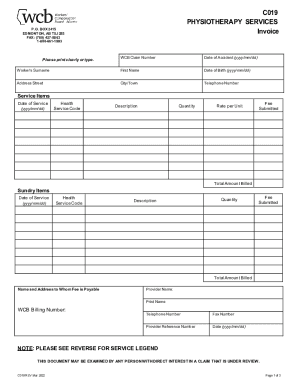

Canada C019 2015 free printable template

Get, Create, Make and Sign Canada C019

Editing Canada C019 online

Uncompromising security for your PDF editing and eSignature needs

Canada C019 Form Versions

How to fill out Canada C019

How to fill out Canada C019

Who needs Canada C019?

Instructions and Help about Canada C019

Hello and welcome back to the exciting videos today in this session we will show you how to create an invoice template using Microsoft Excel we will create this invoice template without using VBA, and we'll use the basic Excel functions and features which we have launched in previous videos to have the maximum calculation simplified and automatic this template is perfect for start-up businesses and individuals alike it can be used to perform the simple invoicing tasks so without wasting much time let's see how we can create an invoice template with the help of basic functions in Excel as you can see we have a blank sheet here and another sheet that contains product details we'll use this product details in the template to fill out the descriptions anyway we come back to invoice template just blank sheet, and then we move our cursor to b1 we first insert the company logo here, so we go to insert tab, and then we click on pictures and insert the company logo this is too big so let's make it smaller, so we reduce size of this image this looks okay we have placed the company logo on the left side of the page however in case if you want to place it anywhere on the page you can place it as per your own choice then we go to i1, and we type invoice and let us change the font size of this text from 11 to 24, and then we will make it bold, and now we'll change the font player as well, so we go to font color, and we look for the code nice font color which matches here you go this is blue X inch 5, so we'll keep it blue X in 5 for this invoice font color, and now we'll type the company details that are selling the products at the top of the invoice, so we go to b4, and we type company name in the packets for now we will have the simple text instead of taking actual details, but you can change it as by own convenience so wherever we are inserting the text inside the packets you can replace it with the actual values then in b5 we will have street address then city state zip and b6 phone detail and b7 then fix to tail and b8 all right this is enough for the company information, and now we will add the customer details like name company name address phone and emails etc, so we go to be 11, and first we type here b2 then we go to b12 and there will have the customer name, so we type name here inside the bracket then company name here in B 13 street address in B 14 city state zips in be 15 and B 16, and then we will have email address in b-17 all right every invoice must have few standard details like customer ID date invoice number etc so in order to add them we go to cell h5, and we type customer ID then we type invoice date invoice number and payment do buy in columns at 6 × 7 and h8 respectable we will have these details in corresponding cells from i-5 to I am, so we select I 5 — I ate ranAnandnwhogHmmmmmmmmmmmmmmmmme me meme tab and under font category will select all borders and come back then we select H 5

People Also Ask about

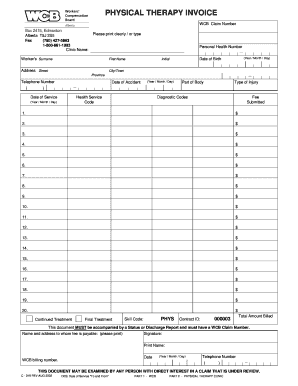

Is physical therapy hard?

What is the purpose of a physical therapist?

What does an invoice include?

What is a physical therapist?

How do you write a professional bill?

How to make a physiotherapy bill?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada C019 straight from my smartphone?

How do I fill out Canada C019 using my mobile device?

Can I edit Canada C019 on an iOS device?

What is Canada C019?

Who is required to file Canada C019?

How to fill out Canada C019?

What is the purpose of Canada C019?

What information must be reported on Canada C019?

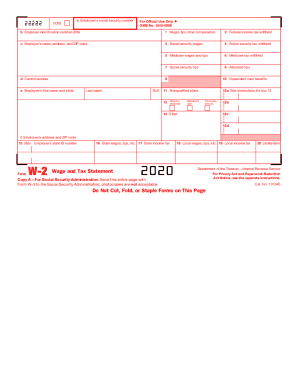

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.