Get the free Payroll System Implementation Requirements ChecklistPersonnel File: What to Include ...

Show details

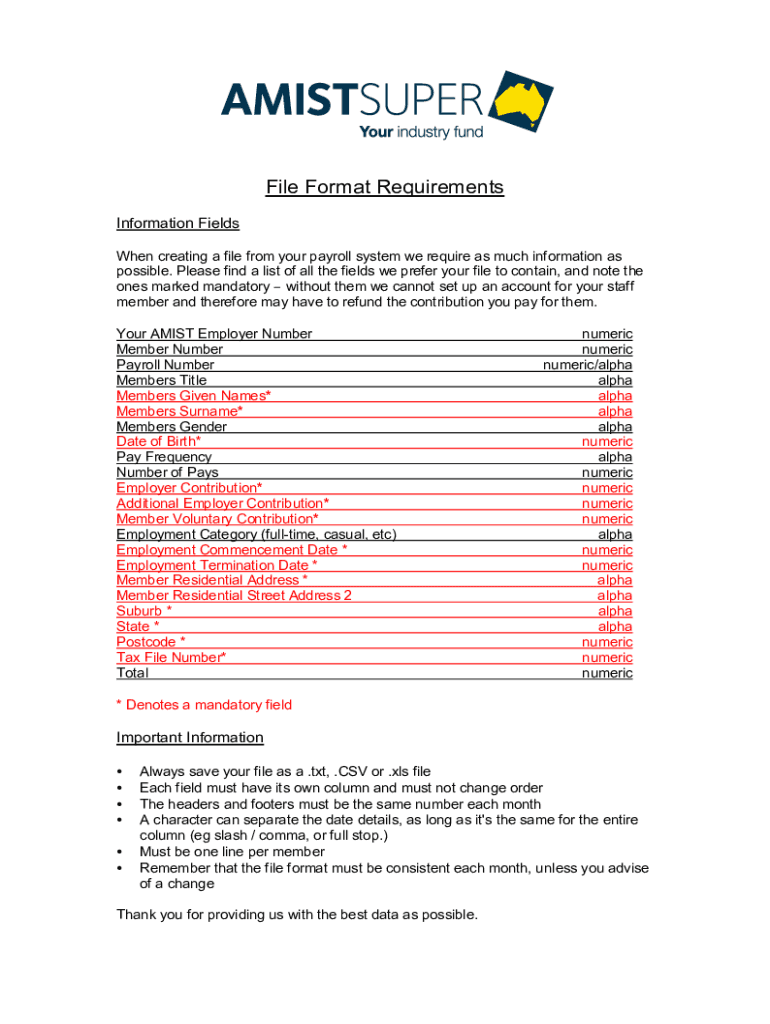

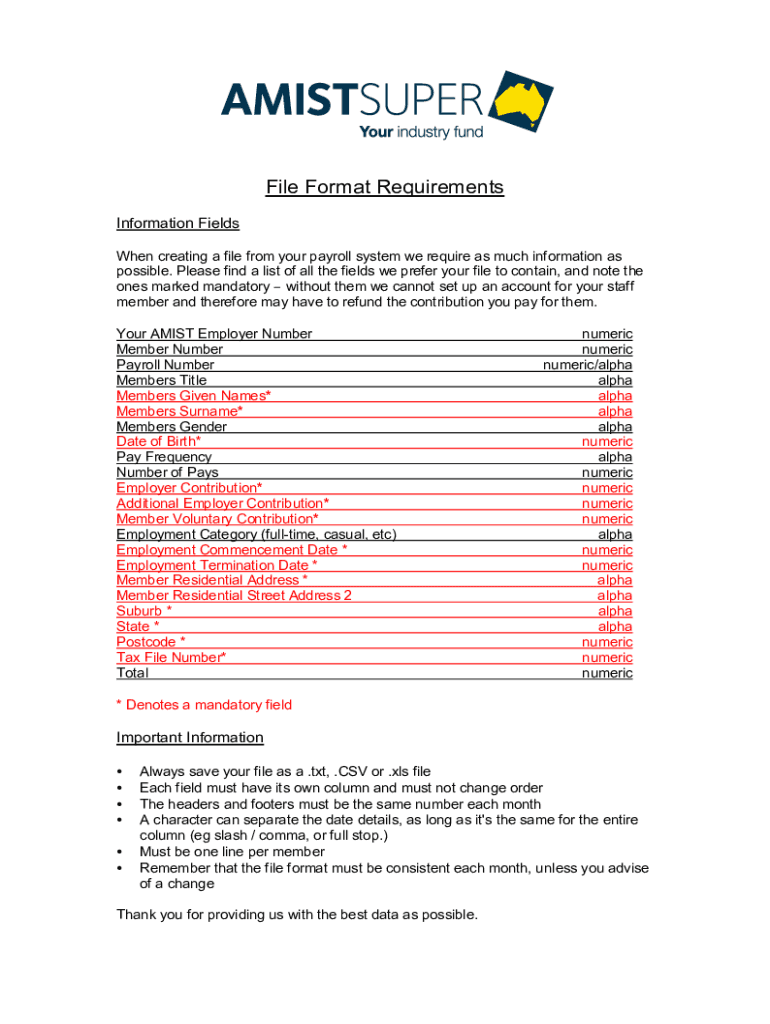

File Format Requirements Information Fields When creating a file from your payroll system we require as much information as possible. Please find a list of all the fields we prefer your file to contain,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll system implementation requirements

Edit your payroll system implementation requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll system implementation requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll system implementation requirements online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payroll system implementation requirements. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll system implementation requirements

How to fill out payroll system implementation requirements

01

Determine the specific requirements of your organization for implementing a payroll system. This could include factors such as the number of employees, payroll frequencies, types of compensation, and any specific legal or regulatory requirements.

02

Research and select a payroll software or system that meets your organization's requirements. Consider factors such as cost, ease of use, integration with existing systems, and scalability.

03

Gather necessary employee information such as employee names, addresses, Social Security numbers, tax withholding information, and bank account details for direct deposit.

04

Configure the payroll system according to your organization's specific requirements. This may involve setting up pay periods, pay rates, deductions, benefits, and tax calculations.

05

Test the payroll system to ensure its accuracy and functionality. Verify that the system accurately calculates and processes payroll, generates reports, and handles any unique situations or exceptions.

06

Train your payroll team or designated payroll administrator on how to use the system effectively. Provide guidance on entering and reviewing employee data, running payroll cycles, generating reports, and addressing any potential issues or errors.

07

Establish a schedule for ongoing maintenance and updates of the payroll system. This may include staying up-to-date with tax laws and regulations, maintaining employee records, and periodically evaluating the system's performance and effectiveness.

08

Monitor the payroll system regularly to ensure data integrity, security, and compliance with applicable laws and regulations. Regularly review payroll reports, reconcile payroll records, and address any discrepancies or errors promptly.

09

