Get the free Estate Planning Questionnaire - Kaiser Law Group

Show details

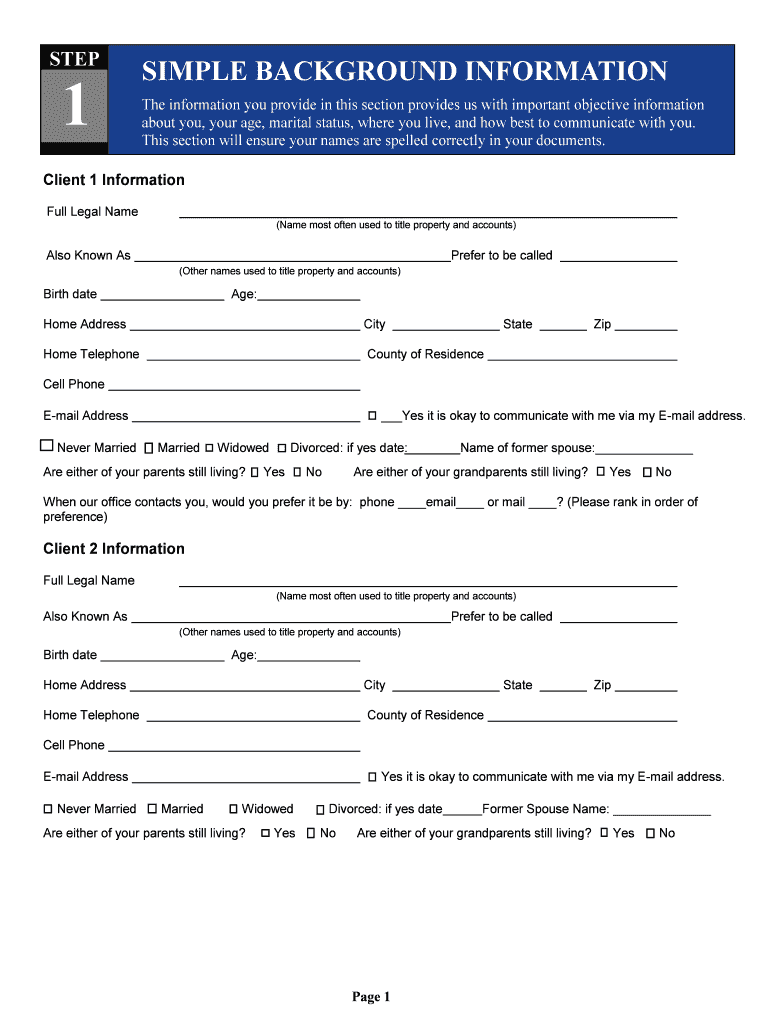

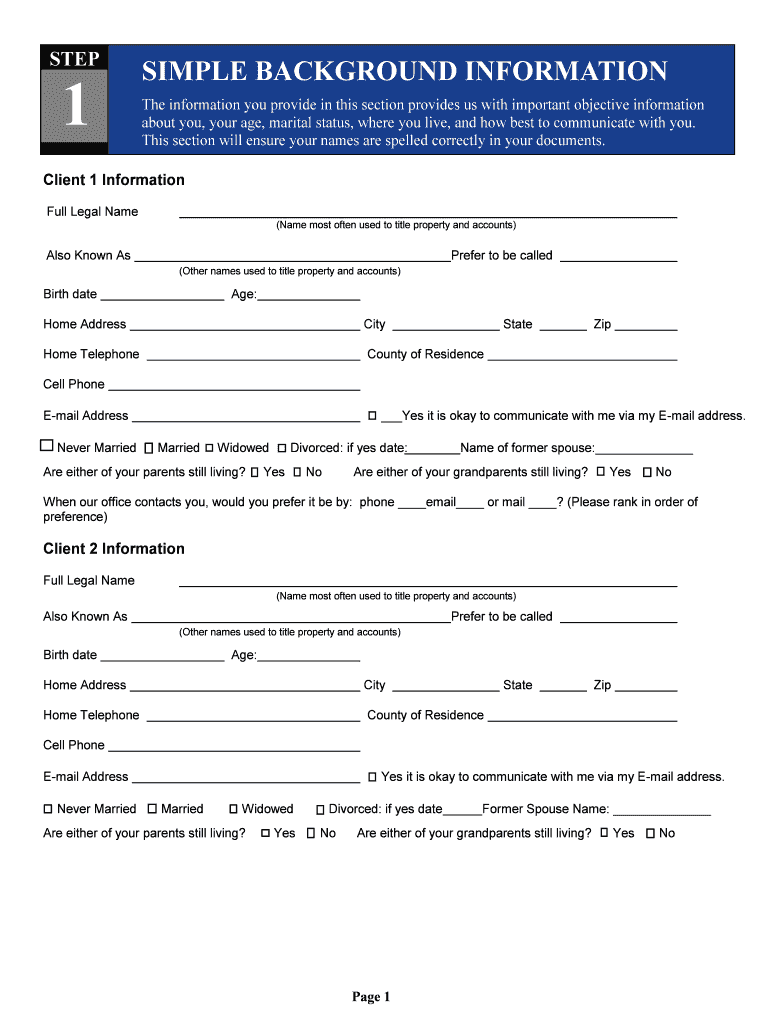

PERSONAL INFORMATION FORM Office Address: 5150 E. Pacific Coast Hwy, Suite 775 Long Beach, CA 90804 (562) 343-2843 Please Note: It can be helpful (and cost-saving for you) if you can fill out the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate planning questionnaire

Edit your estate planning questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate planning questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate planning questionnaire online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit estate planning questionnaire. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate planning questionnaire

01

Start by gathering all relevant documents and information. This includes your personal identification documents, property and asset ownership documents, financial records, insurance policies, and any existing legal documents such as wills or trusts.

02

Review the questionnaire carefully to understand the information it requires. Estate planning questionnaires typically cover areas such as personal information, family structure, beneficiaries, assets, debts, healthcare preferences, and distribution wishes.

03

Begin by providing your basic personal information, such as your full name, date of birth, contact information, and social security number. This information helps to accurately identify you and is crucial for legal documentation.

04

Proceed to provide details about your family structure. This may include the names, ages, and relationships of your spouse, children, and other beneficiaries. Note any special considerations or circumstances regarding family members that may affect your estate plan.

05

Evaluate your assets and debts. You will be prompted to list and describe all your significant assets, including real estate, vehicles, bank accounts, investments, and personal belongings. Additionally, you may need to disclose any outstanding debts or liabilities.

06

Consider your healthcare preferences and end-of-life wishes. The questionnaire may inquire about your desires regarding medical treatment, life-sustaining measures, organ donation, and appointing a healthcare proxy or power of attorney. Think through these decisions carefully and consult with a healthcare professional if necessary.

07

Think about how you want your assets to be distributed after your passing. Specify your beneficiaries, their share or percentage, and any conditions or restrictions you wish to place on the distribution. You may also express any philanthropic or charitable wishes you have.

08

If you already have existing legal documents such as a will, trust, or power of attorney, provide details about them and attach copies if required. This will help ensure consistency and avoid any conflicts between your estate planning questionnaire and prior legal arrangements.

09

Review your completed questionnaire thoroughly before submission. Double-check for accuracy, completeness, and consistency. Make any necessary adjustments or additions, and seek legal advice if you have any doubts or questions.

