TX 55-201 2021 free printable template

Show details

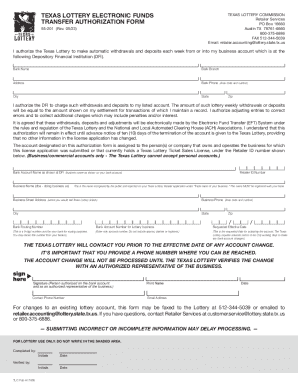

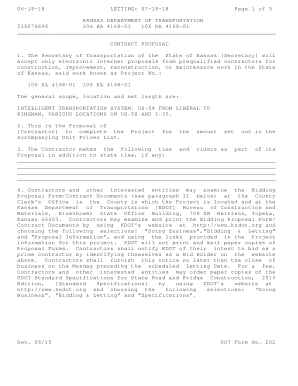

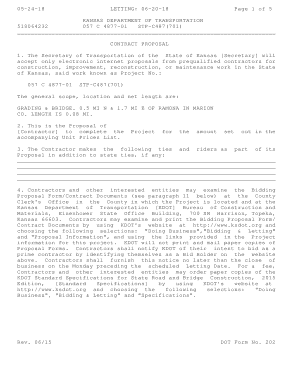

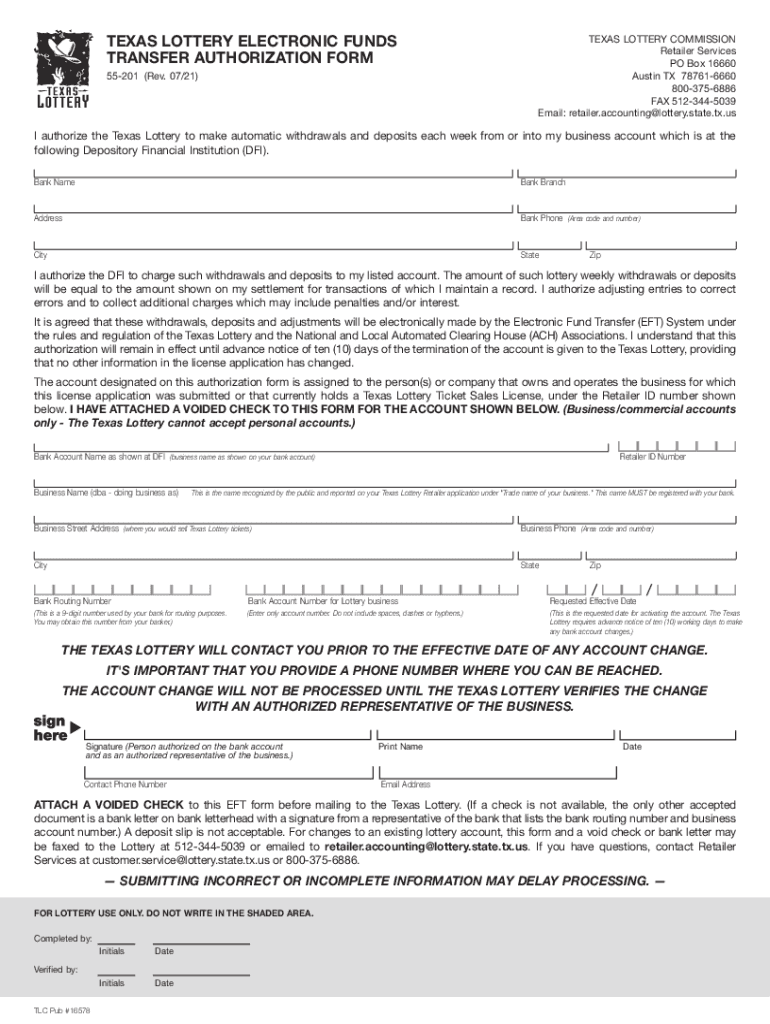

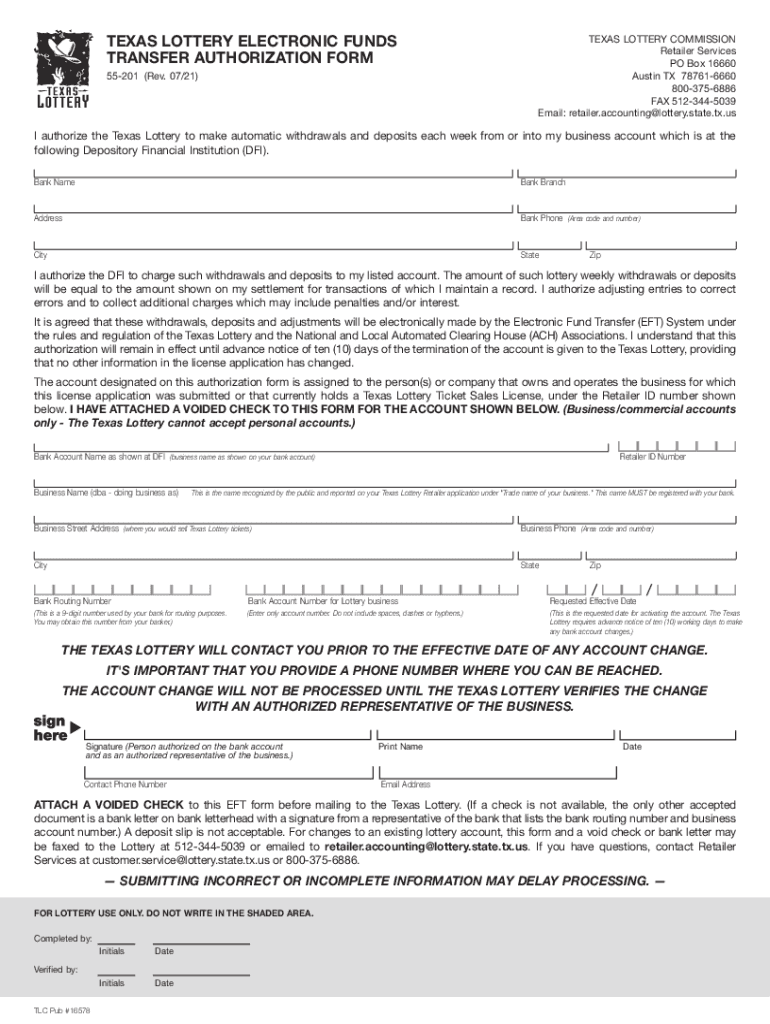

TEXAS LOTTERY ELECTRONIC FUNDS TRANSFER AUTHORIZATION FORM 55201 (Rev. 07/21)TEXAS LOTTERY COMMISSION Retailer Services PO Box 16660 Austin TX 787616660 8003756886 FAX 5123445039 Email: retailer.accounting@lottery.state.tx.usI

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas deposits withdrawals create form

Edit your lottery account signature get form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tx lottery transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing eft tx online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tx lottery authorization latest form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX 55-201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas lottery funds transfer printable form

How to fill out TX 55-201

01

Obtain a copy of form TX 55-201 from the Texas Comptroller's website.

02

Fill in the required personal information including your name, address, and contact information.

03

Provide details about your business, including the type of business and its location.

04

Indicate the specific reason for filing the form in the designated section.

05

Complete any additional sections that apply to your situation, such as tax information or exemptions.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the appropriate office as indicated in the instructions.

Who needs TX 55-201?

01

Business owners who are applying for a specific exemption or permit in Texas.

02

Individuals or entities seeking to report business activity to the Texas Comptroller.

03

Taxpayers who need to document their claim for tax-related adjustments or allowances.

Fill

tx lottery electronic download

: Try Risk Free

People Also Ask about tx lottery authorization

How to redeem Texas scratch off tickets?

How can I redeem my prize? A: Cash prizes up to $599 may be claimed at any Texas Lottery retailer. Cash prizes of $600 and above may be claimed at any Texas Lottery claim center around the state of Texas.

How do I claim $1000 scratch off tickets in Texas?