Communicate with employees about the implementation of the new payroll system and any changes in payroll processes or procedures. Provide clear instructions on how employees can access their pay stubs, view their tax withholdings, and address any payroll-related questions or concerns.

Who needs payroll system implementation requirements?

01

Any organization that employs staff and pays wages or salaries would likely need payroll system implementation requirements. This can include businesses of all sizes, non-profit organizations, government agencies, and educational institutions.

02

Payroll system implementation requirements are particularly important for organizations with multiple employees, complex payroll structures, or those that need to comply with specific legal or regulatory requirements associated with payroll processing and reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send payroll system implementation requirements to be eSigned by others?

To distribute your payroll system implementation requirements, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get payroll system implementation requirements?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific payroll system implementation requirements and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my payroll system implementation requirements in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your payroll system implementation requirements directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is payroll system implementation requirements?

The payroll system implementation requirements refer to the necessary steps and configurations needed to set up and utilize a payroll system effectively.

Who is required to file payroll system implementation requirements?

Employers or businesses who are planning to implement a new payroll system or update their existing one are required to file payroll system implementation requirements.

How to fill out payroll system implementation requirements?

You can fill out the payroll system implementation requirements by following the specific guidelines provided by the payroll system provider or consulting with a professional for assistance.

What is the purpose of payroll system implementation requirements?

The purpose of payroll system implementation requirements is to ensure that the payroll system is set up correctly, accurately calculates employee compensation, and complies with all relevant laws and regulations.

What information must be reported on payroll system implementation requirements?

The information reported on payroll system implementation requirements typically includes employee details, compensation rates, tax withholding information, and any other relevant payroll data.

Fill out your payroll system implementation requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll System Implementation Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.