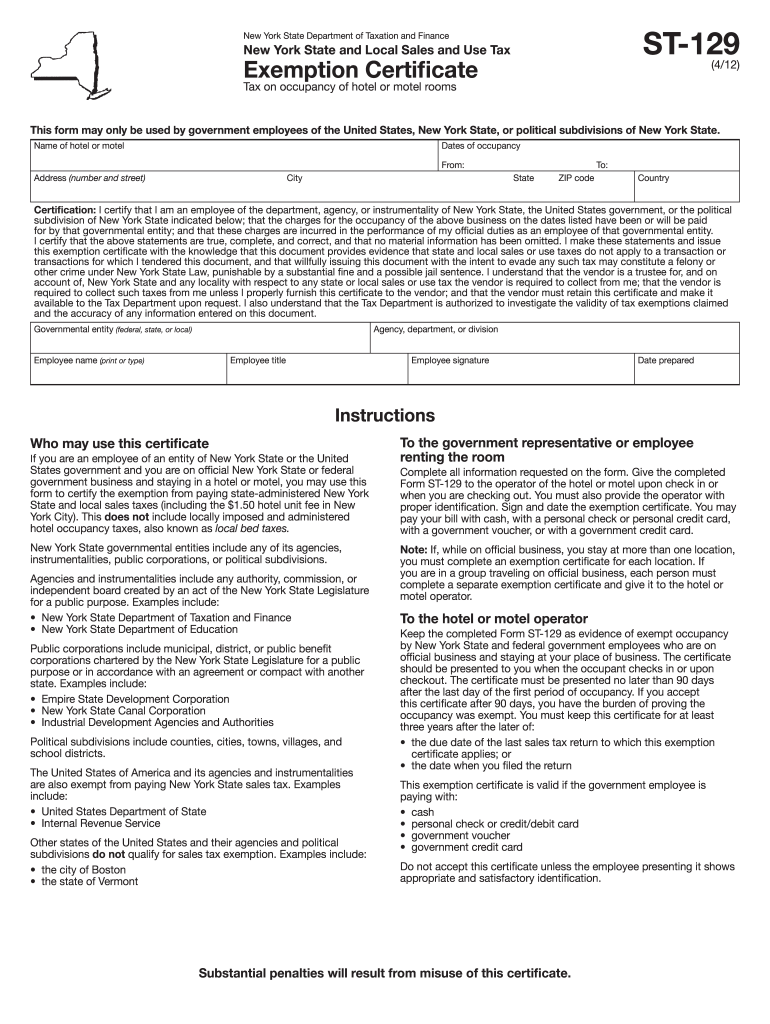

NY DTF ST-129 2012 free printable template

Get, Create, Make and Sign NY DTF ST-129

How to edit NY DTF ST-129 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF ST-129 Form Versions

How to fill out NY DTF ST-129

How to fill out NY DTF ST-129

Who needs NY DTF ST-129?

Instructions and Help about NY DTF ST-129

Laws dot-com legal forms guide a form I — 129 is used by the US Department of Homeland Security for the petition of a non-immigrant worker visa the form is required for any worker who does not intend to become a permanent resident to legally enter the United States in this case we are using the form I — 129 provided by the Department of Homeland Security examples of the form can be found online or directly from a Department of Homeland Security office the first step is to provide the employer information on the form in the proper boxes put the employers name followed by their address and contact number you must identify the purpose of the petition in part to include the non-immigrant classification of the worker the basis for the classification and the requested action that relates to your application in line 5 indicate how many applicants your form I — 129 will cover in part 3 you must identify the individual or group you are sponsoring for the petition indicate the person or groups name birthdates social security numbers locations of birth and any other information that applies to the applicant you may need supplemental forms which are provided for each additional person covered by the form I — 129 provide the processing information in part 4 select the offices that need to be informed of approval of the form on the fourth page in part 4 indicate the passport and supplemental petitions being filed in conjunction with this form select yes or no for each corresponding question some questions may require you to write supplemental information on the extra forms that come with the form I — 129 fill in part 5 stating the information of the employer and the nature of the employment you must include the type of business the type of employment the compensation that will be given to the employee dates of the employment period and any other information that relates to your situation part 6 requires the employer to certify that they will comply with all technological data release regulations the employer must indicate whether a license from the US Department of Commerce is needed for this type of employment page 6 require signatures and certificate of the employer as well as the preparer of the form if someone other than the employee entity filled it out to watch more videos please make sure to visit laws dot-com

People Also Ask about

What 10 US states do not accept out of state resale certificates?

Does New York accept out of state resale certificates?

How much is room tax in New York?

What is the tax exempt form for NYC?

Do I need a reseller permit in NY?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY DTF ST-129?

How do I complete NY DTF ST-129 online?

How do I edit NY DTF ST-129 online?

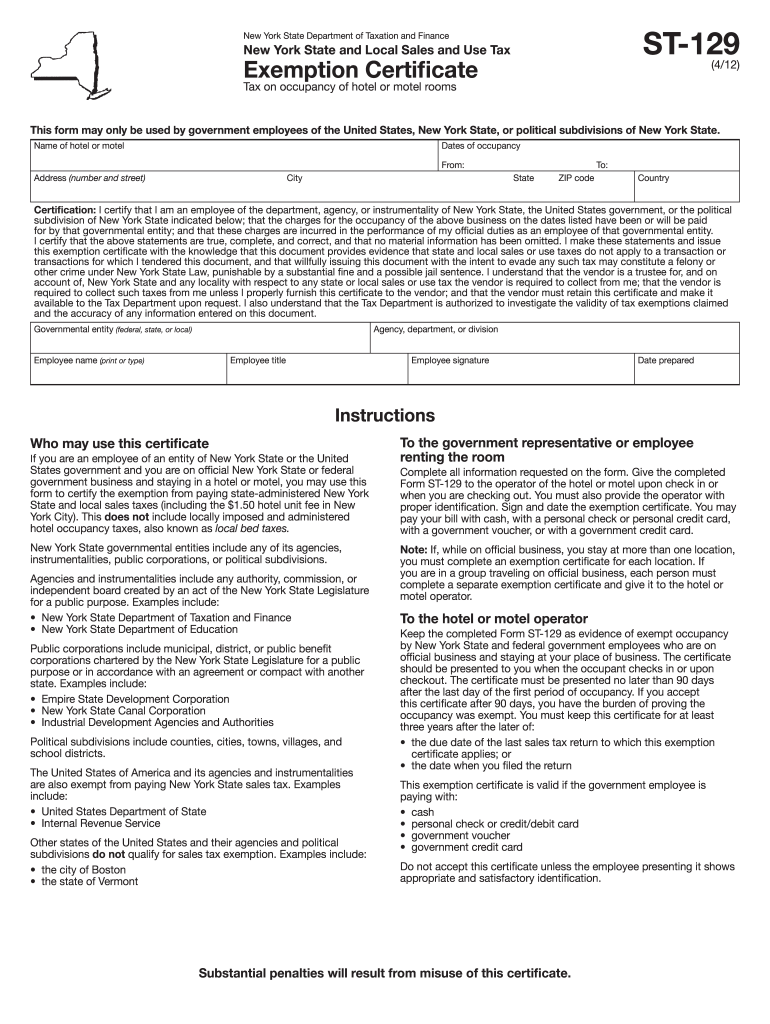

What is NY DTF ST-129?

Who is required to file NY DTF ST-129?

How to fill out NY DTF ST-129?

What is the purpose of NY DTF ST-129?

What information must be reported on NY DTF ST-129?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.