NY DTF ST-129 2000 free printable template

Show details

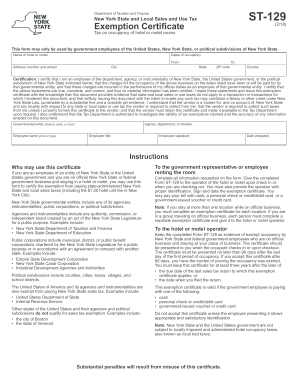

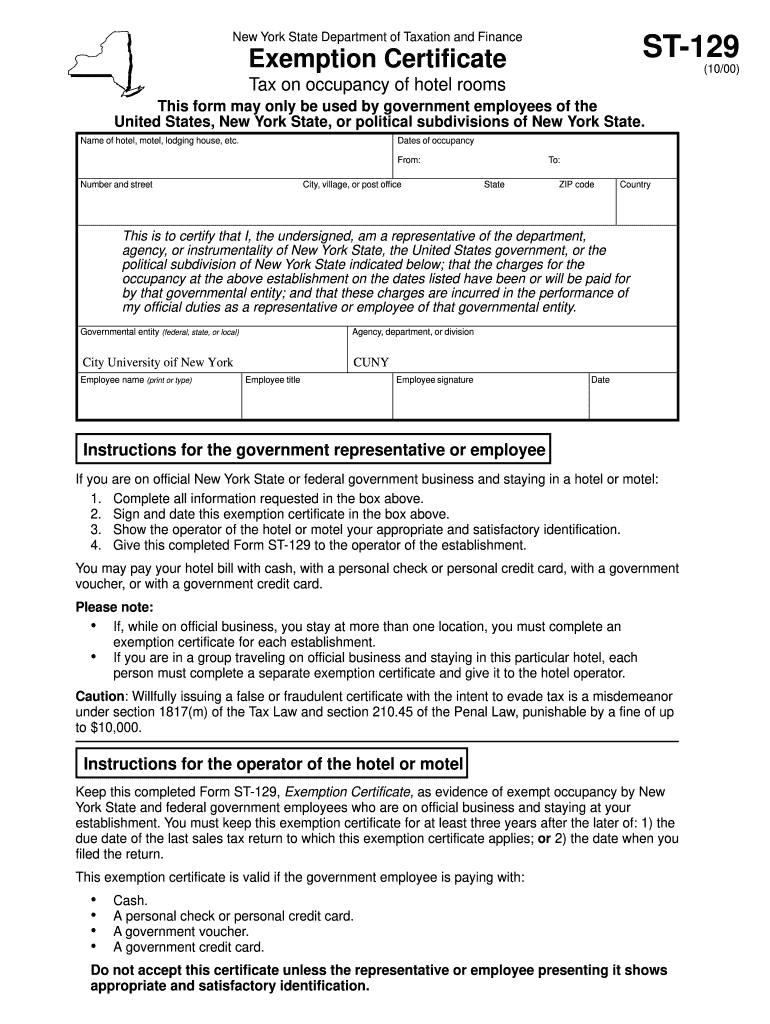

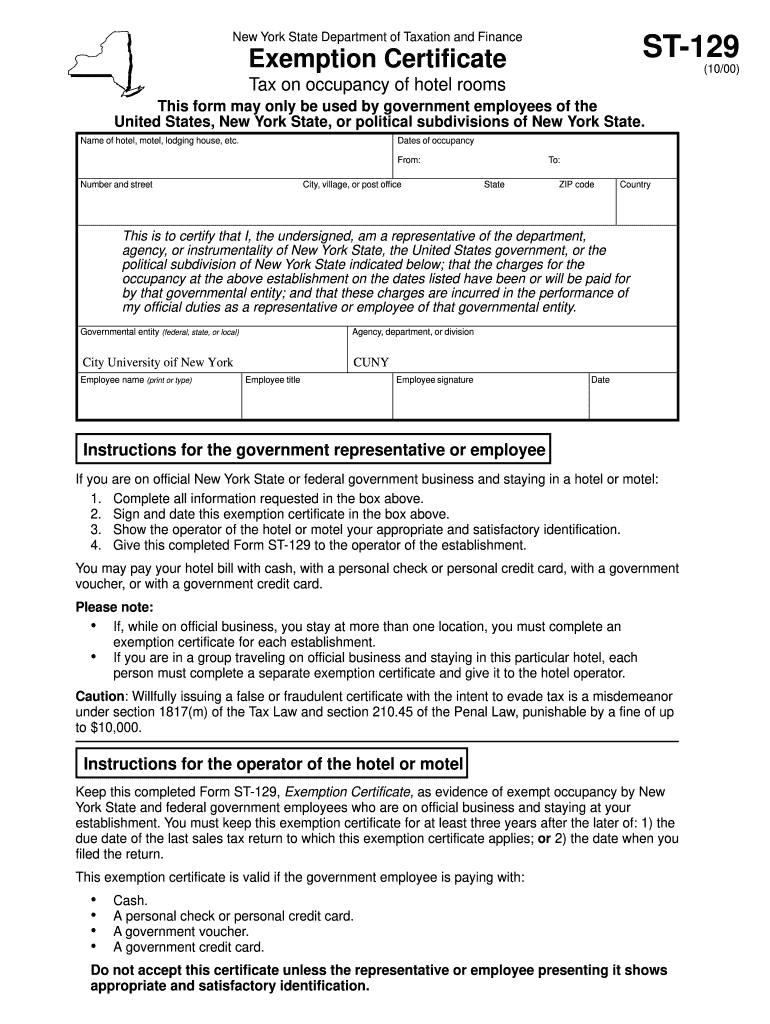

New York State Department of Taxation and Finance ST-129 Exemption Certificate (10/00) Tax on occupancy of hotel rooms This form may only be used by government employees of the United States, New

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF ST-129

Edit your NY DTF ST-129 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF ST-129 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF ST-129 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY DTF ST-129. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ST-129 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF ST-129

How to fill out NY DTF ST-129

01

Download the NY DTF ST-129 form from the New York State Department of Taxation and Finance website.

02

Begin by filling in your name and address in the designated fields.

03

Enter your New York State identification number or Social Security number if applicable.

04

Specify the type of exemption you are claiming by selecting the appropriate box.

05

Provide details regarding the property owned or rented including the address and the nature of the exemption.

06

Review the form for accuracy and ensure all necessary fields are completed.

07

Sign and date the form at the bottom.

08

Submit the completed form to your vendor or the appropriate tax authority.

Who needs NY DTF ST-129?

01

Individuals or businesses claiming a tax exemption on purchases in New York.

02

Non-profit organizations seeking sales tax exemptions.

03

Government entities and certain types of purchasers who are qualified for exemption.

Fill

form

: Try Risk Free

People Also Ask about

Does New York have a hotel tax?

As of September 1, 2021, the full hotel room occupancy tax should be collected and remitted. One of three taxes and one fee that apply to hotel room rentals in New York City. The Department of Finance collects the New York City Hotel Room Occupancy Tax, also known as the Hotel Tax.

What is NY state hotel tax?

New York State Hotel Unit Fee ($1.50 per unit per day)Hotel Room Occupancy Tax. If the rent for the room is…The tax will be…$10 or more, but less than $2050 cents per day per room + the hotel room occupancy tax rate$20 or more, but less than $30$1.00 per day per room + the hotel room occupancy tax rate2 more rows

What is the tax exempt form for NYS?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

