MD Form 13-23 2021 free printable template

Show details

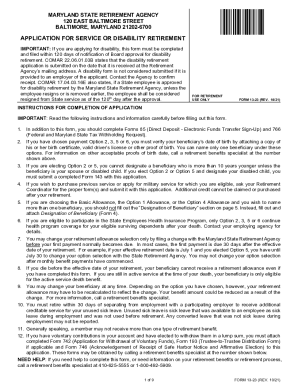

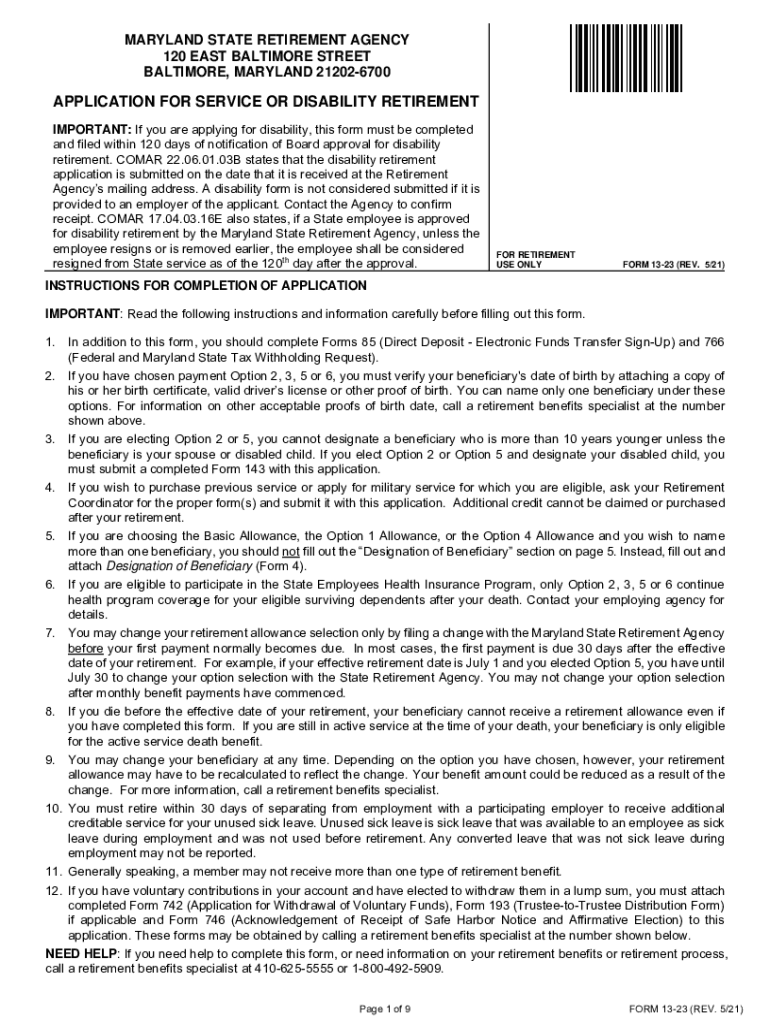

MARYLAND STATE RETIREMENT AGENCY 120 EAST BALTIMORE STREET BALTIMORE, MARYLAND 212026700APPLICATION FOR SERVICE OR DISABILITY RETIREMENT IMPORTANT: If you are applying for disability, this form must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Form 13-23

Edit your MD Form 13-23 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Form 13-23 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD Form 13-23 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MD Form 13-23. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Form 13-23 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Form 13-23

How to fill out MD Form 13-23

01

Gather necessary personal information such as your name, address, and contact details.

02

Include the date of the application at the top of the form.

03

Fill out the section regarding the purpose of the request, providing details relevant to your application.

04

Provide any requested identification or supporting documents in the specified format.

05

Review all information for accuracy, ensuring there are no errors.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate office or online platform as directed.

Who needs MD Form 13-23?

01

Individuals seeking specific documentation from the relevant authority.

02

Organizations that require verification or official recognition.

03

Anyone applying for exemptions or special permissions related to the stated purpose of the form.

Fill

form

: Try Risk Free

People Also Ask about

How is Maryland teacher pension calculated?

Full service retirement allowances equal 1/55 (1.818 percent) of the highest three years' average final salary (AFS) multiplied by the number of years and months of accumulated creditable service.

What is the average pension for teachers in Maryland?

All data come from either the Maryland State Retirement and Pension System or the National Institute on Retirement Security. Employees contribute 7% of salary out of each paycheck to the pension fund. The average teacher retirement benefit is $19,212 per year, or $1,601 per month.

How long do you have to work for the state of Maryland to get a pension?

Retirement eligibility at age 65 with at least 10 years of service, or age 60 with at least 15 years of service at a reduced benefit.

How does Maryland teacher pension work?

The Teachers' Pension System is contributory for all members. You are required to contribute 7% of your normal salary throughout your career to help fund your benefits. Your payment is called your member contribution and is automatically deducted from your paycheck and sent to the Retirement Agency by your employer.

How does MD State Pension work?

You contribute 7% of your annual compensation to the EPS. You earn service credit toward your retirement benefits each day you work and pay your required contribution. Your service credit and age determine when you are eligible for retirement and how much your retirement benefit will be.

What is the tax form for Maryland pensions?

Internal Revenue Service tax form 1099-R provides each payee with detailed information on his or her pension income for the previous year. Most payees receive only one 1099-R tax form each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MD Form 13-23 online?

pdfFiller has made it simple to fill out and eSign MD Form 13-23. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my MD Form 13-23 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your MD Form 13-23 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit MD Form 13-23 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like MD Form 13-23. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is MD Form 13-23?

MD Form 13-23 is a specific form used for reporting certain financial or tax-related information in the state of Maryland.

Who is required to file MD Form 13-23?

Individuals or entities that meet specific criteria set forth by the state of Maryland tax authorities are required to file MD Form 13-23.

How to fill out MD Form 13-23?

To fill out MD Form 13-23, you must gather the required information, follow the instructions provided with the form, and complete each section accurately before submitting it to the relevant state department.

What is the purpose of MD Form 13-23?

The purpose of MD Form 13-23 is to collect specific financial information for tax assessment and compliance purposes within the state of Maryland.

What information must be reported on MD Form 13-23?

MD Form 13-23 typically requires reporting of income, deductions, credits, and other financial details as mandated by the Maryland state tax guidelines.

Fill out your MD Form 13-23 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Form 13-23 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.