Get the free AL AUDITED R P

Show details

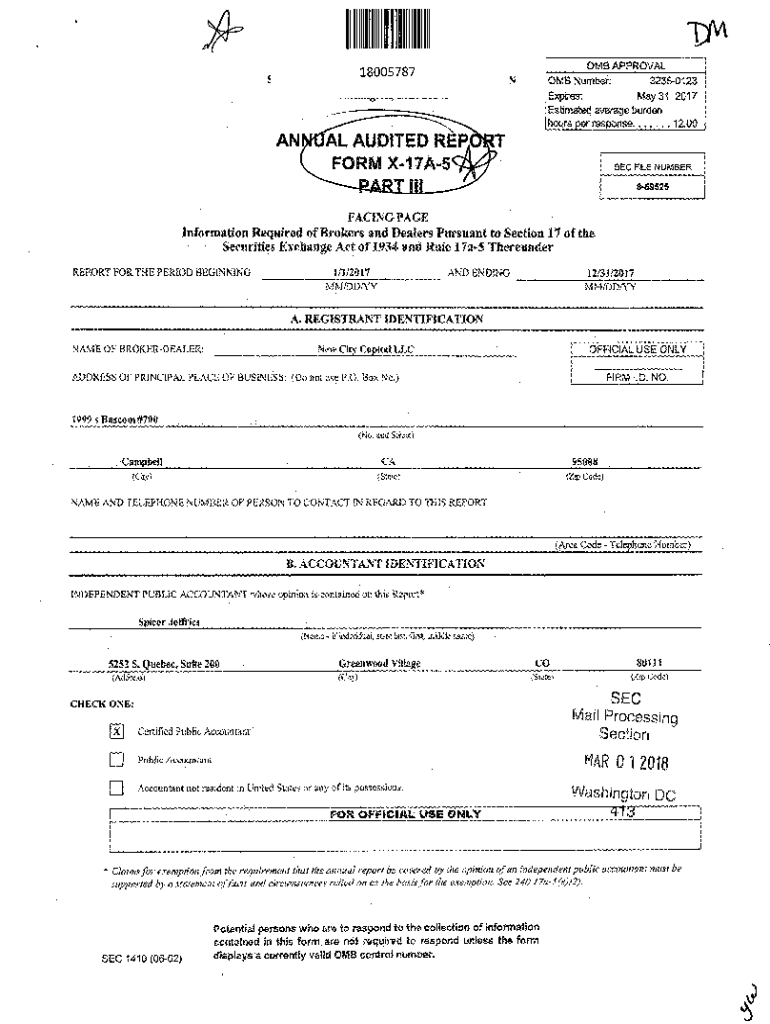

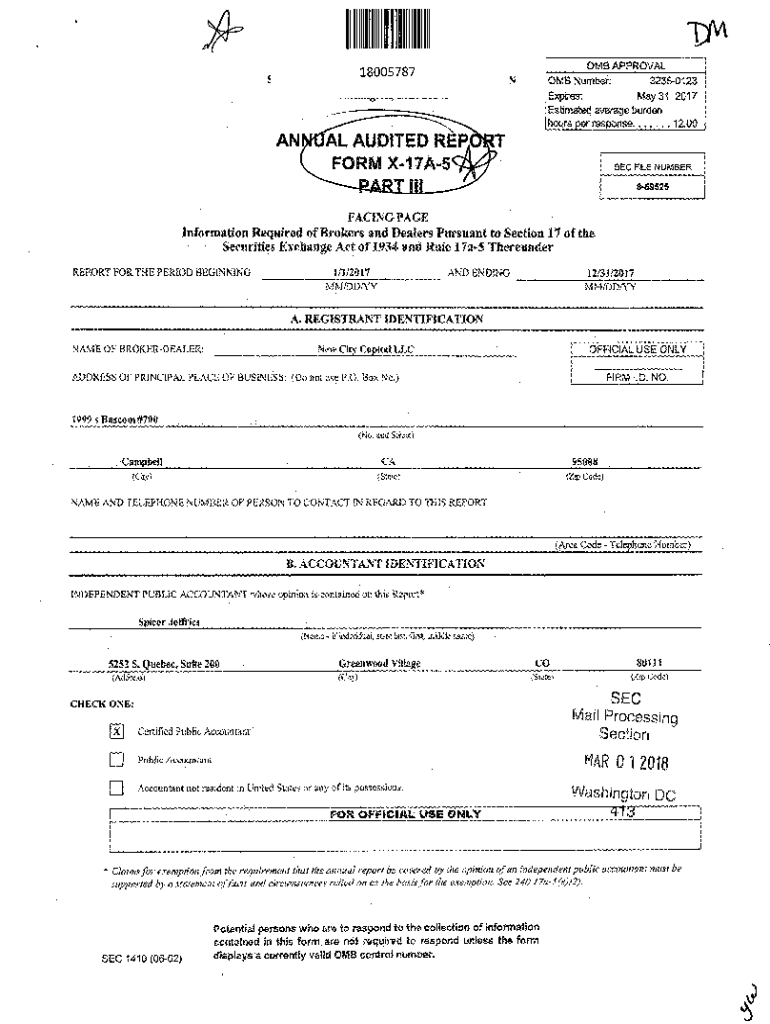

Lillllllllllll 18005787e OMB APPROVAL OMB Number: 32350123NExpires:May 31, 2017Estimated average burden hours per response. ANAL AUDITED R P... ...12.00TFORM X17A5 RT Ill SEC FILE NUlviBERassasFACINCPAGE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign al audited r p

Edit your al audited r p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your al audited r p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit al audited r p online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit al audited r p. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out al audited r p

How to fill out al audited r p

01

To fill out an audited r p, follow these steps:

1. Begin by gathering all the necessary documents and information related to the audit.

02

Start by entering the basic details of the audited entity, such as the company name, address, and contact information.

03

Identify the auditors involved in the audit process and provide their names, qualifications, and contact details.

04

Specify the audit period for which the report is being prepared. This typically includes the start and end dates of the audit.

05

Present a detailed description of the scope of the audit, which involves outlining the specific areas or processes that were audited.

06

Provide an overview of the audit methodology and procedures followed during the audit.

07

Include any findings or observations noted during the audit, along with supporting evidence.

08

Outline the audit conclusions and recommendations, if any.

09

Attach any additional supporting documents, such as financial statements, supporting schedules, or audit reports.

10

Review the completed audited r p to ensure accuracy and completeness.

11

In case of any discrepancies or missing information, consult with the auditors or relevant authorities before finalizing the document.

12

Once verified, sign and date the audited r p to certify its authenticity.

13

Distribute copies of the audited r p to the concerned parties, such as the audited entity, auditors, management, and regulatory authorities.

Who needs al audited r p?

01

An audited r p is needed by various entities and individuals, including:

02