What is NY ST 120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid. Certificate of Authority issued by the Tax Department and is making.

Do you have to pay tax on hotels in New York?

No sales tax is due from hotel guests who are considered to be permanent residents. In order to be a permanent resident, a guest must stay in the hotel for at least 90 consecutive days without interruption. In New York City only, the local sales tax applies until a guest has stayed for at least 180 consecutive days.

How to apply for tax exempt from New York?

To make tax exempt purchases: Complete Form ST-119.1 (This form is mailed with your exemption certificate, and is not available on our Web site. To get additional copies of this form, contact our sales tax information center.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NY DTF ST-129?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NY DTF ST-129 and other forms. Find the template you need and change it using powerful tools.

How do I execute NY DTF ST-129 online?

pdfFiller has made it simple to fill out and eSign NY DTF ST-129. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit NY DTF ST-129 in Chrome?

Install the pdfFiller Google Chrome Extension to edit NY DTF ST-129 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is NY DTF ST-129?

NY DTF ST-129 is a form used in New York State for claiming a sales tax exemption for purchases made by certain organizations, including certain nonprofits and government entities.

Who is required to file NY DTF ST-129?

Organizations that are exempt from New York sales tax, such as certain nonprofit entities, religious organizations, and government agencies, are required to file NY DTF ST-129.

How to fill out NY DTF ST-129?

To fill out NY DTF ST-129, provide the organization's name, address, and exemption certificate number. Indicate the nature of the purchases and include the signature of an authorized representative.

What is the purpose of NY DTF ST-129?

The purpose of NY DTF ST-129 is to document and authorize the exemption from sales tax for eligible organizations when making purchases.

What information must be reported on NY DTF ST-129?

The information that must be reported on NY DTF ST-129 includes the organization's name, address, exemption certificate number, and details of the exempt transactions.

Fill out your NY DTF ST-129 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF ST-129 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.