Get the free Claim for Excess Proceeds Form - Spanish. Reclamo por ingresos excedentes de venta

Show details

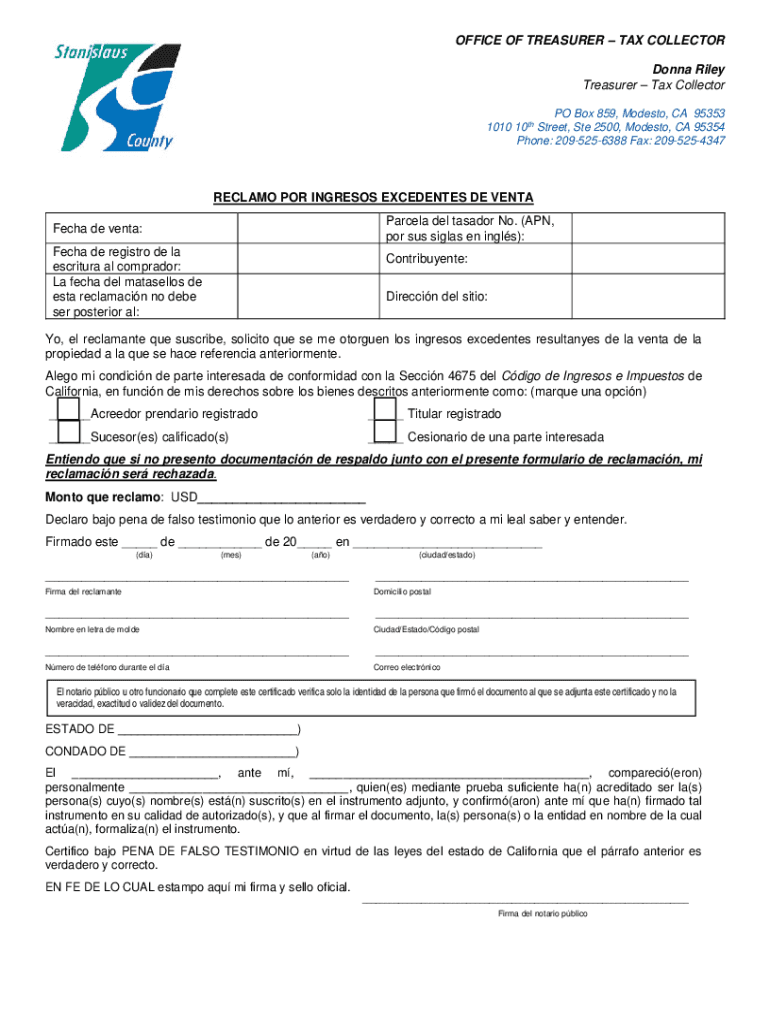

OFFICE OF TREASURER TAX COLLECTOR Donna Riley Treasurer Tax Collector PO Box 859, Modesto, CA 95353 1010 10th Street, Ste 2500, Modesto, CA 95354 Phone: 2095256388 Fax: 2095254347RECLAMO POR INGRESS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for excess proceeds

Edit your claim for excess proceeds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for excess proceeds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for excess proceeds online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claim for excess proceeds. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for excess proceeds

How to fill out claim for excess proceeds

01

Gather all necessary documents such as proof of ownership, identification, and any supporting evidence.

02

Research and find the appropriate form or template for the claim for excess proceeds.

03

Fill out the form accurately and completely, providing all required information.

04

Attach any relevant documents or evidence that support your claim.

05

Double-check all the information provided in the claim form for accuracy and completeness.

06

Submit the completed claim form and supporting documents to the designated authority or organization.

07

Follow up on your claim by regularly checking with the authority or organization for updates or additional requirements.

08

Be patient and persistent, as the process of claiming excess proceeds may take some time.

09

If your claim is approved, ensure you follow any further instructions provided by the authority or organization.

10

Once you have received the excess proceeds, make sure to use them responsibly according to your intentions or goals.

Who needs claim for excess proceeds?

01

Anyone who believes they are entitled to excess proceeds from a financial or legal transaction.

02

Individuals who have sold property, assets, or items and received an amount larger than the agreed upon price.

03

Beneficiaries who have a rightful claim to excess funds from a deceased person's estate or insurance policy.

04

Parties involved in a legal settlement or judgment that resulted in excess funds.

05

Claimants who have successfully contested a foreclosure or tax sale and are entitled to excess funds.

06

People who have overpaid certain fees or taxes and are eligible for a refund of the excess amount.

07

Individuals who have been awarded excess compensation through a class action lawsuit or similar legal action.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send claim for excess proceeds to be eSigned by others?

When you're ready to share your claim for excess proceeds, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in claim for excess proceeds?

With pdfFiller, the editing process is straightforward. Open your claim for excess proceeds in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the claim for excess proceeds form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign claim for excess proceeds. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is claim for excess proceeds?

Claim for excess proceeds is a process to retrieve funds that are leftover after a property is sold at a tax sale for more than the amount owed in taxes.

Who is required to file claim for excess proceeds?

The owner of the property or other parties with a legal interest in the property are required to file a claim for excess proceeds.

How to fill out claim for excess proceeds?

To fill out a claim for excess proceeds, you must provide proof of ownership or legal interest in the property, along with personal identification and contact information.

What is the purpose of claim for excess proceeds?

The purpose of claim for excess proceeds is to ensure that the rightful owner or parties receive the funds that are rightfully theirs after a property is sold at a tax sale.

What information must be reported on claim for excess proceeds?

Information such as proof of ownership, legal interest in the property, personal identification, and contact information must be reported on a claim for excess proceeds.

Fill out your claim for excess proceeds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Excess Proceeds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.