You can: Fill out a Claim Form online and print for postal mailing, Send us an e-mail to request a form, Go to your local retailer for a form, or. Call us for a form at 800-37-LOTTO (800-375-6886).

How much tax do you pay on a $1000 scratch off ticket in Texas?

The tax withholding rate is 24% for lottery winnings, less the wager, for prizes greater than $5,000.

Do you pay taxes on $1000 lottery winnings Texas?

Texas is one of 10 states that does not tax lottery winnings at the state level.

What happens to unclaimed lottery winnings in Texas?

"Unclaimed prizes revert back to the state for programs authorized by the Texas Legislature, including the Foundation School Fund and Fund for Veterans' Assistance, which are the primary beneficiaries of the Texas Lottery. Government Code 466.408 sets forth the use of unclaimed prize money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tx lottery transfer online in Gmail?

lottery account form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in texas funds transfer 2021?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your texas funds transfer 2021 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit texas funds transfer 2021 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your texas funds transfer 2021, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is TX 55-201?

TX 55-201 is a form used for reporting specific information related to certain tax obligations in the state of Texas.

Who is required to file TX 55-201?

Individuals or businesses that meet certain criteria as defined by Texas tax regulations are required to file TX 55-201.

How to fill out TX 55-201?

To fill out TX 55-201, applicants should provide accurate information according to the instructions on the form, including details about their tax situation and required financial data.

What is the purpose of TX 55-201?

The purpose of TX 55-201 is to ensure that the state collects necessary tax information for compliance and auditing purposes.

What information must be reported on TX 55-201?

The information that must be reported on TX 55-201 includes taxpayer identification details, the nature of the tax obligation, and any relevant financial data related to the tax being reported.

Fill out your texas funds transfer 2021 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Funds Transfer 2021 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.