Get the free Charitable Trust Financial Report - bMinnesotab Attorney General

Show details

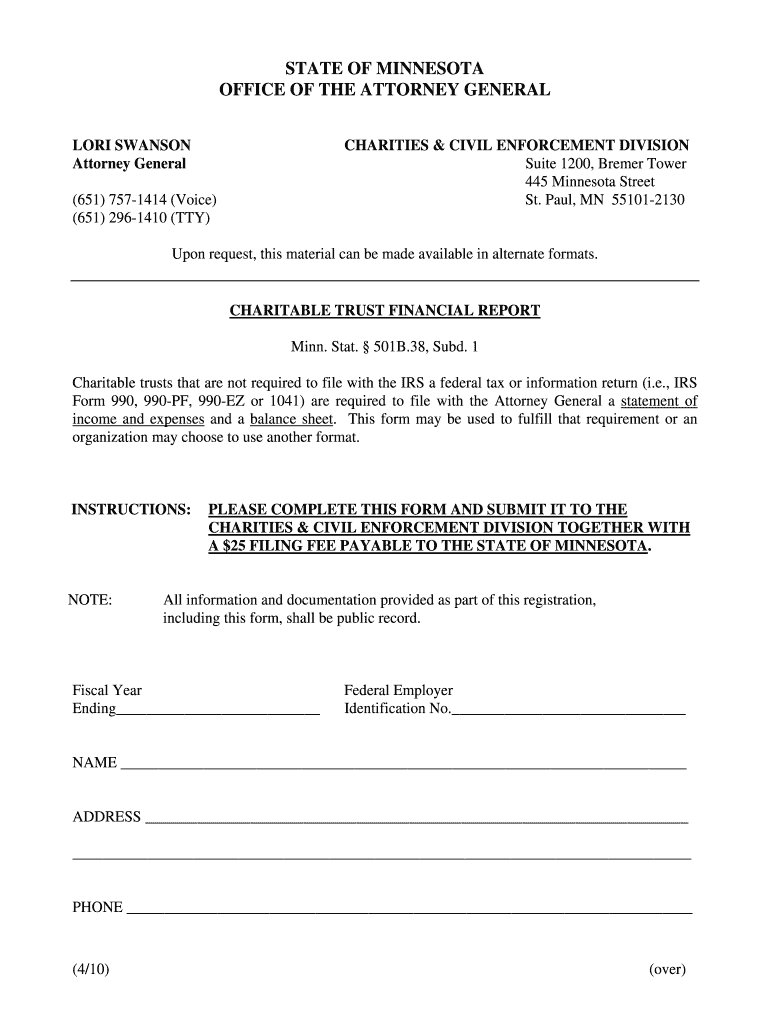

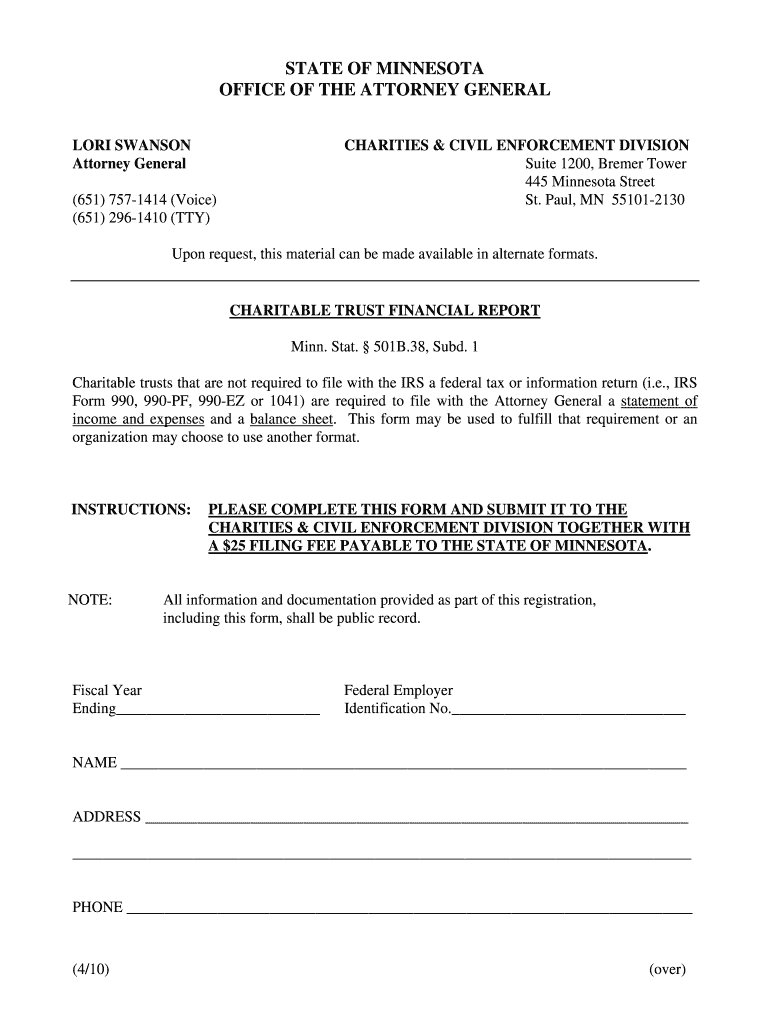

STATE OF MINNESOTA OFFICE OF THE ATTORNEY GENERAL LORI SWANSON Attorney General CHARITIES & CIVIL ENFORCEMENT DIVISION Suite 1200, Bremen Tower 445 Minnesota Street St. Paul, MN 551012130 (651) 7571414

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable trust financial report

Edit your charitable trust financial report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable trust financial report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable trust financial report online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charitable trust financial report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable trust financial report

How to fill out a charitable trust financial report:

01

Start by gathering all relevant financial information, including income, expenditures, assets, and liabilities associated with the charitable trust.

02

Organize the financial information in a clear and structured manner, ensuring that all transactions are properly documented and categorized.

03

Use appropriate accounting software or spreadsheets to record and calculate the financial data accurately.

04

Include an income statement, balance sheet, and cash flow statement to provide a comprehensive overview of the trust's financial activities.

05

Prepare a detailed breakdown of expenses, such as administrative costs, program expenses, fundraising expenses, etc.

06

Ensure compliance with any legal and regulatory requirements specific to charitable trust reporting.

07

Review the financial report for accuracy and completeness, double-checking all figures and calculations.

08

Save a copy of the financial report for future reference and audit purposes.

Who needs a charitable trust financial report:

01

Donors: Donors who contribute to a charitable trust may request or require a financial report to understand how their donations are being utilized.

02

Trustees: Trustees, who are responsible for managing and overseeing the charitable trust, often require financial reports to monitor the trust's financial health and ensure proper use of funds.

03

Regulatory authorities: Government agencies or organizations that regulate charitable trusts may request financial reports to ensure compliance with legal and accounting standards.

04

