Get the free The Charitable Remainder Trust: Do Good and Get Tax Breaks

Show details

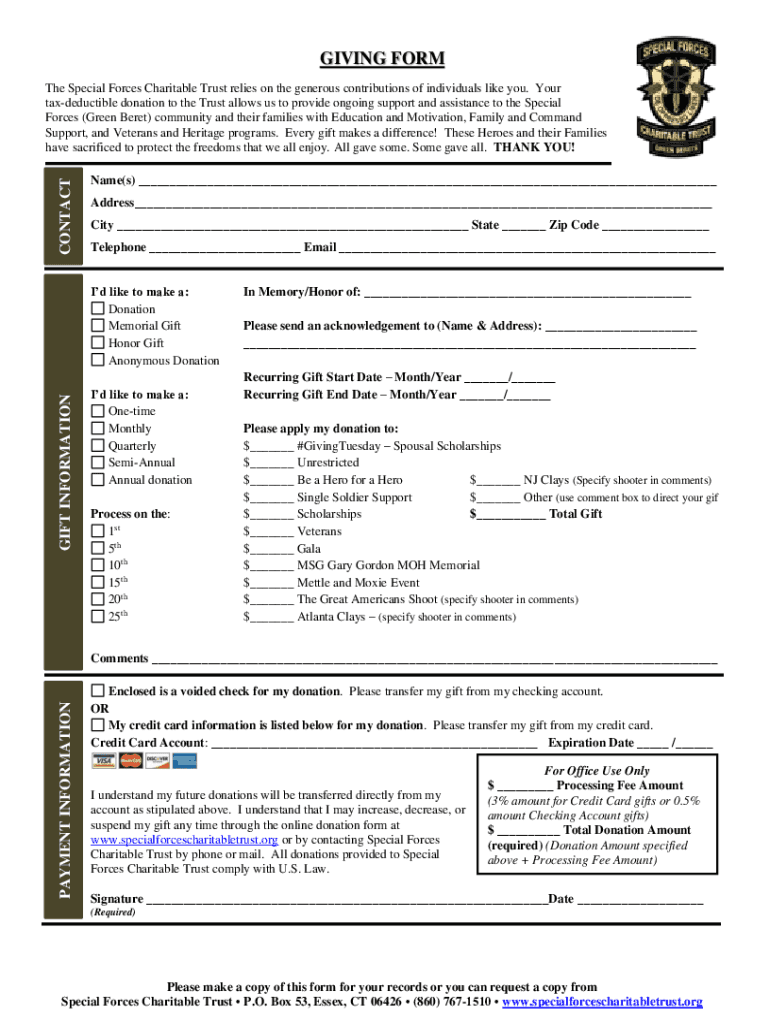

GIVING FORMCONTACTThe Special Forces Charitable Trust relies on the generous contributions of individuals like you. Your

tax-deductible donation to the Trust allows us to provide ongoing support and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form charitable remainder trust

Edit your form charitable remainder trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form charitable remainder trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form charitable remainder trust online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form charitable remainder trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form charitable remainder trust

How to fill out form charitable remainder trust

01

To fill out a form for a charitable remainder trust, follow these steps:

02

Begin by reading the instructions on the form carefully. Understand what information is required and where it needs to be filled.

03

Provide your personal information, such as your name, address, and contact details. Make sure to fill in all the required fields accurately.

04

Follow the instructions to indicate the type of trust you are creating. This may include selecting a charitable beneficiary and specifying the distribution method.

05

Provide details about the assets or property you intend to place in the trust. This may involve describing the type of asset, its value, and any special considerations.

06

Calculate the payout rate or percentage for the charitable beneficiary. This determines the amount they will receive from the trust each year.

07

If necessary, consult an attorney or financial advisor to ensure you understand the legal and financial implications of establishing a charitable remainder trust.

08

Review the completed form to ensure accuracy and completeness.

09

Sign and date the form as required, and include any additional supporting documents that may be requested.

10

Make a copy of the completed form and supporting documents for your records before submitting it to the appropriate entity or organization.

Who needs form charitable remainder trust?

01

A charitable remainder trust form may be needed by individuals or organizations who:

02

- Wish to make a charitable contribution while still retaining an income stream from the contributed assets.

03

- Want to reduce their taxable income by receiving a charitable deduction for the value of the assets placed in the trust.

04

- Seek to provide for a charity or nonprofit organization upon their death or after a specified period of time.

05

- Desire to ensure the long-term financial stability of a charitable organization or cause they hold dear.

06

- Have significant assets or property they would like to donate to charity and want to explore tax-efficient options.

07

- Are looking for ways to optimize their estate planning strategies while supporting causes they care about.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form charitable remainder trust?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form charitable remainder trust and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute form charitable remainder trust online?

pdfFiller has made filling out and eSigning form charitable remainder trust easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the form charitable remainder trust in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form charitable remainder trust right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is form charitable remainder trust?

A charitable remainder trust (CRT) is a type of irrevocable trust that provides income to the grantor or other designated individuals for a specified period, after which the remaining assets are donated to a charitable organization.

Who is required to file form charitable remainder trust?

Generally, the trustee of the charitable remainder trust is responsible for filing the appropriate tax forms related to the trust, as well as informing beneficiaries about income distributions.

How to fill out form charitable remainder trust?

To fill out the form for a charitable remainder trust, one must provide information about the trust assets, the income beneficiaries, and details regarding the charitable recipient, following the specific guidelines outlined by the IRS.

What is the purpose of form charitable remainder trust?

The purpose of a charitable remainder trust is to provide a way for individuals to receive income from their assets during their lifetime while eventually benefiting a charitable organization.

What information must be reported on form charitable remainder trust?

Information reported typically includes details about the trust's income, expenses, distribution to beneficiaries, and the charitable organization that will receive the remainder of the assets.

Fill out your form charitable remainder trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Charitable Remainder Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.