Get the free Automatic Debit Authorization Form - Navient

Show details

P.O. Box 9500 Wilkes-Barre, PA 18773-9500 Borrower Name: Account Number: Automatic Debit Authorization Form Agreement: I, the bank account holder, authorize Sallie Mae and its successors and assigns

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic debit authorization form

Edit your automatic debit authorization form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic debit authorization form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automatic debit authorization form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic debit authorization form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic debit authorization form

How to Fill Out Automatic Debit Authorization Form:

01

Gather the necessary information: Before starting to fill out the form, make sure you have all the required information at hand. This usually includes your name, address, bank account details, and the name of the company or organization that will be debiting your account.

02

Read the instructions carefully: It's important to review the form's instructions thoroughly. They will provide specific guidance on how to complete each section and what information is required.

03

Fill in personal information: Begin by filling in your personal details, such as your full name, address, email, and phone number. Double-check for any errors or misspellings.

04

Provide bank account details: Enter your bank account details accurately, including the account number and the bank's routing number. These are crucial to ensure the proper routing of funds.

05

Specify authorization details: Indicate the specific authorization details for the automatic debit. This includes the amount to be debited, the frequency (e.g., monthly or annually), and the start date. Be sure to comply with any guidelines or limitations mentioned on the form.

06

Review and sign: Carefully review all the information you have provided to ensure its accuracy. Then, sign and date the form according to the form's instructions. Your signature signifies your consent and agreement to allow the specified debits from your account.

Who needs an Automatic Debit Authorization Form?

01

Individuals or businesses making regular payments: An automatic debit authorization form is typically required when an individual or business wants to authorize another party to automatically debit their bank account for recurring payments. This could include monthly bills, subscription services, membership fees, or loan payments.

02

Utility companies and service providers: Utility companies, such as electricity, water, or cable providers, often require customers to complete an automatic debit authorization form. This ensures hassle-free payments for their services and avoids late fees or service disruptions.

03

Non-profit organizations and charities: Non-profit organizations and charities may request automatic debit authorization to ease the collection of recurring donations or membership fees. This helps them plan and budget their activities more effectively.

04

Financial institutions and lenders: Banks, credit card companies, and lenders often require an automatic debit authorization form when setting up automatic loan or credit card payments. This helps them ensure timely payments and minimizes the risk of missed or late payments.

Remember, it's important to carefully read and understand the terms and conditions associated with an automatic debit authorization form before providing your consent. If you have any questions or concerns, it is always recommended to seek clarification from the relevant party.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my automatic debit authorization form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your automatic debit authorization form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit automatic debit authorization form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your automatic debit authorization form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the automatic debit authorization form in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your automatic debit authorization form in minutes.

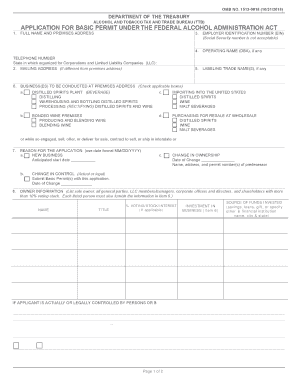

What is automatic debit authorization form?

An automatic debit authorization form is a document that allows a company or organization to automatically withdraw funds from a customer's bank account to pay for goods or services.

Who is required to file automatic debit authorization form?

Any customer who wishes to authorize automatic debit payments from their bank account is required to file an automatic debit authorization form.

How to fill out automatic debit authorization form?

To fill out an automatic debit authorization form, the customer needs to provide their bank account information, the amount to be debited, the frequency of payments, and their signature.

What is the purpose of automatic debit authorization form?

The purpose of an automatic debit authorization form is to streamline the payment process for both the customer and the company, ensuring timely and consistent payments.

What information must be reported on automatic debit authorization form?

The information reported on an automatic debit authorization form typically includes the customer's name, bank account number, routing number, payment amount, payment frequency, and authorization signature.

Fill out your automatic debit authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Debit Authorization Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.