Auditors: Independent auditors may require a financial report to assess the trust's financial statements and provide an objective opinion on their accuracy and compliance.

05

Beneficiaries: Beneficiaries of the charitable trust may have a vested interest in reviewing the financial report to understand the trust's financial position and how it impacts their benefits or objectives.

06

Grantors: Grantors who provide funding or grants to the charitable trust may request financial reports to evaluate the trust's financial stability and fulfill due diligence requirements.

Overall, the charitable trust financial report serves as a crucial tool for transparency, accountability, and decision-making for various stakeholders involved with the trust.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify charitable trust financial report without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including charitable trust financial report, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send charitable trust financial report to be eSigned by others?

When your charitable trust financial report is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit charitable trust financial report online?

The editing procedure is simple with pdfFiller. Open your charitable trust financial report in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is charitable trust financial report?

A charitable trust financial report is a document that outlines the financial activities and performance of a charitable trust organization.

Who is required to file charitable trust financial report?

Charitable trust organizations are required to file a financial report.

How to fill out charitable trust financial report?

The charitable trust financial report can be filled out by providing details of income, expenses, assets, and liabilities of the organization.

What is the purpose of charitable trust financial report?

The purpose of the charitable trust financial report is to provide transparency and accountability to donors, regulators, and the public regarding the financial management of the organization.

What information must be reported on charitable trust financial report?

Information such as income, expenses, assets, liabilities, donations, and grants must be reported on the charitable trust financial report.

Fill out your charitable trust financial report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Trust Financial Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.