Get the free Corporate Tax Credit - Private School Tuition Fund 123

Show details

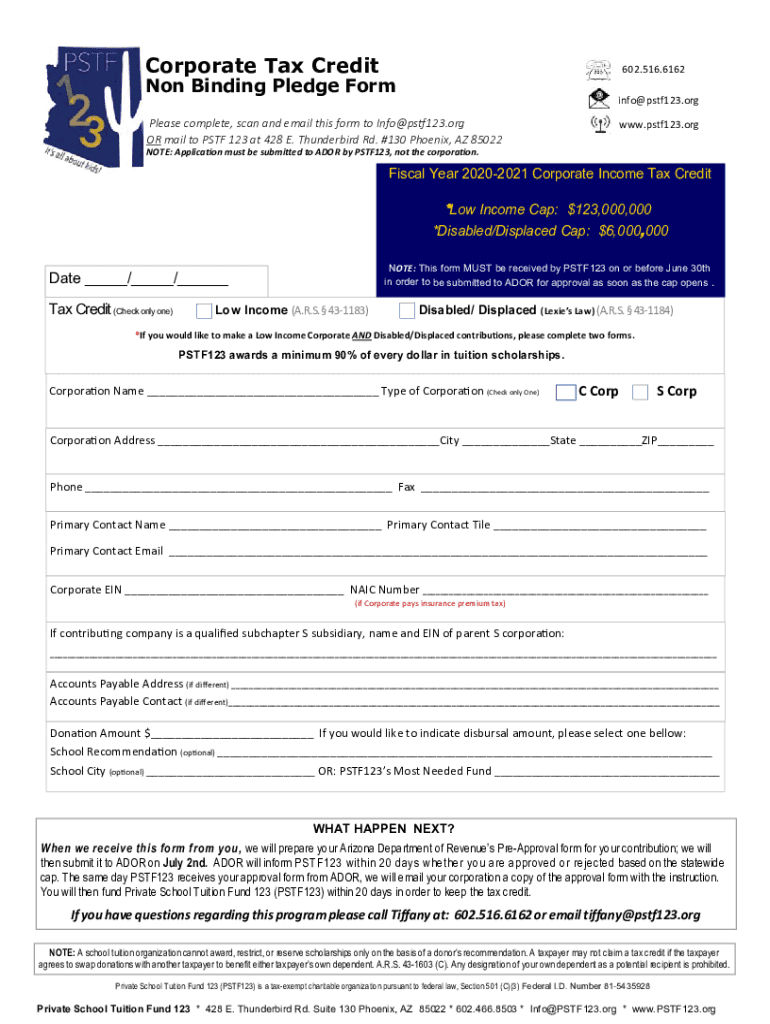

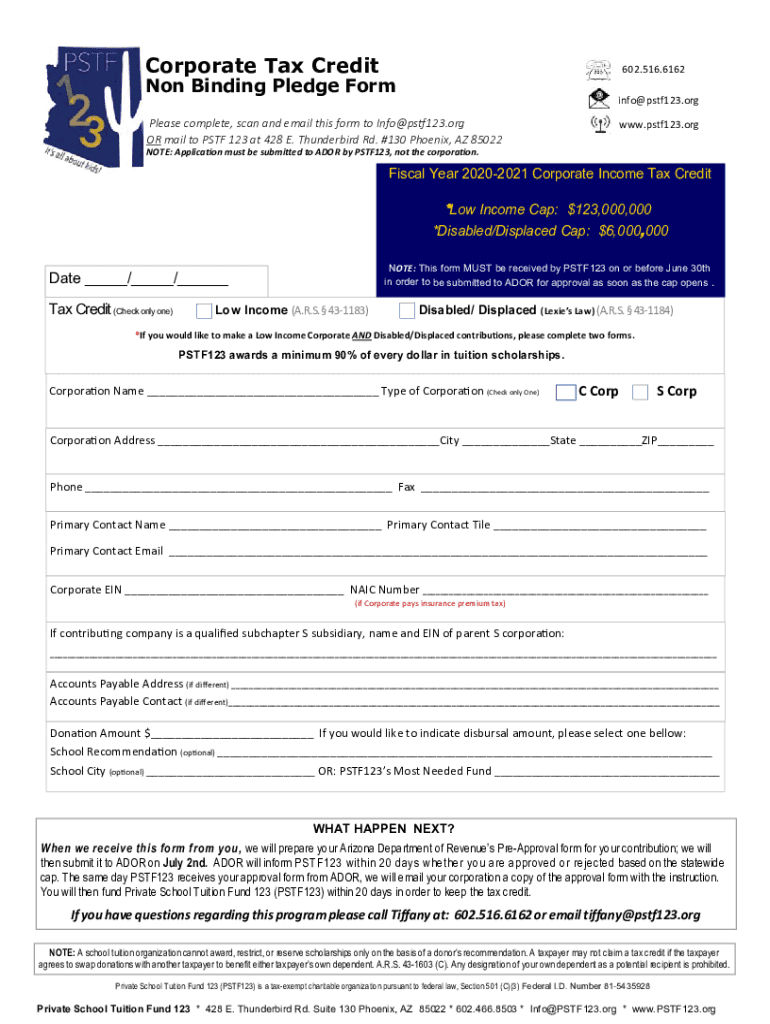

Corporate Tax Credit602.516.6162Non Binding Pledge Forminfo@pstf123.org www.pstf123.orgPlease complete, scan and email this form to Info@ps123.org OR mail to PSF 123 at 428 E. Thunderbird Rd. #130

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate tax credit

Edit your corporate tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate tax credit online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit corporate tax credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate tax credit

How to fill out corporate tax credit

01

Gather all necessary financial documents, such as income statements, balance sheets, and tax returns.

02

Determine if your corporation qualifies for any tax credits. This may involve consulting with a tax professional or reviewing applicable tax laws.

03

Identify the specific corporate tax credit you wish to apply for. Research its requirements, application process, and deadlines.

04

Fill out the necessary forms and provide all required information accurately and completely.

05

Review and double-check the completed application for any errors or missing information.

06

Attach any supporting documents or additional information required for the tax credit application.

07

Submit the completed application before the deadline specified by the tax authority.

08

Follow up with the tax authority to ensure your application is processed and to address any inquiries or requests for further information.

09

Keep copies of all submitted documents and correspondence related to the corporate tax credit application for your records.

Who needs corporate tax credit?

01

Corporations with eligible business activities that qualify for specific tax credits.

02

Startups or small businesses looking to reduce their tax liability and improve their financial position.

03

Companies operating in industries or sectors targeted by government incentives to promote economic growth.

04

Businesses engaged in research and development activities, as research tax credits are commonly available.

