Canada C019 2021 free printable template

Show details

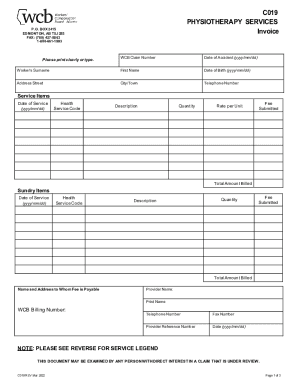

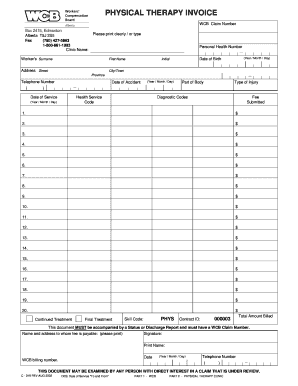

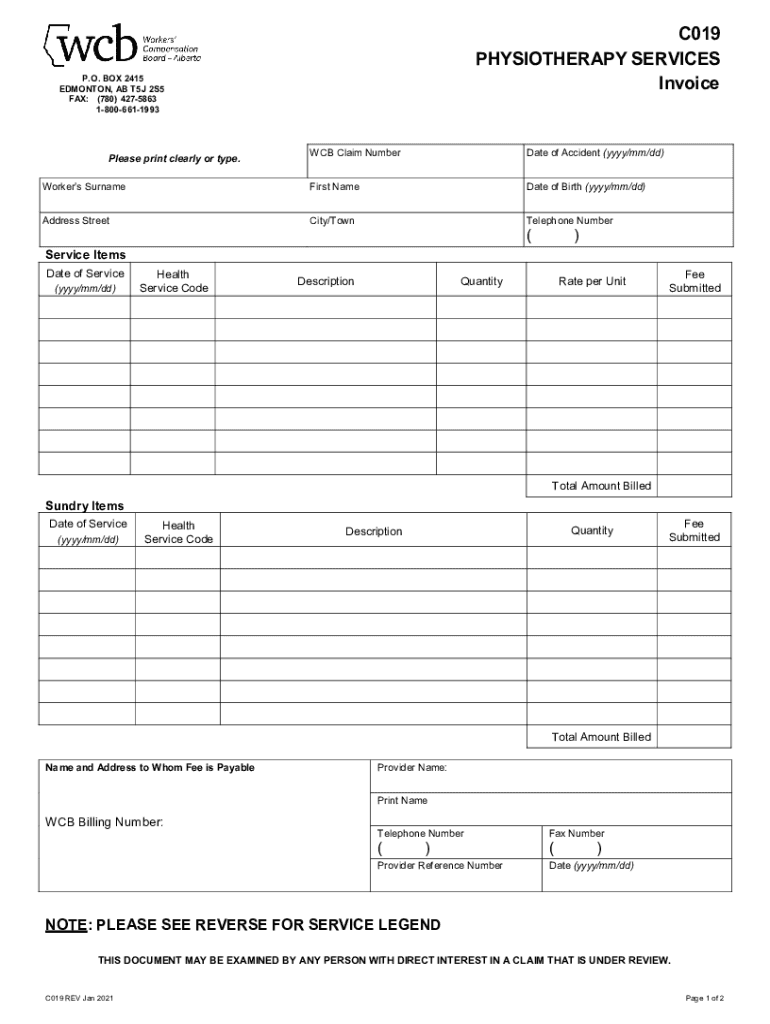

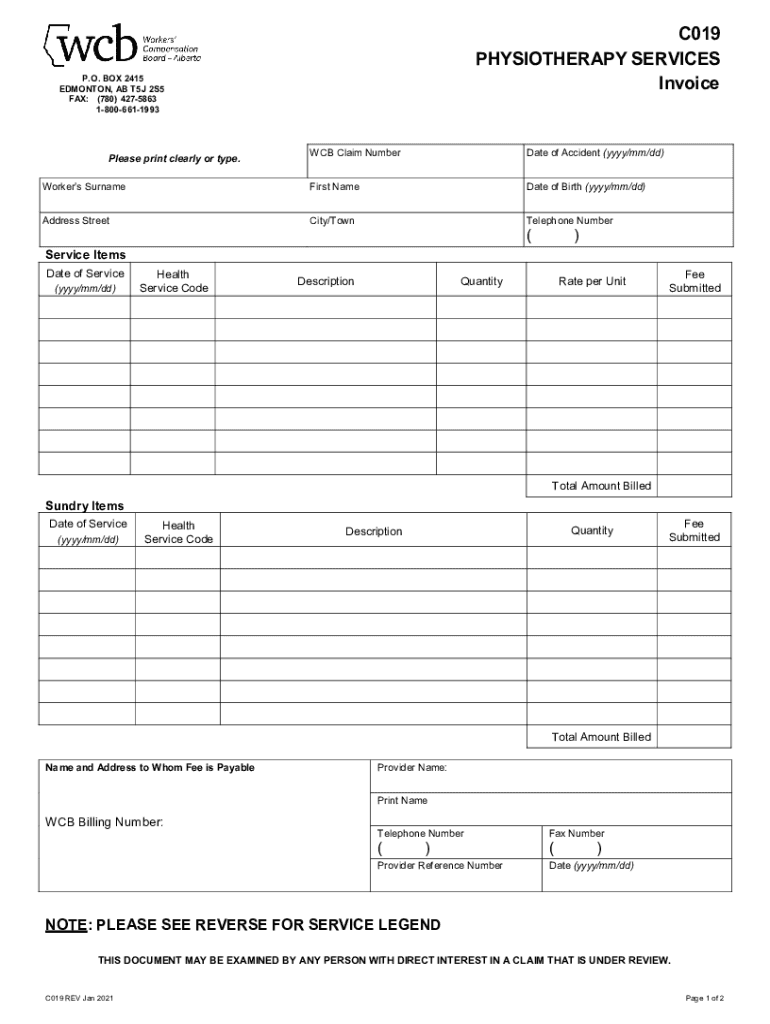

C019 PHYSIOTHERAPY SERVICES Invoice. O. BOX 2415 EDMONTON, AB T5J 2S5 FAX: (780) 4275863 18006611993WCB Claim Numerate of Accident (YYY/mm/dd)Workers SurnameFirst Name Date of Birth (YYY/mm/dd)Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada C019

Edit your Canada C019 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada C019 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada C019 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada C019. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada C019 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada C019

How to fill out Canada C019

01

Obtain a copy of the Canada C019 form from the official website.

02

Read the instructions provided with the form to understand the requirements.

03

Fill out your personal information in the designated sections, including your name, address, and contact details.

04

Provide your identification information as required, such as your Social Insurance Number (SIN) or other relevant ID.

05

Complete the specific sections about your employment or business activities.

06

Review the eligibility criteria to ensure you meet the necessary requirements for completing the form.

07

Double-check all the provided information for accuracy before submission.

08

Sign and date the form to validate your submission.

09

Submit the completed form according to the instructions provided (via online portal or mail).

Who needs Canada C019?

01

Individuals applying for certain government benefits in Canada.

02

Business owners needing to report income for tax purposes.

03

Self-employed individuals tracking their earnings during a specific period.

04

Applicants seeking support during financial hardship or unemployment.

Fill

form

: Try Risk Free

People Also Ask about

Is physical therapy hard?

Physical therapy can be physically demanding. You are likely to spend a lot of time on your feet when working with patients. Since you're helping patients regain physical capabilities, this often involves demonstrating tasks and providing physical support during rehabilitative exercises.

What is the purpose of a physical therapist?

Physical therapists examine each person and then develops a treatment plan to improve their ability to move, reduce or manage pain, restore function, and prevent disability. Physical therapists can have a profound effect on people's lives.

What does an invoice include?