Who needs an estate planning questionnaire?

01

Anyone who wants to create or update their estate plan can benefit from a comprehensive estate planning questionnaire. It serves as a valuable tool in organizing and documenting important information, ensuring your wishes are accurately reflected in your estate plan.

02

Individuals with complex or sizable estates may find an estate planning questionnaire especially beneficial. It helps to navigate the intricacies of wealth distribution, tax planning, charitable bequests, and other specialized considerations.

03

Couples who are preparing joint estate plans should both complete an estate planning questionnaire. This helps to align their shared goals and ensure that their individual preferences and intentions are addressed.

04

Aging individuals or those with health concerns may use an estate planning questionnaire to express their healthcare preferences, appoint healthcare proxies, and consider long-term care arrangements.

05

Individuals who have experienced significant life changes, such as marriage, divorce, birth of a child, or acquisition of new assets, should consider updating their existing estate plan. An estate planning questionnaire facilitates the process of reassessing and adjusting the plan accordingly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify estate planning questionnaire without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including estate planning questionnaire, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in estate planning questionnaire without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing estate planning questionnaire and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my estate planning questionnaire in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your estate planning questionnaire and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is estate planning questionnaire?

Estate planning questionnaire is a document that helps individuals organize and document their personal and financial information to create an effective estate plan.

Who is required to file estate planning questionnaire?

Any individual who wants to create an estate plan or update an existing one may be required to fill out an estate planning questionnaire.

How to fill out estate planning questionnaire?

To fill out an estate planning questionnaire, individuals can follow the instructions provided in the document and provide accurate and detailed information about their assets, beneficiaries, and wishes for distribution.

What is the purpose of estate planning questionnaire?

The purpose of an estate planning questionnaire is to help individuals gather all necessary information to create an effective estate plan that reflects their wishes and ensures smooth distribution of assets.

What information must be reported on estate planning questionnaire?

Typically, an estate planning questionnaire will ask for information on assets, liabilities, beneficiaries, and preferences for distribution of assets.

Fill out your estate planning questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Planning Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.