- Companies and corporations that are required to provide audited financial statements as per legal or regulatory requirements.

03

- Shareholders and investors who seek assurance about the accuracy and reliability of a company's financial information.

04

- Banks and financial institutions that require audited reports to evaluate the creditworthiness of a business.

05

- Government agencies and regulatory bodies that oversee compliance with financial reporting standards.

06

- Potential business partners or buyers who need to assess the financial health and performance of a company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my al audited r p in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your al audited r p and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in al audited r p without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your al audited r p, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my al audited r p in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your al audited r p and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is al audited r p?

Al audited r p refers to the annual audit report that is conducted by a certified public accountant to provide an independent assessment of an organization's financial statements.

Who is required to file al audited r p?

Organizations that are required by law or regulation to have an annual audit, such as publicly traded companies, non-profit organizations, and certain government entities, are required to file al audited r p.

How to fill out al audited r p?

To fill out al audited r p, you must provide your financial statements, supporting documentation, and any other information requested by the auditor. It is important to follow the auditor's guidelines and ensure accuracy in reporting.

What is the purpose of al audited r p?

The purpose of al audited r p is to provide assurance to stakeholders, such as investors, creditors, and regulators, that an organization's financial statements are accurate and reliable.

What information must be reported on al audited r p?

Al audited r p must include the organization's financial statements, auditor's opinion, management's discussion and analysis, and any other information required by auditing standards.

Fill out your al audited r p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Al Audited R P is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.