It includes the cost of the products purchased or services rendered to the buyer. Invoices can also serve as legal records, if they contain the names of the seller and client, description and price of goods or services, and the terms of payment.

What is a physical therapist?

Physical therapists help injured or ill people improve movement and manage pain. They are often an important part of preventive care, rehabilitation, and treatment for patients with chronic conditions, illnesses, or injuries.

How do you write a professional bill?

Learn how to write an invoice: Start with a professional layout. Include company and customer information. Add a unique invoice number, an issue date, and a due date. Write each line item with a description of services. Add up line items for total money owed. Include your payment terms and options. Add a personal note.

How to make a physiotherapy bill?

If you are creating a Physiotherapy bill for the first time, here are the essential components you must mention: Name and Age of Client: Customer Address and Zip Code: Description of Services Availed: Hours Spend and Charges For it: Comments and Special Instructions: Total Cost, Along With GST and Discounts:

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada C019?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific Canada C019 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit Canada C019 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Canada C019 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the Canada C019 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your Canada C019 in seconds.

What is Canada C019?

Canada C019 is a form used in Canada for reporting certain income tax information.

Who is required to file Canada C019?

Individuals, partnerships, or corporations that meet specific criteria related to tax obligations and income reporting are required to file Canada C019.

How to fill out Canada C019?

To fill out Canada C019, collect the necessary financial information, follow the instructions provided with the form, and ensure all required fields are completed accurately.

What is the purpose of Canada C019?

The purpose of Canada C019 is to provide the Canada Revenue Agency (CRA) with detailed information about specific sources of income for tax assessment purposes.

What information must be reported on Canada C019?

The information that must be reported on Canada C019 includes details such as income types, amounts, and any applicable deductions or credits.

Fill out your Canada C019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada c019 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.