05

Corporations seeking to incentivize certain behaviors or activities through tax credits, such as investing in renewable energy or hiring specific types of employees.

06

Any corporation that wishes to take advantage of available tax savings and maximize their after-tax profits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit corporate tax credit in Chrome?

Install the pdfFiller Google Chrome Extension to edit corporate tax credit and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the corporate tax credit electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit corporate tax credit on an iOS device?

Use the pdfFiller mobile app to create, edit, and share corporate tax credit from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is corporate tax credit?

Corporate tax credit is a type of tax incentive designed to promote certain behavior or activities within a business. It allows businesses to reduce their overall tax liability by claiming credits for specific actions or investments.

Who is required to file corporate tax credit?

Any corporation or business entity that meets the criteria for the specific tax credit being claimed is required to file for corporate tax credit.

How to fill out corporate tax credit?

Filing for corporate tax credit usually involves providing detailed information about the specific activity or investment that qualifies for the credit, as well as completing the necessary forms or documentation required by the tax authorities.

What is the purpose of corporate tax credit?

The purpose of corporate tax credit is to incentivize businesses to engage in activities that benefit the economy, such as investing in research and development, creating jobs, or implementing environmentally friendly practices.

What information must be reported on corporate tax credit?

The information that must be reported on corporate tax credit typically includes details about the specific activity or investment that qualifies for the credit, as well as any supporting documentation required by the tax authorities.

Fill out your corporate tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.