UK HMRC VAT431C 2021 free printable template

Show details

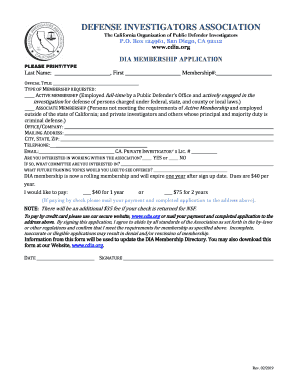

VAT refunds for DIY house builders Claim form for conversions HMRC use only Claim reference number To claim back the VAT you've paid on building materials and services used for your conversion, answer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC VAT431C

Edit your UK HMRC VAT431C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC VAT431C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HMRC VAT431C online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK HMRC VAT431C. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC VAT431C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC VAT431C

How to fill out UK HMRC VAT431C

01

Obtain the UK HMRC VAT431C form from the official HMRC website.

02

Read the accompanying guidance notes for the form to understand the requirements.

03

Enter your business details including name, address, and VAT registration number in the designated fields.

04

Complete the sections that ask for financial information, including sales and purchases data for the specified period.

05

Provide any additional information required, such as any special circumstances related to your VAT accounting.

06

Review all entries for accuracy before submitting the form.

07

Submit the completed form to HMRC either electronically or by post as per the instructions provided.

Who needs UK HMRC VAT431C?

01

Businesses that are registered for VAT in the UK and need to report changes, corrections, or specific requirements related to their VAT returns.

02

VAT-registered traders who have to submit additional information due to certain circumstances.

Fill

form

: Try Risk Free

People Also Ask about

Can you claim VAT back on a washing machine?

You're restricted from recovering VAT on things like refrigerators, washing machines, dishwashers, and so on. In addition, the treatment of flooring is quite important. You're not entitled to recover VAT on carpets, but if you lay down a hardwood floor, that VAT is recoverable.

Can I claim VAT back on conversion?

You can't claim overpaid VAT So if you're doing a conversion, e.g. a barn conversion, you can only claim VAT on contractors' invoices if it's the right amount of VAT. In other words, if your contractor charges 20% for work that is eligible for 5%, then you can't claim ANY of the VAT on those services.

How do I claim VAT back from USA?

Usually you'll need to mail your stamped VAT refund form to an address the shop provides. But you don't always have to wait to get back home. Some big airports, ports and train stations have VAT refund offices where you can get your refund right away — if the retailer you shopped at uses that office.

Can you claim 100% VAT back?

Claim 100% of the VAT – You can reclaim the full amount of VAT paid on all fuel – including personal use – but you have to pay a fuel scale charge that specific to your type of vehicle. The government has a useful Fuel Scale Charge opens in new window tool you can use to calculate the cost.

What is the VAT claim form 431C?

This Scheme allows you to claim VAT back on building materials you have purchased, and on the services of conversion, when you convert a previously non-residential property into a dwelling. If you buy a converted house from a property developer, you'll not be charged VAT.

Can I claim VAT back on a new kitchen?

You can claim VAT back on building materials, as long as they were used to form part of the building and can't be removed without either using tools or damaging the building in the process. Examples include: fitted kitchen units.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the UK HMRC VAT431C electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your UK HMRC VAT431C in seconds.

Can I create an electronic signature for signing my UK HMRC VAT431C in Gmail?

Create your eSignature using pdfFiller and then eSign your UK HMRC VAT431C immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit UK HMRC VAT431C on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing UK HMRC VAT431C.

What is UK HMRC VAT431C?

UK HMRC VAT431C is a form used by businesses in the UK to disclose information about their VAT (Value Added Tax) liabilities and exemptions, particularly in relation to how they calculate and report VAT.

Who is required to file UK HMRC VAT431C?

Businesses that are registered for VAT in the UK and are claiming or adjusting VAT reliefs are typically required to file UK HMRC VAT431C.

How to fill out UK HMRC VAT431C?

To fill out UK HMRC VAT431C, businesses need to provide their VAT registration number, details of transactions, calculations of VAT due, and any adjustments for exemptions or reliefs. It is important to follow the provided guidance to ensure accuracy.

What is the purpose of UK HMRC VAT431C?

The purpose of UK HMRC VAT431C is to enable HMRC to assess and validate the VAT claims and exemptions made by businesses, ensuring compliance with tax regulations.

What information must be reported on UK HMRC VAT431C?

UK HMRC VAT431C requires reporting information such as the VAT registration number, details of exempt goods or services, calculation of VAT payable, and any adjustments related to VAT relief.

Fill out your UK HMRC VAT431C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC vat431c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.