Get the free Donations to Charities Are Still Tax Deductible

Show details

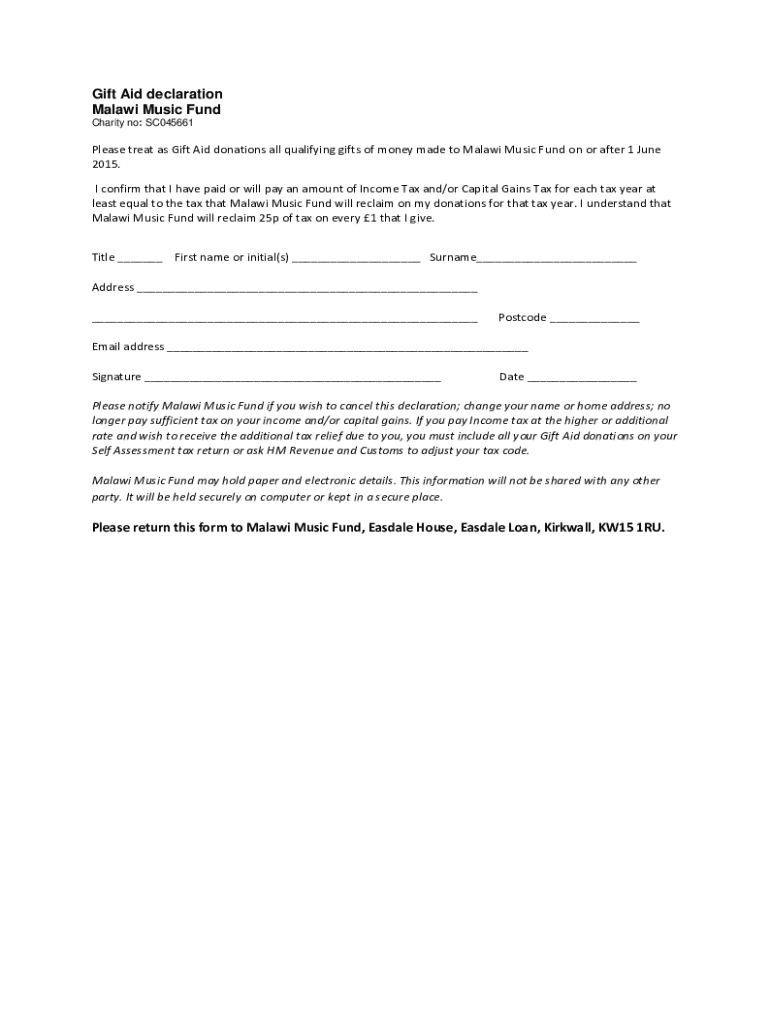

Gift Aid declaration Malawi Music Fund Charity no: SC045661Please treat as Gift Aid donations all qualifying gifts of money made to Malawi Music Fund on or after 1 June 2015. I confirm that I have

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donations to charities are

Edit your donations to charities are form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donations to charities are form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donations to charities are online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donations to charities are. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donations to charities are

How to fill out donations to charities are

01

Research and choose a charity that aligns with your values and cause.

02

Visit the charity's website or contact them to find out their donation process.

03

Decide on the type and amount of donation you want to make.

04

Fill out the donation form or provide the necessary information online.

05

Choose your preferred payment method and provide the required details.

06

Review the donation details and verify its accuracy.

07

Submit the donation form or complete the online payment process.

08

Some charities may provide a tax receipt for your donation. If applicable, ensure to provide any necessary information for tax purposes.

09

Follow up with the charity if you have any questions or require further assistance.

Who needs donations to charities are?

01

Various individuals and groups can benefit from donations to charities such as:

02

- Those living in poverty or facing economic difficulties

03

- Homeless individuals or families

04

- Children in need of education or healthcare support

05

- Refugees and displaced individuals

06

- Animal shelters and organizations working for animal welfare

07

- Environmental conservation projects

08

- Local community initiatives

09

- Medical research organizations

10

- Relief and disaster response organizations

11

- Non-profit organizations advocating for social justice, human rights, equality, etc.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get donations to charities are?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific donations to charities are and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute donations to charities are online?

Completing and signing donations to charities are online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out donations to charities are using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign donations to charities are and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is donations to charities are?

Donations to charities are gifts of money or goods given to nonprofit organizations or other charitable causes to support their mission and programs.

Who is required to file donations to charities are?

Individuals or organizations who make donations to charities are required to file for tax purposes.

How to fill out donations to charities are?

Donations to charities are typically reported on the donor's tax return using a specific form provided by the tax authority. The form will require information such as the name of the charity, the date and amount of the donation.

What is the purpose of donations to charities are?

The purpose of donations to charities are is to support organizations that provide charitable services, such as helping those in need, advancing education, or promoting health and wellness.

What information must be reported on donations to charities are?

Information such as the name of the charity, the date and amount of the donation, and any acknowledgment provided by the charity must be reported on donations to charities are.

Fill out your donations to charities are online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donations To Charities Are is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.