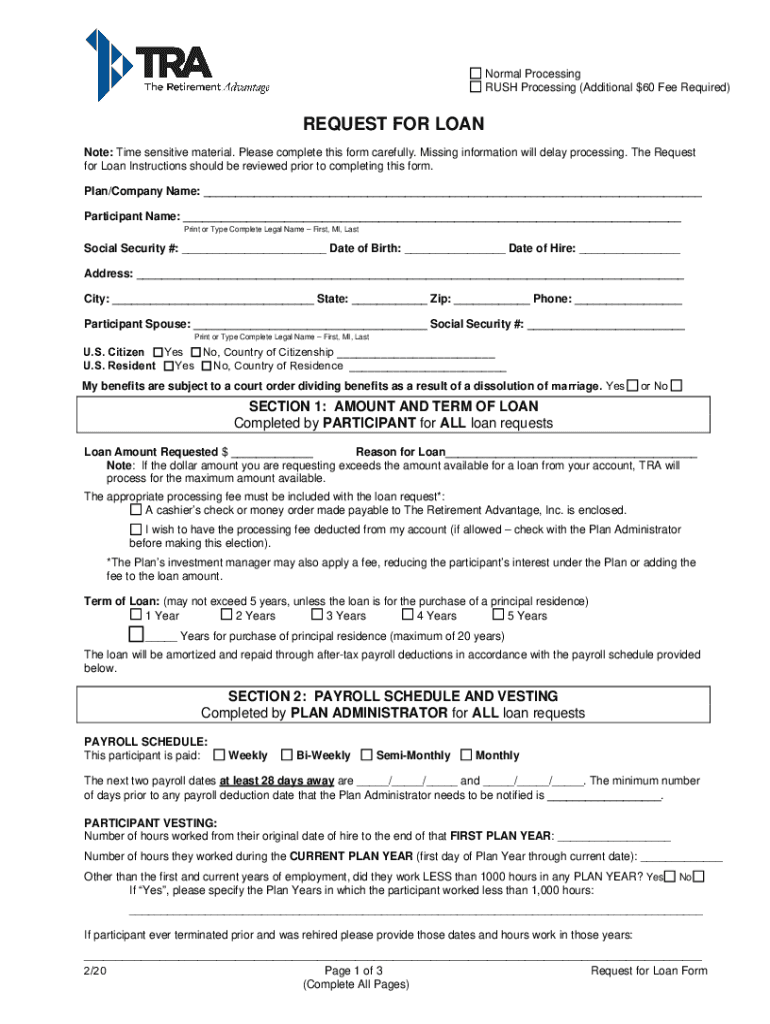

Normal Processing RUSH Processing (Additional $60 Fee Required)REQUEST FOR LOAN Note: Time sensitive material. Please complete this form carefully. Missing information will delay processing. The Request

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 26 cfr 601201 rulings

Edit your 26 cfr 601201 rulings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 26 cfr 601201 rulings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 26 cfr 601201 rulings online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 26 cfr 601201 rulings. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 26 cfr 601201 rulings

How to fill out 26 cfr 601201 rulings

01

To fill out 26 CFR 601.201 rulings, follow these steps:

02

Read and understand the purpose of the rulings.

03

Familiarize yourself with the relevant tax laws and regulations.

04

Gather all the necessary information and documentation related to the ruling.

05

Analyze the specific tax issue or question to be addressed in the ruling.

06

Research any relevant previous rulings or guidance issued by the IRS.

07

Draft a clear and concise ruling that provides a detailed explanation or interpretation of the tax law.

08

Review and revise the ruling for accuracy and clarity.

09

Submit the completed ruling to the appropriate IRS office or department.

10

Keep a copy of the ruling for your records.

11

Monitor any updates or changes to the tax laws that may impact the ruling.

12

Maintain compliance with the ruling and adjust any tax practices accordingly.

Who needs 26 cfr 601201 rulings?

01

Individuals and organizations that need guidance or clarification on tax matters related to 26 CFR 601.201 may require the 26 CFR 601.201 rulings.

02

Tax professionals, including accountants, tax attorneys, and consultants, often refer to these rulings to ensure compliance and make informed decisions for their clients.

03

Government agencies, such as the Internal Revenue Service (IRS), may rely on these rulings when interpreting and enforcing tax laws.

04

Businesses and individuals who are subject to the provisions of 26 CFR 601.201 and seek guidance on tax issues specific to their circumstances may benefit from these rulings.

05

Taxpayers who want to understand the IRS's official position on a particular tax matter covered by 26 CFR 601.201 can refer to these rulings.

06

Overall, anyone involved in tax planning, preparation, or compliance may find these rulings useful in navigating the complexities of the tax system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 26 cfr 601201 rulings online?

pdfFiller has made it simple to fill out and eSign 26 cfr 601201 rulings. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit 26 cfr 601201 rulings on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 26 cfr 601201 rulings.

How do I edit 26 cfr 601201 rulings on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 26 cfr 601201 rulings on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is 26 cfr 601201 rulings?

26 CFR 601.201 relates to the IRS rules regarding the issuance of rulings and procedures for tax matters, providing guidelines for taxpayers and their representatives.

Who is required to file 26 cfr 601201 rulings?

Taxpayers seeking a formal ruling on specific tax issues are required to file under 26 CFR 601.201, typically involving complex tax situations or clarifications on tax obligations.

How to fill out 26 cfr 601201 rulings?

To fill out 26 CFR 601.201 rulings, taxpayers must complete a specific application form detailing the tax issue, providing relevant facts, and submitting necessary documentation to support their request.

What is the purpose of 26 cfr 601201 rulings?

The purpose of 26 CFR 601.201 rulings is to provide taxpayers with assurance on the tax treatment of a specific transaction, helping them understand their tax liabilities and compliance requirements.

What information must be reported on 26 cfr 601201 rulings?

Information that must be reported includes the taxpayer's details, a description of the issue, relevant facts, applicable law and regulations, and any supporting documents necessary for the ruling.

Fill out your 26 cfr 601201 rulings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

26 Cfr 601201 Rulings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.